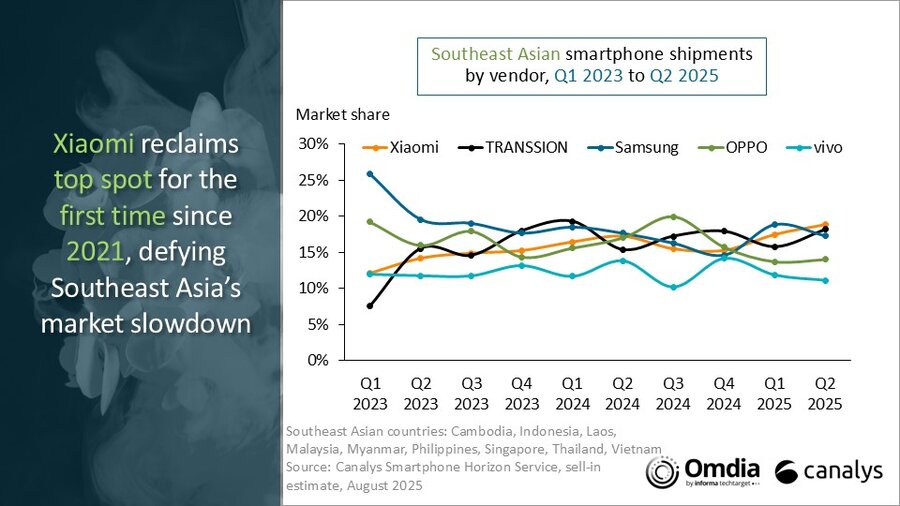

After four years out of the lead, Xiaomi has finally reclaimed its number one position in Southeast Asia’s smartphone market, according to Canalys’s latest report. In Q2 2025, Xiaomi shipped 4.7 million units—securing a 19% market share and posting 8% year-over-year growth. The key driver? The REDMI lineup, which has gained significant traction with Southeast Asian consumers thanks to its aggressive pricing and broad distribution.

Navigating Market Challenges

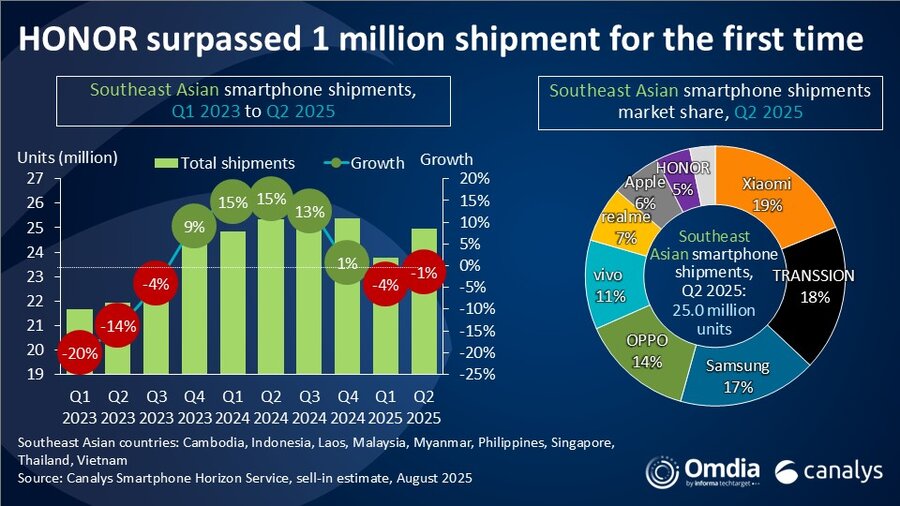

The Southeast Asian smartphone sector faced a tough Q2 2025. Total shipments slipped 1% year-over-year, down to 25 million units, as ongoing tariff uncertainties continued to dampen consumer spending across the region. Despite the macroeconomic headwinds, Xiaomi’s focus on value-for-money devices and wider channel reach enabled the company to outperform competitors and reclaim the top spot.

