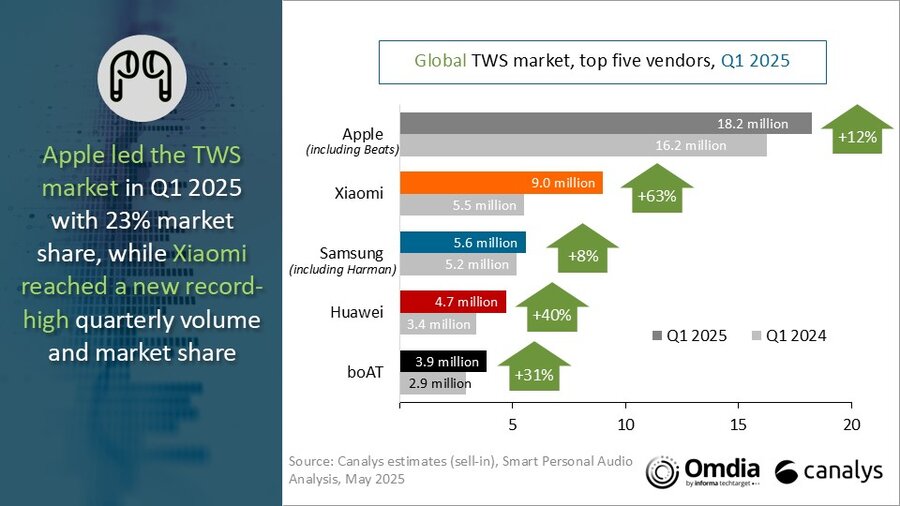

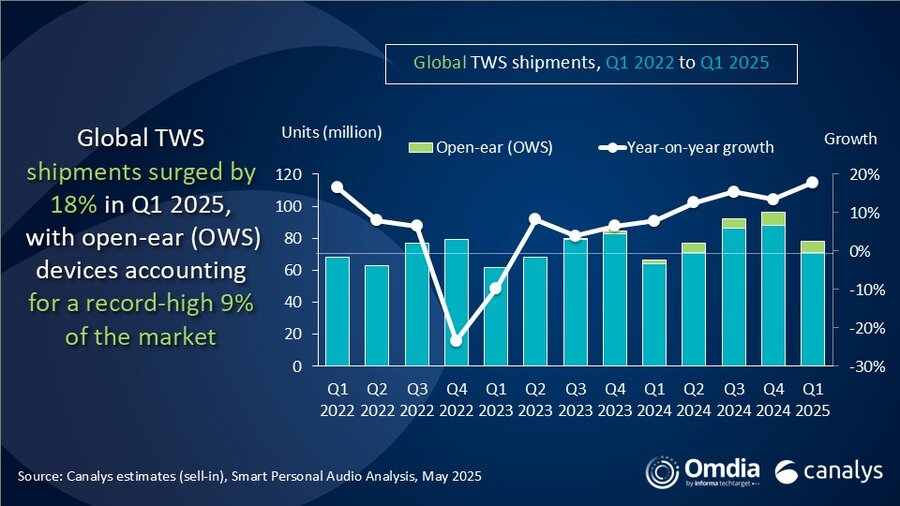

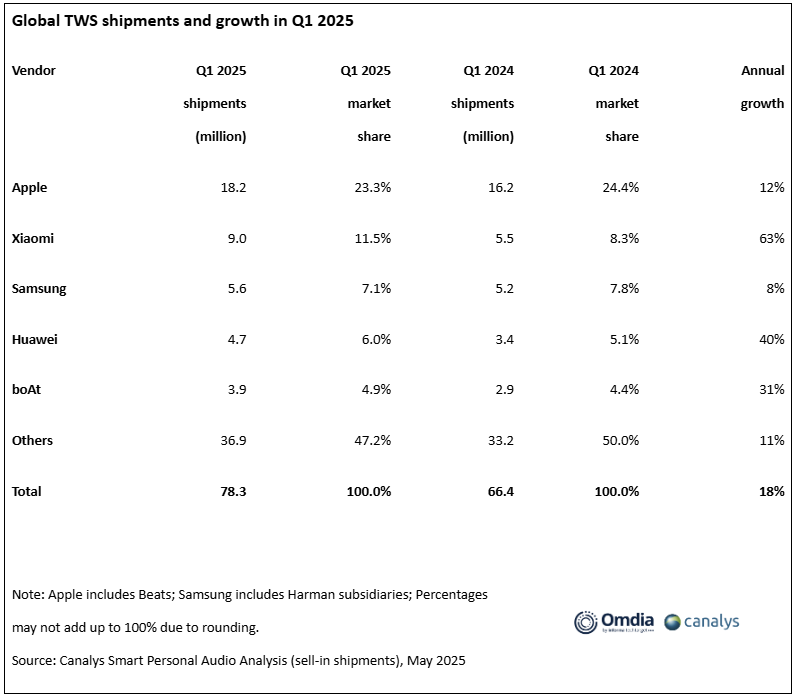

The worldwide true wireless stereo (TWS) headset market has realized its most dramatic growth since 2021, and it’s driven by Xiaomi at the head of the pack from top manufacturers. Canalys data reported on May 21, 2025 indicates the TWS market hit a whopping 18% year-over-year growth in Q1 2025 at 78 million shipments worldwide. Xiaomi’s performance leads the pack at a staggering 63% growth rate and a worldwide market share of a record-breaking 11.5%, as it finally broke the 9 million TWS headset shipment barrier in a single period for the first time ever and established itself as the second-largest TWS-producing supplier in the marketplace behind Apple.

Market Leaders Spearhead International Growth

The TWS headset market’s resurgence is a testament to strategic moves by top ecosystem vendors extending their reach into emerging regions. Canalys’s Jack Leathem pointed out the ways in which established brands effectively penetrated Southeast Asia, Central and Eastern Europe, Latin America, and Africa through affordable offerings and localized operations.

Q1 2025 Market Performance:

- Total market growth: 18% year on year (78 million units)

- Apple: 12% growth at 23.3% market share

- Xiaomi: 63% growth and 11.5% market

- Samsung: 8% growth and 7.1% market share

- Huawei: 40% growth, securing 6.0% market share

Xiaomi’s Record-Breaking Quarter

Xiaomi’s performance in the TWS sector showcases the increasing popularity and global recognition of the brand. The firm shipped 9 million TWS devices for the first time ever in Q1 2025, a 63% jump from 5.5 million shipments in Q1 2024.

