The smartwatch market worldwide is going back to growth this year, and Xiaomi is solidifying a leading position within such a recovery. According to the latest forecast from Counterpoint Research, shipments should increase steadily after the slowdown of last year. Brands will be helped by fresh hardware platforms, optimization of software, and more powerful health-focused features.

Global Smartwatch Market Returns to Growth

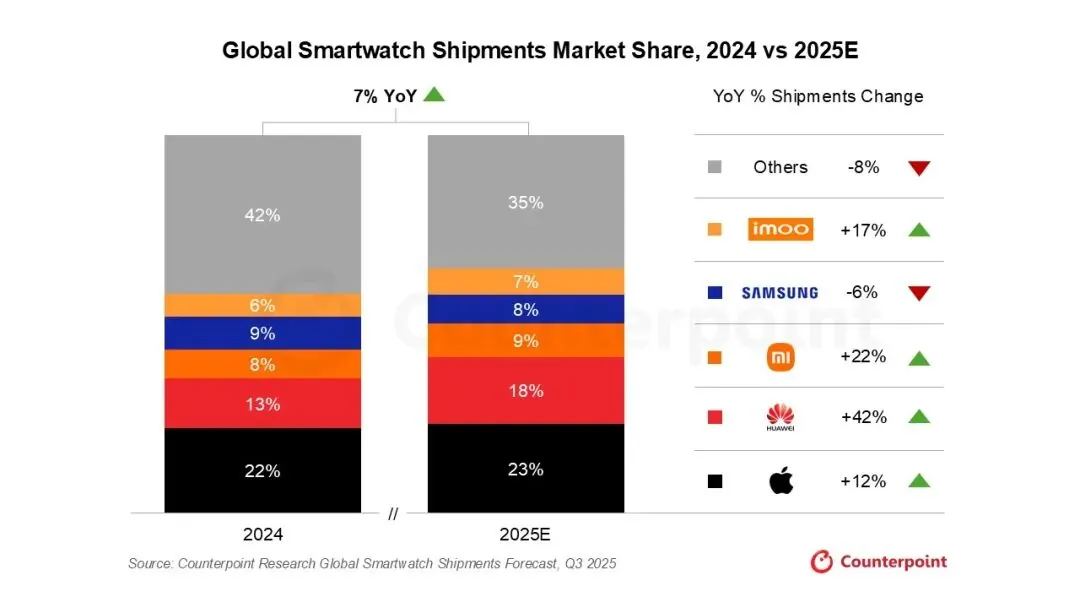

It has begun a period of recovery after the contraction in 2024. According to research by Counterpoint Research, worldwide smartwatch shipments are set to increase around 7% year over year by the end of 2025. This is mainly led by refreshed product portfolios, efficiency gains in chips, and deeper integration between hardware and software platforms.

Consumers are also showing increased interest in mid-to-high-end smartwatches. Advanced health monitoring, longer battery life, and tighter integrations with smartphones are no longer high-end exclusives but expected features.

China Becomes the Core Growth Engine

China has now become the most important growth engine for the global smartwatch market. Analysts at Counterpoint add that three of the world’s top five smartwatch brands come from China. Government-backed consumer subsidies and climbing household incomes have accelerated the cycles of device replacements.

Xiaomi is leading this with its wide product portfolio, ranging from affordable smart bands to feature-rich smartwatches. The ecosystem approach, driven by the integration of Xiaomi HyperOS and HyperConnect, increases user retention and cross-device usage. Consequently, China’s global market share is projected to grow from 25% in 2024 to 31% in 2025.

Xiaomi Among the Top Five Brands in the World

According to data, the top five smartwatch makers in 2025 could be Apple, Huawei, Xiaomi, Samsung, and Xiaotiancai. Apple leads the list, followed by Xiaomi as it consolidates its position with steady shipment volumes and an aggressive pricing policy.

Huawei is expected to demonstrate a 42% year-on-year shipment growth, whereas Samsung may show a slight decline. Meanwhile, Xiaomi enjoys the dividends of having a balanced portfolio and a strong brand, especially in Asia and emerging markets.

Apple’s rebound bolsters broader market stability.

Apple’s newest smartwatch generation saw shipment growth of 12% YoY in Q3 2025, breaking a long period of decline. This helps to give more stability to the overall market and indicates the renewed confidence of consumers across the category.

Consider the case of a circle which is tangent to two intersecting straight lines both internally and externally.

Emir Bardakçı

Emir Bardakçı