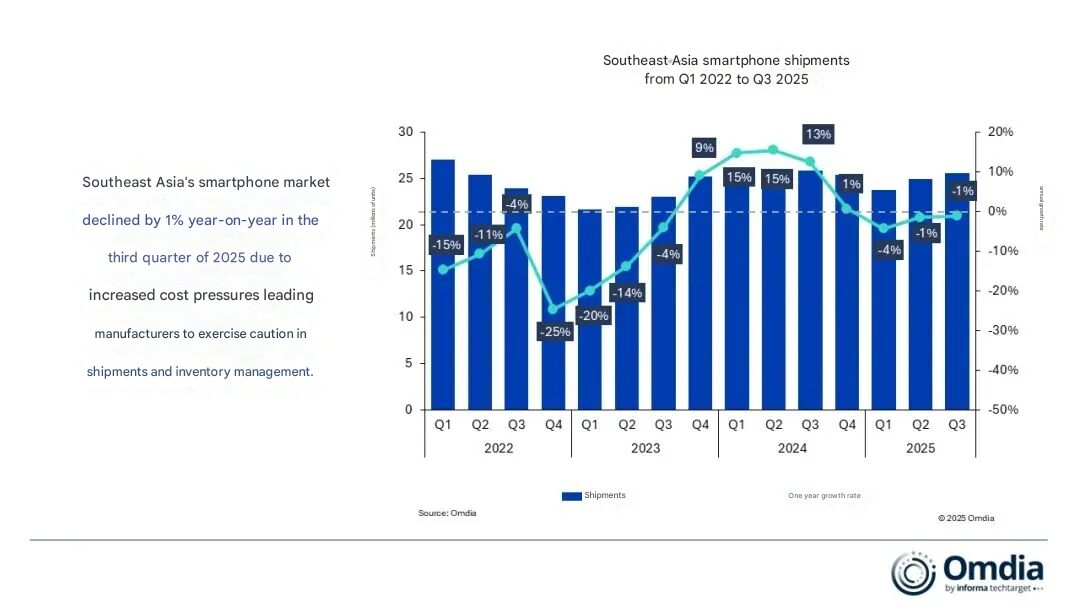

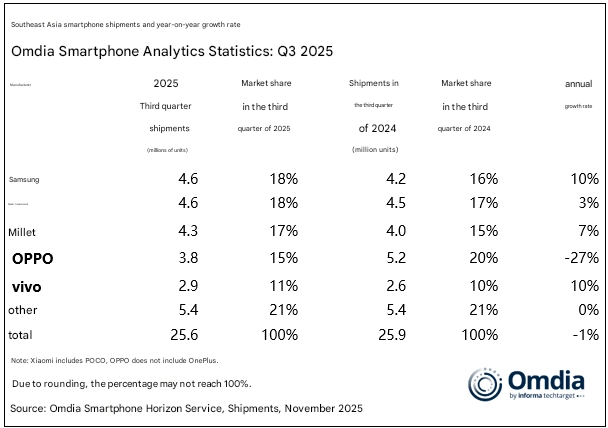

The new Omdia report indicates a small contraction of 1% year-over-year in Q3 2025, as the Southeast Asia smartphone market shipped 25.6 million units. While shrinking, the competition among the leading brands remains intense, especially for Xiaomi, which continued to solidify its positioning due to remarkable performance from the POCO series. Readers can also see previous Xiaomi market analyses on XiaomiTime.com or look at some related model updates on HyperOSUpdates.com.

Market Overview: Shipments Down but Competition Stable

The Southeast Asian market declined for the third straight quarter, affected by high price sensitivity and supply-chain adjustments. While total shipments were down, leading brands continued to pursue strategic momentum in various price segments.

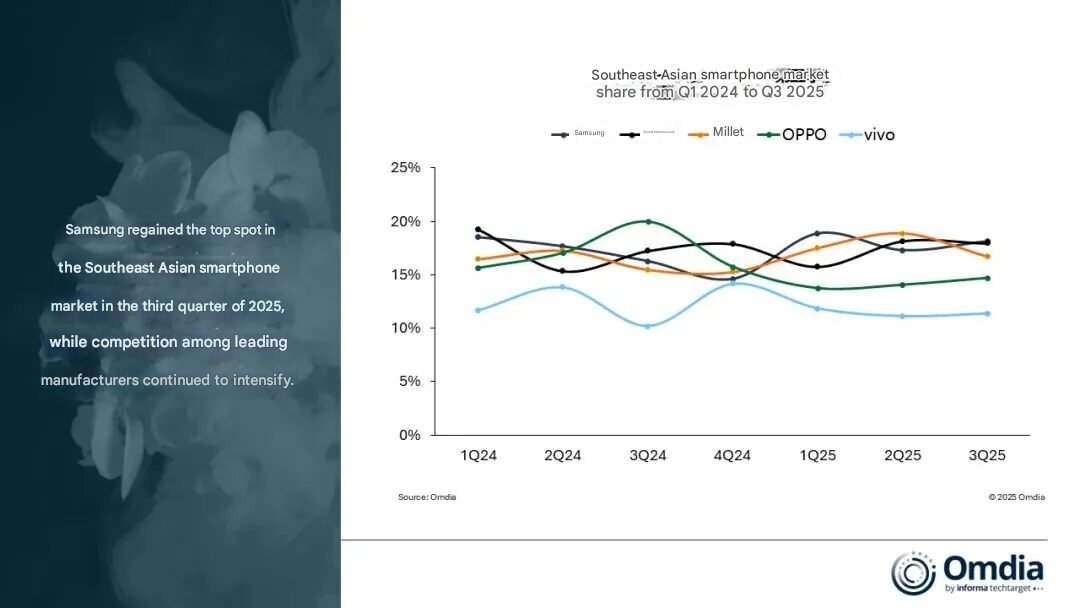

Samsung took back the lead, shipping 4.6 million units to secure an 18% market share, since it was better positioned in higher-end markets like Thailand, Malaysia, and Vietnam to offset the competitive pressure from Indonesia and the Philippines.

Strong Performance by Xiaomi, Driven by POCO Series

Xiaomi came third with 4.3 million units shipped and a 17% market share. Driving this performance was the strong market reception of the POCO lineup following the introduction of a new entry-level model. Its strategy for accelerating shipment volume and widening channel penetration has continued to consolidate its competitive position.

OPPO followed with 3.8 million units and a 15% share, but shipment numbers dropped because of weakened market demand and ongoing restructuring across the distribution channels. Meanwhile, vivo secured the fifth position with 2.9 million units and an 11% market share, supported primarily by the new Y series models complementing its established V series.

Shifts in Entry-Level Dynamics

Entry-level smartphones continue to dominate the landscape, with over 60% of devices selling below US$200. Omdia believes that this segment is becoming increasingly volatile but still ultimately defines overall market leadership. Though OPPO and vivo look to pursue value-centric strategies, Xiaomi and Honor maintain shipment-driven expansion strategies. In fact, Q3 shipments for Honor doubled year-on-year due to an increase in channel penetration for the X6c.

Outlook: Increased Costs and New Approaches

In the second half of 2025, manufacturers will have to be even more aggressive in their product strategies,” added Omdia’s senior research manager. The increase in component costs, especially memory and storage, will put pressure on low-price segments, which are balanced on a tightrope between competitive pricing and profitability. To maintain margins while remaining attractive in highly price-sensitive markets, brands can make hardware adjustments or changes in price positioning and/or marketing spend.

Emir Bardakçı

Emir Bardakçı