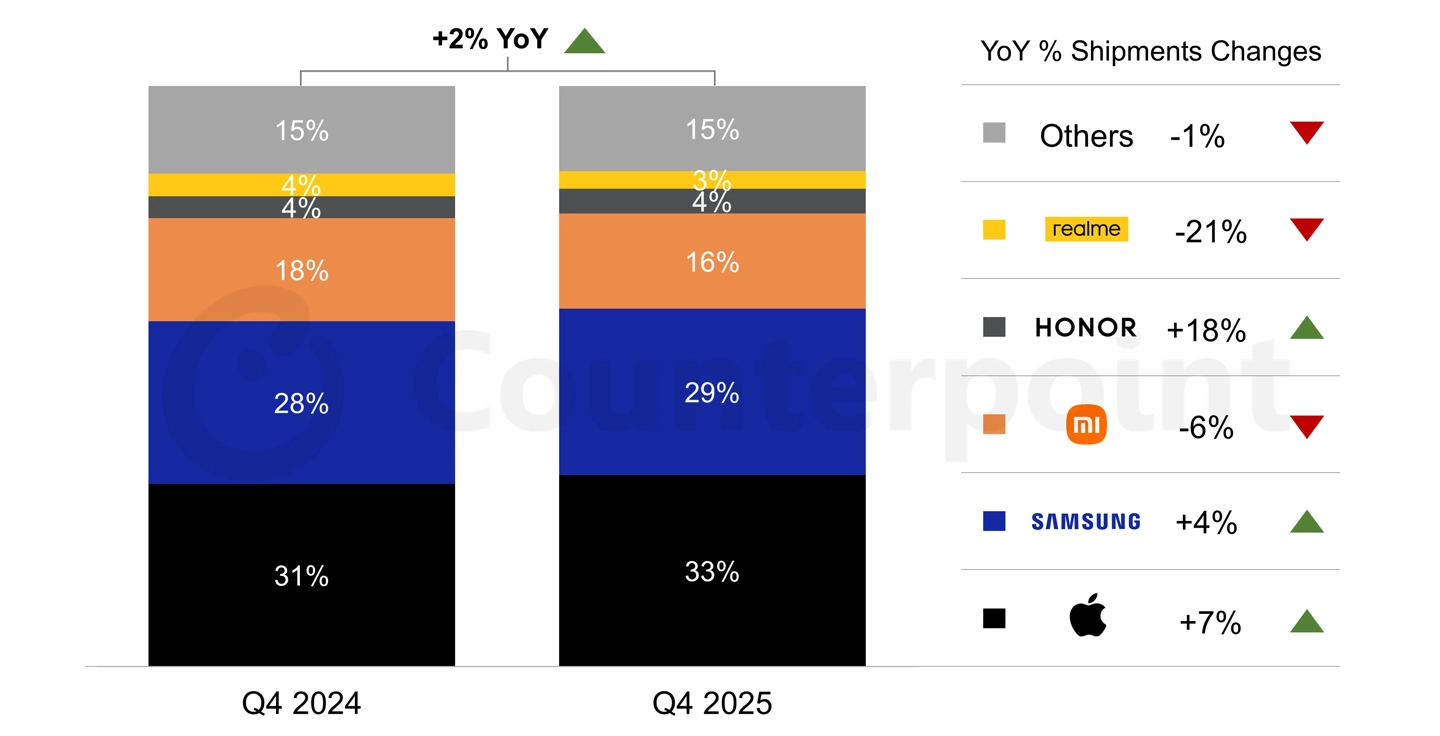

Counterpoint Research published a new report detailing European smartphone shipments for the fourth quarter of 2025. The overall market delivered a strong performance with a 2% year-over-year increase in shipments, continuing a steady recovery trend despite ongoing macroeconomic challenges. However, Xiaomi faced a difficult quarter as the company navigated fierce competition and shifting consumer demands across different regions.

Apple Takes the Lead

Apple grabbed the top spot with a 33% market share and a 7% shipment increase driven by the highly popular iPhone 17 series.

Samsung Secures Second Place

Samsung recovered from previous slumps to claim a 29% market share following a 4% growth in year-over-year shipments.

Xiaomi Faces Difficulties

Xiaomi experienced a 6% decline in shipments and dropped to a 16% market share due to intense pressure from Apple in Eastern Europe and weaker sales of the Xiaomi 15T series.

Honor Surges Forward

Honor delivered the best growth performance by expanding its reach in Western Europe and achieving a massive 18% increase in shipments.

Realme Shipments Drop

Realme ranked fifth overall but suffered a severe 21% decline in year-over-year shipments, leaving the brand with a 3% market share.

Looking ahead to 2026, analysts warn that rising memory chip prices will increase component costs and likely trigger a significant market downturn. Xiaomi must adjust its strategy and launch highly competitive devices to regain its lost momentum in the European market.

Burak Mete Erdoğan

Burak Mete Erdoğan

It’s hardly surprising when Xiaomi continues withholding its best products from the global market. Why wasn’t the Xiaomi 17 Pro Max launched worldwide? That kind of decision reflects a deeply flawed global strategy. If they don’t wake up and start treating international customers as first-class consumers, they risk losing serious ground. At this rate, Huawei could easily overtake them within the next two years.