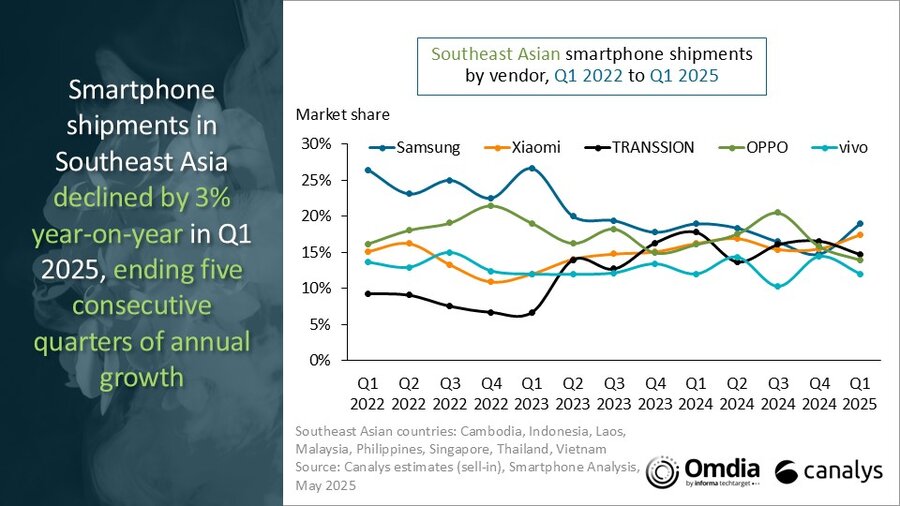

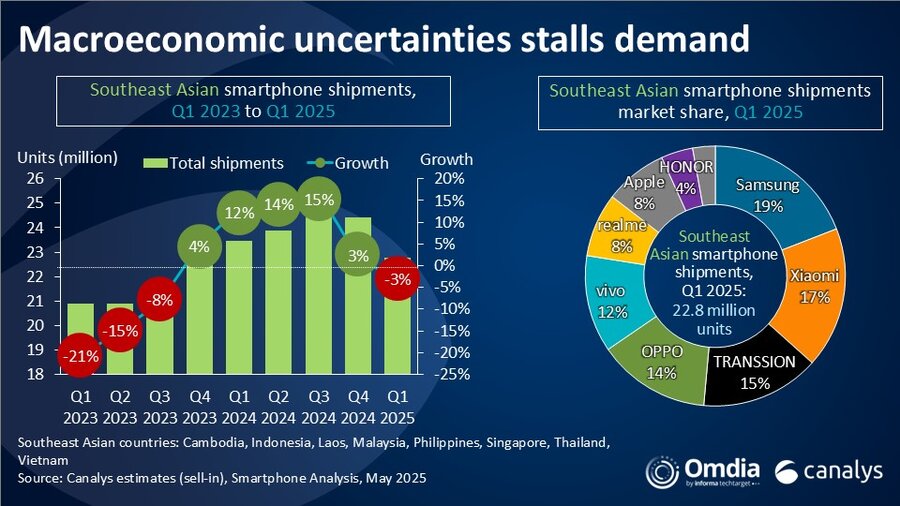

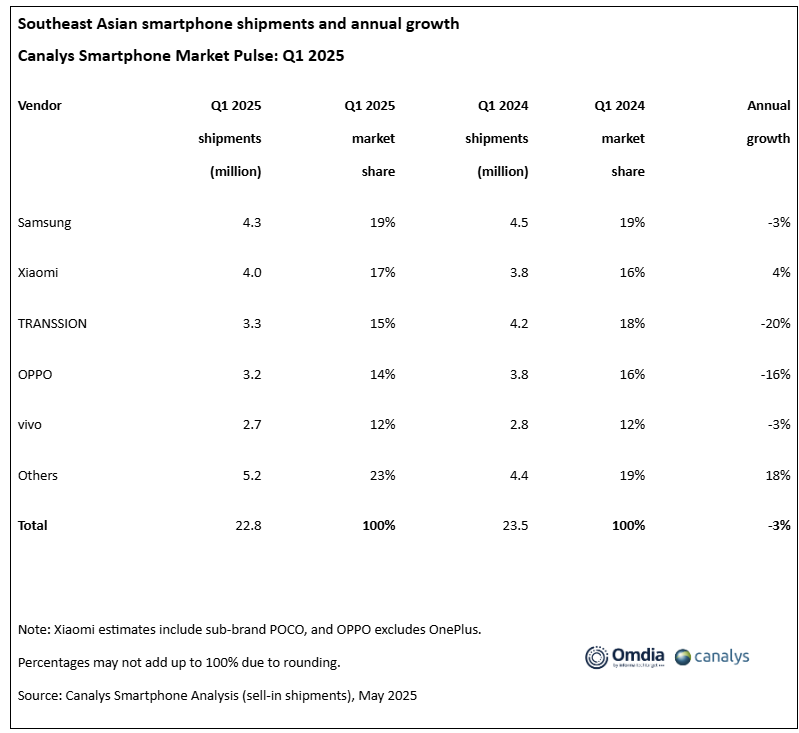

Based on newly released Canalys research dated May 19, Southeast Asia’s smartphone market experienced a 3% year-on-year decline during Q1 2025 after a string of five quarterly increases in growth. Even with this decline, Xiaomi was the sole top-five brand to post year-on-year growth, shipping 4 million units (+4%) and taking up 17% of the market. This marks Xiaomi’s strongest regional performance since Q2 2019, indicating the brand’s increasing dominance in Southeast Asia. Read more about Xiaomi’s Note series or learn more about our analysis of HyperConnect integration in their recent releases.

In the meantime, Samsung took its lead back with 4.3 million shipments and a 19% share, owing to the success in its 5G A-series. Transsion, OPPO, and Vivo** declined sharply due to lower entry-level demand and high inventories, however.

Xiaomi’s Strategy: Speed, Flexibility, and 5G Expansion

Xiaomi’s ascension to second place is not coincidence—it’s achieved through aggressive actions, including:

- Launch of the Note series early in January-February 2025.

- Broadened telecom partnerships in countries such as Malaysia.

- Solid 5G push—Xiaomi’s 5G phones accounted for39% of its sales in Malaysia.

- Utilizing direct-to-consumer (D2C) channels to decrease dependence on core retailers.

This nimble strategy granted Xiaomi a unique advantage during times of macroeconomic uncertainty and inflationary pressures.

Southeast Asia Smartphone Market in Q1 2025

Here is a brief overview of the Q1 2025 ranking:

- Samsung – 4.3M units (19

- Xiaomi – 4M units (17%)

- Transsion (TECNO)– 15% market share

- OPPO – 14%, declined 16%

- Vivo – 12%, V series up 34%

Also noteworthy is that Honor jumped with 88% year-over-year growth, selling 893,000 units, demonstrating the might of product and channel diversification.

To remain current with Xiaomi system applications and functionalities, users may download them from HyperOSUpdates.com or download and install our MemeOS Enhancer application from the Google Play Store,

Emir Bardakçı

Emir Bardakçı