Xiaomi has officially announced its unaudited financial results for Q3 2025, with the company recording its strongest quarter to date and marking a significant leap forward in its long-term “Human × Car × Home” strategy. Revenue amounted to RMB113.1 billion, approximately USD 15.6 billion, representing a year-over-year increase of 22.3%. This quarter also represents the fourth consecutive period in which Xiaomi exceeded RMB100 billion in revenue. (Related: Xiaomi 17 Series Review | HyperOS 3 Features Overview) The Group’s adjusted net profit surged 80.9% to RMB11.3 billion (USD 1.56 billion), significantly outperforming market expectations.

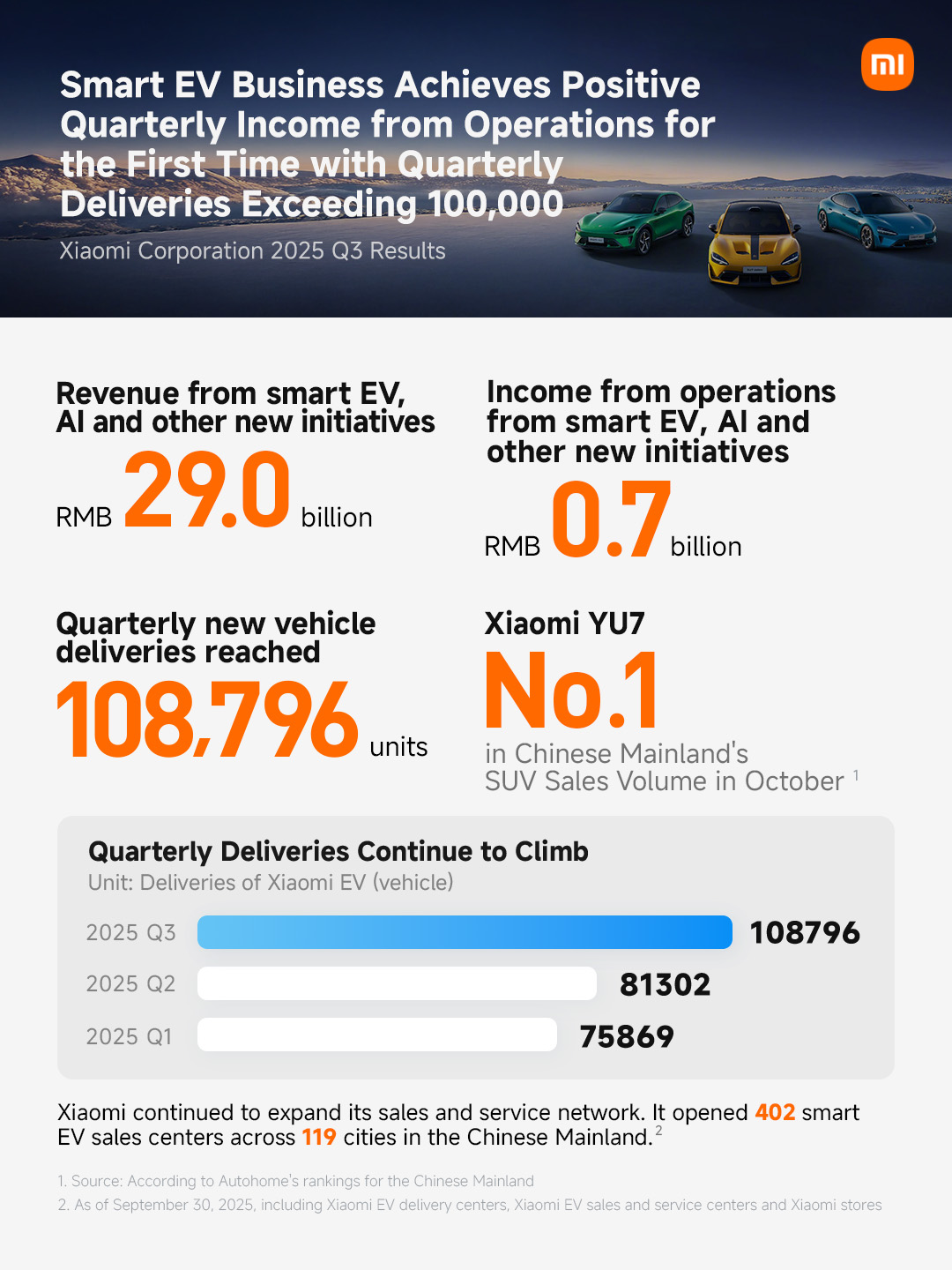

Xiaomi EV Business Achieves First Ever Operating Profit

One of the biggest highlights for this quarter came from Xiaomi’s smart EV and new initiatives division.

