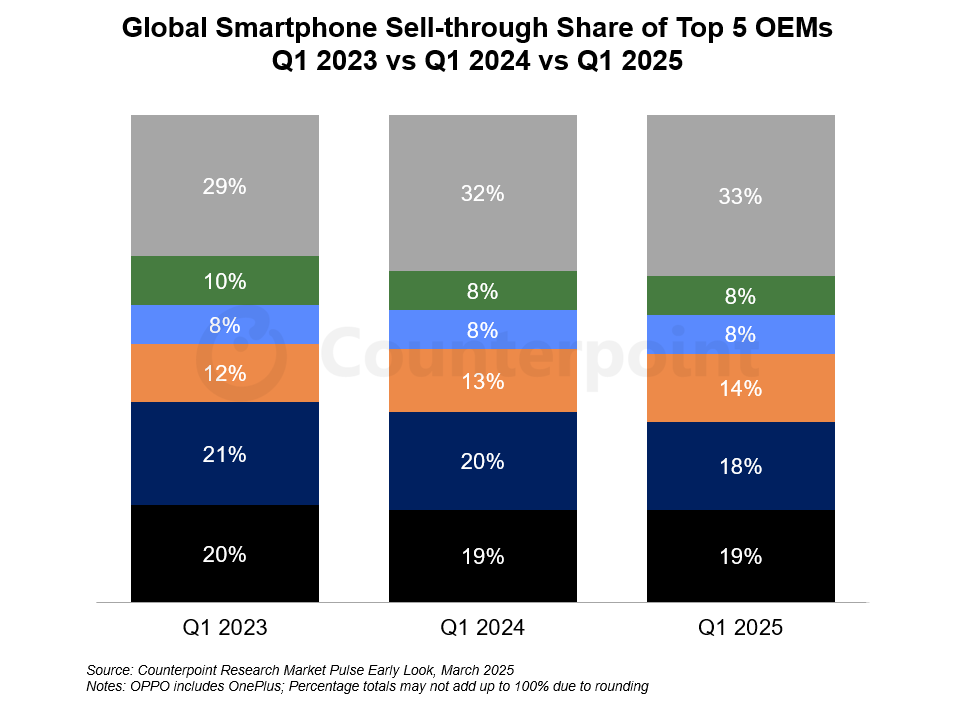

Smartphone shipments increased by 3% annually in the first quarter of 2025, as indicated by a recent Counterpoint Research study. Although this reflects a recovery trend in the mobile sector, driven primarily by high demand in markets such as China, Latin America, and Southeast Asia, big players recorded uneven performances. Xiaomi, a top brand in emerging markets, recorded a low 2% annual surge in shipments in Q1 2025. Compared to that, Samsung and Apple’s shipments increased by 1% and 14% respectively. The performance happens as the market grapples with uncertainty in tariff policies as well as careful inventory planning by the manufacturers. You can also see how Xiaomi is doing in software updates such as HyperOS 2 enhancements.

Xiaomi’s Competitive Position in the Global Market Xiaomi

In spite of its dominance in price-conscious markets, Xiaomi stood in third place in Q1 2025 global shipments, followed by Samsung and Apple. The leadership of Samsung was the result of the success in the launch of the Galaxy S25 series and new A-series smartphones in the affordable price range. Apple, historically one that does not launch new phones during the first quarter, still found a second position with strong sales in Japan and other developed economies.

The 2% growth of Xiaomi: An Indication of Stability or Stagnation?

Although a 2% growth might be small, it emphasizes Xiaomi’s consistent dominance in important markets. The company remains dominant in markets such as Indonesia and India, where budget and mid-tier devices sell well. Yet its global pace is restricted compared to the competition. The gap can only increase unless Xiaomi ramps up the pace of innovations or broadens the high-end range aggressively.

Analyst Insights and Industry Outlook

Senior analyst Yang Wang explained that the 3% quarter-on-quarter growth fell short of the 6% that had been expected based on trade policy uncertainty as well as inventory hesitancy. In an additional warning, he stressed that the market can still struggle during 2025, leading to the prospect of flat or even negative growth for the year. In the same vein, senior analyst Jene Park explained that Apple, although leading in sell-through performance, came in second with sell-in shipments due to few product launches at the outset of the year.

Summary of Q1 2025 Smartphone Growth Rates

- Samsung: +1% YoY (Q1 2025)

- Apple: +14% YoY

- Xiaomi: +2% YoY

Final Thoughts

Xiaomi’s moderate growth is indicative of its continued dominance in emerging markets but also points to challenges in increasing premium share worldwide. As the competition mounts, particularly from Apple and Samsung, the next few acts of Xiaomi—perhaps around the upcoming release of HyperOS 2.2—will be important in keeping the momentum going in 2025.

Source: Counterpoint Research

Emir Bardakçı

Emir Bardakçı

Stop making false promises to your customer base.