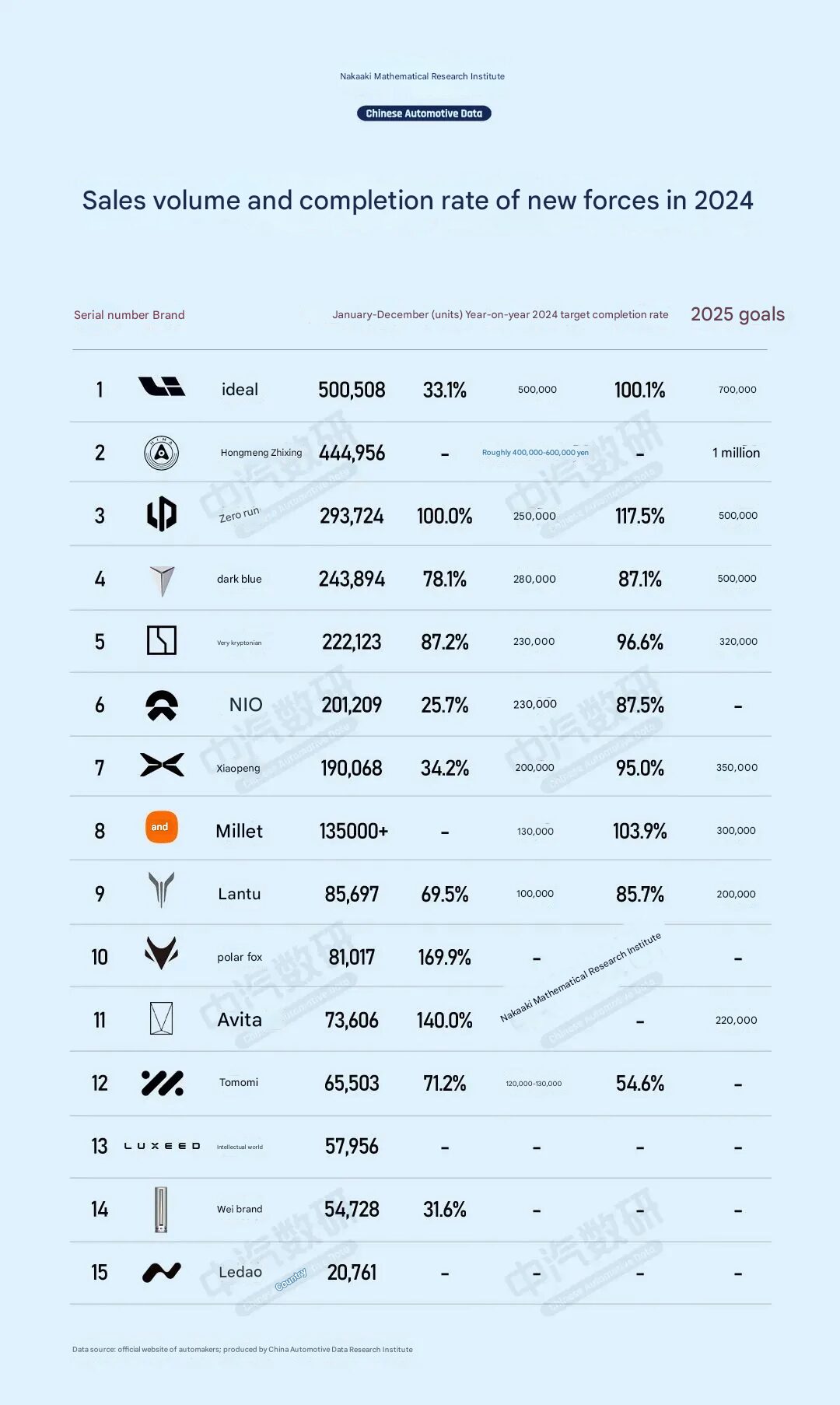

Below is the 2024 sales data for China’s major domestic automakers, which on the whole looks very solid across the board. Among the ones listed above, only Xiaomi, Ideal, and Leapmotor delivered more than their annual sales targets, reflective of the high growth rate in the industry.

2024 Sales Target Achievement Rates

According to the China Automotive Digital Research Institute, sales completion rates for top performers are as follows:

- Xiaomi Auto: 103.9%

- Ideal Auto: 100.1%

- Leapmotor: 117.5%

These results underpin the ability of these companies to meet or exceed expectations despite a competitive and evolving market landscape.

Strong Performers Close to Target

Other manufacturers, such as Zeekr and Xiaopeng, missed their targets but were equally impressive:

- Zeekr: 96.6%

- Xiaopeng: 95%

Aggressive Goals for 2025

Automakers’ aggressive sales targets for 2025 include:

- Leapmotor: It increases its target to **500,000 vehicles

- Xiaomi Auto: to reach 300,000 vehicles, twice as many targeted for 2024 – Lantu Auto: Plan on a goal of 200,000 vehicles, raised from 2024

- Avita (Changan Automobile): From 90,000 units in 2024 to an ambitious target of 220,000 units for 2025

It implies more targets the automakers have set optimistically, confidently, for further growth, together with the great demand flowing in for the electric and smart vehicles within the Chinese borders. In their current state, 2025 is gearing up to be yet another transformational year driven by Xiaomi, Ideal, and Leapmotor, characterized by an even higher pace of innovation, aggressive competition, and wider consumer acceptance of emerging automotive technologies.

Emir Bardakçı

Emir Bardakçı