The segment booked revenue of RMB29.0 billion (USD 4 billion), a staggering growth of 199% over the prior year period. More importantly, the division recorded positive operating income for the first time, which reached RMB0.7 billion.

In Q3, Xiaomi delivered 108,796 smart EVs, bringing total deliveries for the first three quarters to over 260,000 units. The Xiaomi YU7 continued to lead the market and secured the No.1 SUV sales position across the Chinese Mainland in October. Today, Xiaomi operates 402 EV sales centers across 119 cities, further showing the rapid expansion of its nationwide automotive ecosystem.

Expansion of EV Manufacturing and Sales

Xiaomi’s EV strategy continues to scale efficiently, supported by strong R&D investments and improved manufacturing output. The growing sales, enhanced service networks, and broad consumer adoption underpin Xiaomi’s status as a highly competitive EV brand within China.

Smartphone Business Strengthens Global Position

The company’s smartphone business generated RMB46.0 billion in Q3, retaining its position as a top-three global smartphone vendor for the 21st consecutive quarter, with worldwide shipments reaching 43.3 million units.

In the Chinese Mainland, Xiaomi ranked No.2 in unit sales and realized significant advancements in the premium smartphone segment. The firm’s share of the RMB4,000–6,000 (USD 550–830) category surged to 18.9%, up 5.6 percentage points year-over-year.

The Xiaomi 17 Series was an important contributor to such growth, with first-month sales up 30% compared to the Xiaomi 15 Series. Over 80% of all sales were contributed by the Xiaomi 17 Pro and Xiaomi 17 Pro Max, indicating increased demand for high-end Xiaomi flagship devices.

Leadership in Global Markets

Xiaomi smartphones ranked top-three in 57 countries and regions and top-five in 68 global markets, reaffirming the brand’s strong global footprint.

IoT and Smart Home Ecosystem Surpasses 1 Billion Connected Devices

IoT and lifestyle product revenues at Xiaomi reached RMB27.6 billion (USD 3.82 billion), while the gross margin increased to 23.9% in Q3 2025. Meanwhile, the number of connected IoT devices excluding smartphones, tablets, and laptops rose to 1.035 billion units.

In October, Xiaomi’s first Smart Home Appliance Factory went into operation officially. The facility supports annual production of up to 7 million air conditioners and strengthens the Group’s smart home manufacturing capacity. Furthermore, Xiaomi maintained top-ranked global performance in key product categories like tablets, TWS earbuds, and wearable devices.

Xiaomi Home App User Growth

The Xiaomi Home App reached 114.6 million MAUs in September 2025, which keeps consumers engaging with the HyperConnect ecosystem.

Internet Services Revenue Reaches All-Time High

Internet services revenue reached RMB9.4 billion, representing an increase of 10.8% year-over-year, or the highest in Xiaomi’s history. At the end of the reporting period, global MAU reached 741.7 million, of which 187.3 million users were in the Chinese Mainland. Overseas internet services also saw double-digit expansion at 19.1% year-over-year.