Competitive Rankings: Q2 2025

Here’s a quick look at the latest rankings:

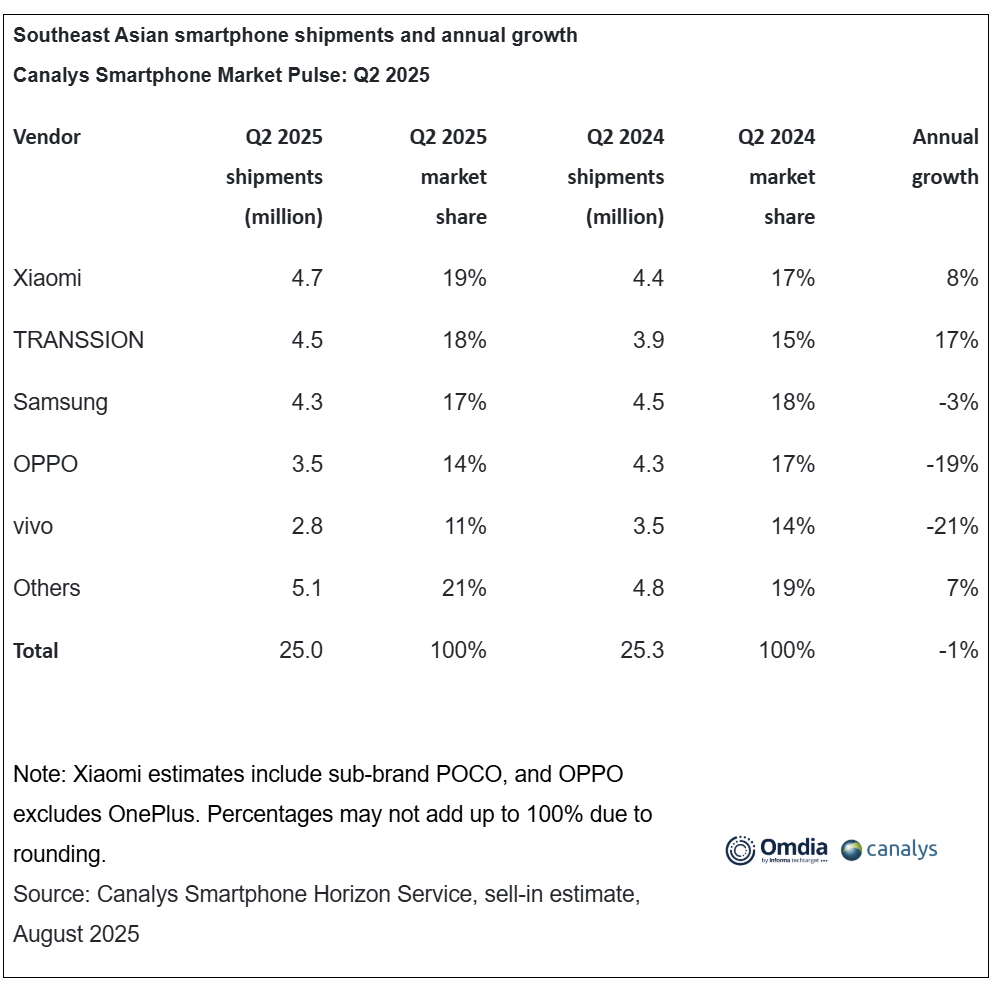

- Xiaomi: 4.7M units (19% share, +8% YoY)

- Transsion: 4.5M (18% share, +17% YoY)

- Samsung: 4.3M (17% share, -3% YoY)

- Oppo: 3.5M (14% share, -19% YoY)

- Vivo: 2.8M (11% share, -21% YoY)

Transsion moved up to second place, posting impressive 17% year-over-year growth, largely thanks to new entry-level models. Samsung held onto third, capitalizing on increased demand for 5G models in Vietnam and Singapore (notably the Galaxy A06 5G and A16 5G). Oppo and Vivo, meanwhile, saw significant declines.

Global Context & Regional Preferences

On a global scale, smartphone shipments dipped slightly to 288.9 million units in Q2 2025. Samsung retained global leadership with 57.5 million units shipped. However, local preferences continue to shape market dynamics: Huawei leads mainland China, Vivo dominates in India, and Apple remains the top choice in the United States. Xiaomi’s strong performance in Southeast Asia reflects its ability to tailor strategy to regional market conditions and consumer demands.

Source: Canalys

Emir Bardakçı

Emir Bardakçı