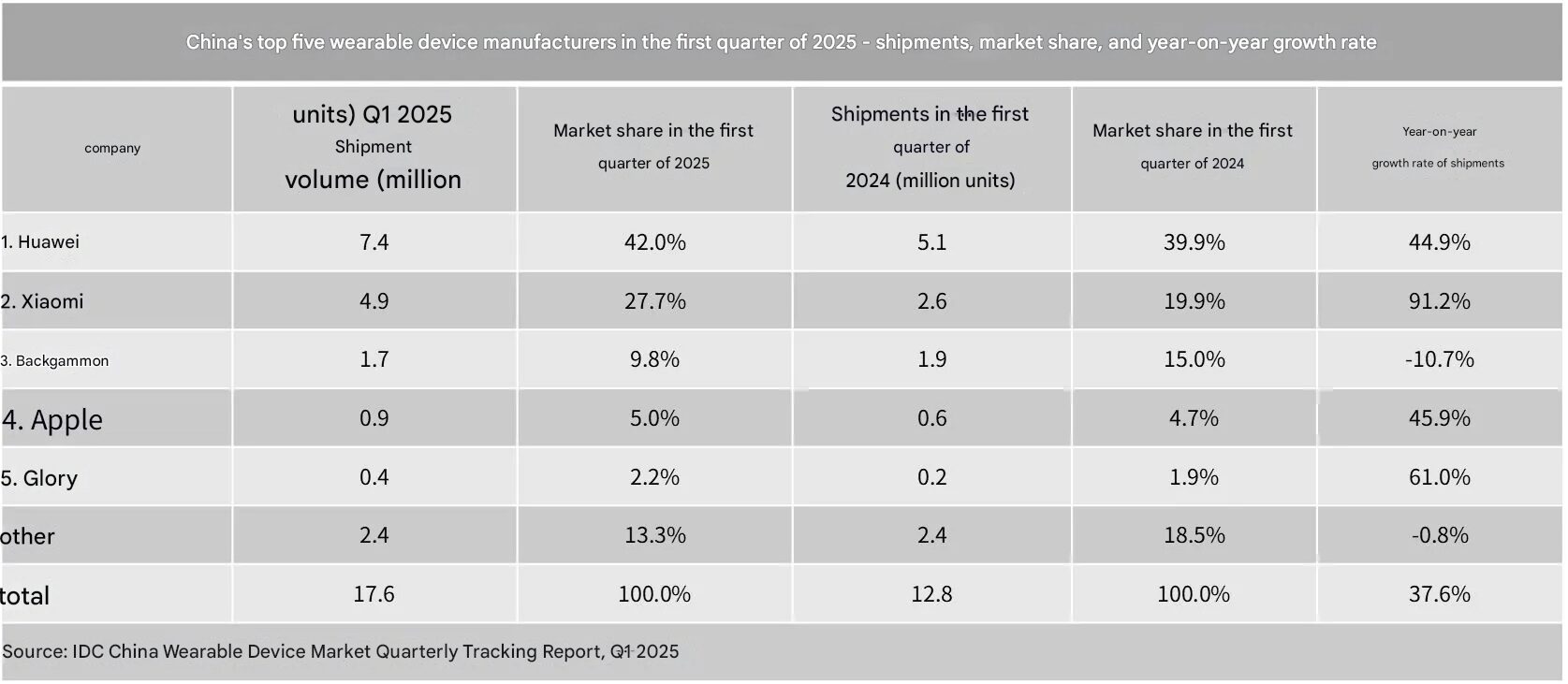

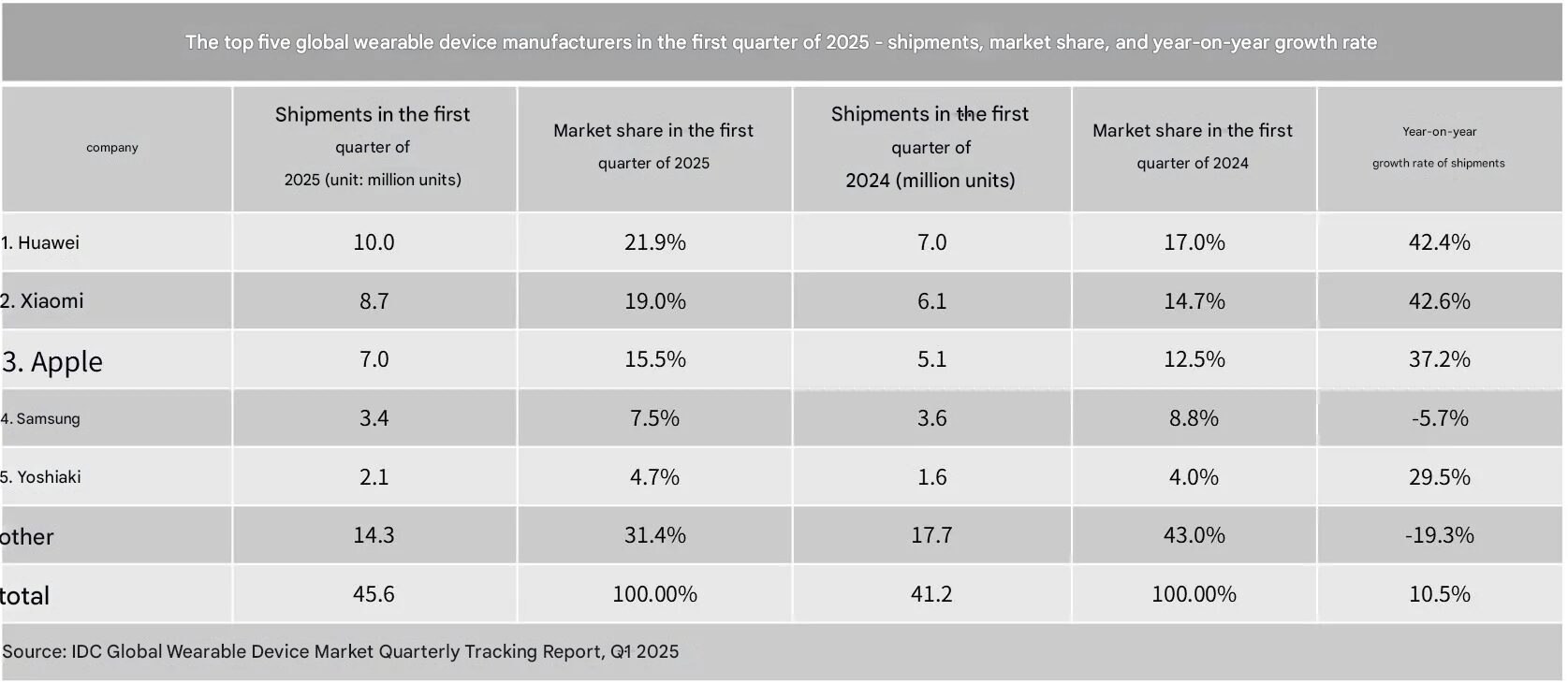

According to recent data released by IDC, the global market for wrist-worn devices exhibited substantial growth in the first quarter of 2025, with total shipments reaching 45.57 million units—a year-over-year increase of 10.5%. The Chinese market, in particular, experienced remarkable expansion, recording shipment volumes of 17.62 million units and an impressive 37.6% growth rate. Within this competitive landscape, Xiaomi distinguished itself as a leading contributor to global market momentum. For further details on Xiaomi’s recent wearable developments and the integration of HyperOS within its ecosystem, additional resources are available.

Overview of Market Recovery

The wrist-worn device category, encompassing both smartwatches and fitness bands, demonstrated consistent growth across segments. Global smartwatch shipments reached 34.81 million units in Q1 2025, reflecting a 4.8% increase from the previous year. The Chinese smartwatch market contributed 11.4 million units, a 25.3% rise. Fitness bands outperformed smartwatches in terms of growth, with global shipments totaling 10.76 million units (a 34.0% increase), and Chinese shipments reaching 6.21 million units for a 67.9% year-on-year increase.

Xiaomi’s Leadership and Market Strategy

In Q1 2025, Xiaomi’s wearable product line saw significant global shipment growth, with particularly strong performance in China, where the company outpaced its top five competitors. This regional success has served as a primary engine for Xiaomi’s expansion in global markets.

Beyond China, Xiaomi achieved substantial growth in Latin America and the Asia Pacific regions. The brand’s strategy—offering entry-level devices under both the Xiaomi and REDMI brands, alongside S series products aimed at the mid-range segment—has proven highly effective. This approach supports Xiaomi’s broader premium positioning within the wearables sector.

Shifting Competitive Landscape

The global wearables market has experienced notable shifts among leading brands. Huawei assumed the global leadership position, maintaining robust performance domestically by leveraging its HarmonyOS ecosystem. Apple achieved its highest year-over-year growth in wrist-worn device shipments since 2002, attributable to effective inventory management and competitive pricing strategies.

Conversely, Samsung encountered increased competition from cost-effective Chinese manufacturers in international markets. Garmin, meanwhile, secured fifth place globally through product line diversification and competitive pricing on select models.

Emir Bardakçı

Emir Bardakçı