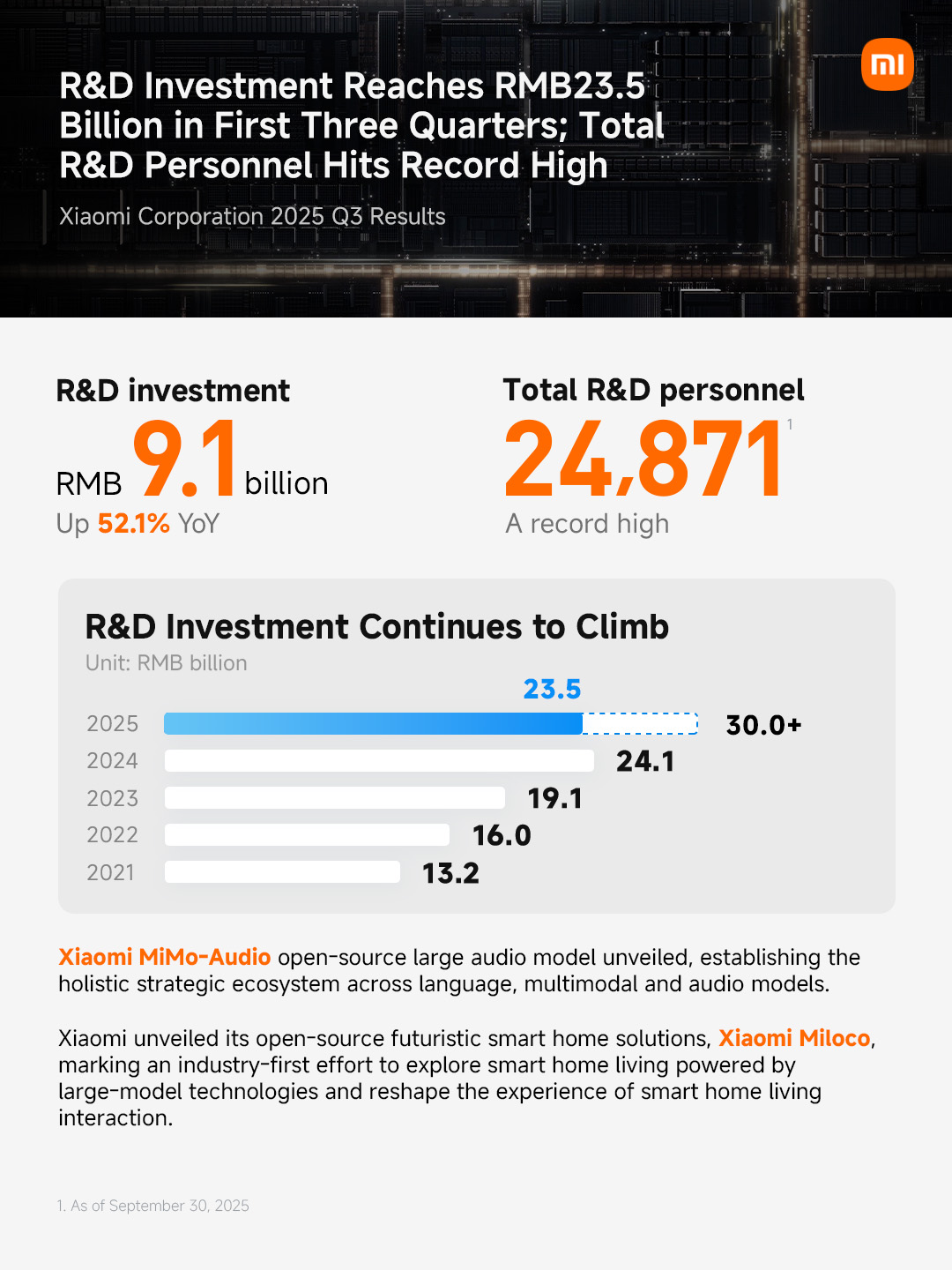

R&D Investment Reaches New Record Driven by AI and HyperOS 3

During this period, Xiaomi further invested heavily in fundamental technologies, with quarterly R&D spending increasing 52.1% to RMB9.1 billion, or USD 1.26 billion. Total R&D personnel rose to 24,871, representing an all-time high. Recent major R&D milestones include:

- Xiaomi-MiMo-Audio — a new open-source large-scale voice model

- Xiaomi Miloco: smart home of the next generation driven by large model power

- Xiaomi HyperOS 3 — major upgrades in AI capabilities and system experience

These innovations further strengthen Xiaomi’s position across smartphones, EVs, and smart home ecosystems.

Results from Xiaomi’s Q3 2025 demonstrate how well the company is executing across its different business segments. From record EV deliveries to significant gains in premium smartphones and a billion-device AIoT platform, Xiaomi continues to build out its leadership position in the global technology landscape.

Emir Bardakçı

Emir Bardakçı