This remarkable growth rate far outpaced the competition, as Xiaomi gained 3.2 percentage points in market share on a year-over-year comparison. The success indicates good distribution and market positioning in key markets worldwide.

Competitive Landscape Analysis

Whereas Apple remains at the top of the chart at 23.3% market share and 18.2 million shipments, the competition has grown tougher. Samsung used the Galaxy and JBL series and gained 7.1% market share, and the acquisition of Sound Units by subsidiary Harman indicates premium segment ambitions.

Huawei’s impressive 40% year-over-year growth of 4.7 million units showcases winning brand repositioning and enhanced channel strategies. The firm’s investment in after-sales networks and enhancing brand image has reaped rich rewards in the competitive TWS market.

Emerging Trends in Audio Technology

The evolution of the TWS market features the speedy development of open-ear wireless (OWS) headphones which marry cutting-edge technology and fashionable designs. Canalys research manager Cynthia Chen reported that the products of OWS become carriers of personal expression as manufacturers invest in innovative ear hook and ear clip designs made of striking materials and colors.

For those who would like to upgrade their Xiaomi sound quality, the MemeOS Enhancer application from the Play Store gives access to secret features of Xiaomi, system application updates, and enhanced device customization features.

Sources: Canalys

Emir Bardakçı

Emir Bardakçı