As per TechInsights’ recent market analysis, Xiaomi retained its robust spot in the international smartphone market in Q1 2025, shipping a whopping 41.9 million units and earning a 14.1% market share globally. This denotes a 2.7% year-on-year increase in shipments, the seventh in a string of consecutive quarters for Xiaomi in the ever-expanding field of smartphones. Xiaomi’s global presence continues to grow, albeit incredibly strongly in the home market of China, in which it recorded a phenomenal 40% year-on-year sales increase driven primarily by the REDMI K80/K70 series, and the flagship Xiaomi 15series.

Global Smartphone Market Overview

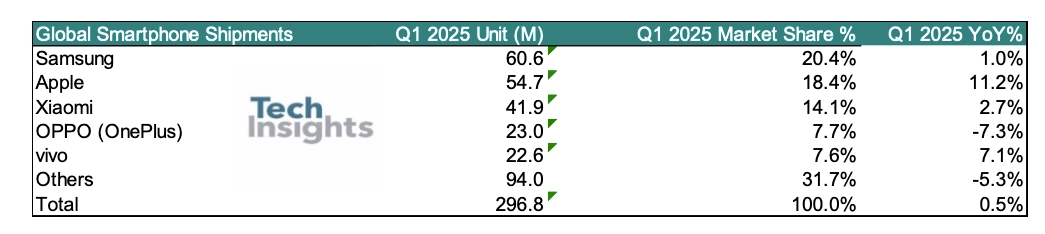

The first quarter of 2025 was marked by moderate expansion as the shipments of smartphones went up by 0.5% year-to-year to 296.8 million units. This represents the sixth quarter in a row of the market recovering for smartphones, although expansion slowed to single-digit levels in the last three quarters. Worldwide smartphone wholesale revenue was stable at $100 billion as the average selling price dropped by a marginal 0.6% to $337.

Key market dynamics involved:

- Robust demand in the Chinese market fueled by smartphone subsidies

- Expansion in Middle East and Africa regions

- iPhone pre-stocking in the United States prior to the implementations of the tariffs

- Decreases in Central and Latin America, Western Europe, and Central and Eastern Europe

Regional Performance of Xiaomi

Xiaomi’s market standing was very different in various regions:

- China: Xiaomi recorded outstanding 40% growth to capture a market share of 19.4% and claim second spot in the local market. It was a significant jump up from 14.8% share in the prior year’s corresponding quarter due to high demand for REDMI K80/K70 and Mi15 series smartphones.

- Asia Pacific and Central/Eastern Europe: Xiaomi retained its top spot in these strategic markets.

- Latin America and Central America: The brand was ranked second, extending its robust performance in the emerging markets.

- Western Europe and Middle East: Xiaomi ranked third in these markets, showing stable performance.

- India: Although ranked fourth behind Samsung, vivo, and OPPO, Xiaomi was affected in this critical market by management transitions, adjustment in inventories, and heightened competition.

Competition Landscape

The rankings of the global smartphone market in Q1 2025 were:

- Samsung: 20.4% share (60.6 million units, +1.0% YoY)

- Apple: 18.4% share (54.7 million units, +11.2% YoY)

- Xiaomi: 14.1% share (41.9 million units, +2.7% YoY)

- OPPO (including OnePlus): 7.7% share (23 million units, -7.3% YoY)

- vivo: 7.6% share (22.6 million units, +7.1% YoY)

In particular, Huawei experienced the most robust increase among all the manufacturers with a rise of 28% year-on-year, regaining the leadership in the Chinese market for the first time since 2021.

Future Outlook

TechInsights predicts a marginal 1% drop in shipments of global smartphones for the entire year 2025. With rising competition, driven in part by the resurgence of Huawei in the 5G segment, Xiaomi will have to sustain its momentum for innovation and market responsiveness.

For users of Xiaomi wishing to access the newest features and updates on their mobile phones, the MemeOS Enhancer app can be found on the Play Store, providing users with access to secret features of Xiaomi, system application updates, and fluid update experiences.

Emir Bardakçı

Emir Bardakçı