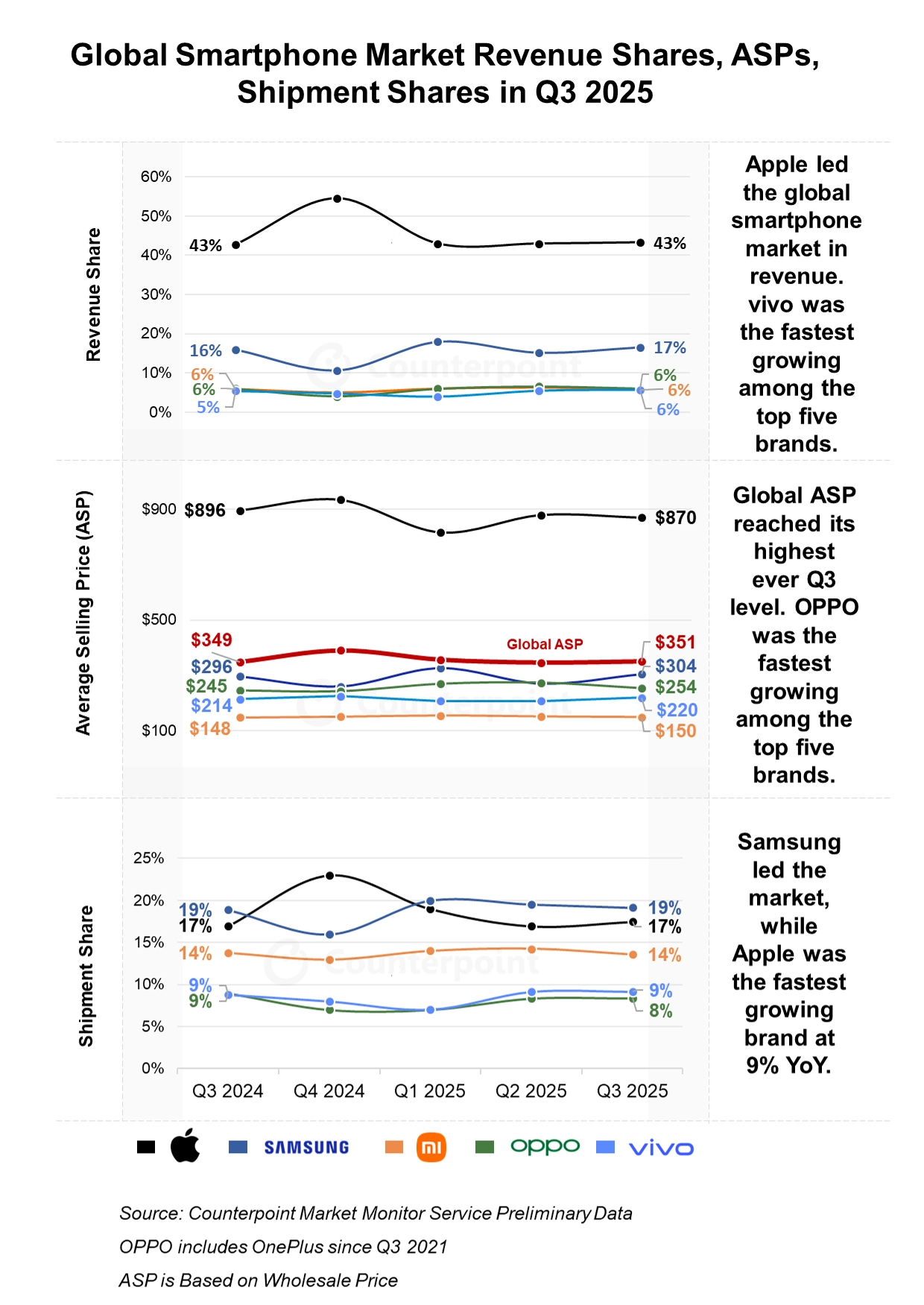

According to the most recent report from Counterpoint Research, global smartphone revenue was up by 5% year-on-year in Q3 2025 to set a new record for the third quarter. Shipments were up by 4% year-on-year, reaching 320 million units. This uptick reflects the continued strong performance of the smartphone industry amid global economic uncertainty. Follow more data insights regarding Xiaomi on HyperOSUpdates.com and the MemeOS Enhancer app.

Senior Analyst Shilpi Jain added that the value growth of smartphones continued to outpace the growth in sales, with a record global ASP of $351. Jain said users are increasingly upgrading to high-end devices, which is driving the global premiumization trend. Trade-in programs, installment plans, and bundled offers have helped make these upgrades more achievable, especially in **emerging markets, where the ASP grew even faster than in mature regions.

Apple and Samsung Lead, Xiaomi Strengthens Third Position

Research director Jeff Fieldhack added that Apple reached a record revenue in Q3 2025, up 6% year-over-year. While the average selling price declined slightly, iPhone shipments were up 9%, driven by a very strong performance of the iPhone 17 series, in particular the standard version with its high cost-performance ratio. The new iPhone 16e also contributed to Apple’s expanded reach.

Samsung remained at the top of the worldwide market with a 19% market share, recording 9% revenue growth and a 3% increase in ASP. The strong shipment performance of the Galaxy S25 series, joined by the foldable models such as Z Fold7 and Z Flip7, drove this result. High-end model adoption continued to boost the company’s profitability.

Xiaomi Shows Strong Growth Across Emerging Regions

Xiaomi solidified its third-place rank with a 14% global market share, up 2% year-on-year. Strong demand for mid-to-high-end smartphones from emerging markets in Southeast Asia, the Middle East and Africa, and Latin America helped offset softer sales in some mature regions for the company.

This could be argued to align with Xiaomi’s wider strategy, under the leadership of Lei Jun, focused on value-driven innovations and premium designs. Models in the series, such as the Xiaomi 15 series and the Redmi K80 Ultra, have garnered encouraging feedback from the market and proved the surging influence of Xiaomi beyond China. Users can keep their Xiaomi devices optimized with the MemeOS Enhancer app via Google Play, which offers system app updates and hidden feature activations.

OPPO and vivo Continue to Expand Premium Lineups

OPPO experienced the highest ASP increase among the top five smartphone brands, rising 3.4% year-on-year, while revenue grew by 1%. The Reno 14 series and the company’s emphasis on higher-end devices contributed significantly to this rise.

Meanwhile, vivo achieved the fastest revenue growth of 12% year-over-year, driven by a strong performance in India, Southeast Asia, the Middle East, and Africa. This demonstrates the growing potential of those markets for phone makers that manage to balance affordability with quality.

The Future of the Smartphone Market

Going forward, analysts forecast that the premiumization trend would accelerate further in 2025. The sustained popularity of foldables along with growing AI integration and HyperOS-level ecosystem development will help fuel steady revenue and ASP growth worldwide.

The resilience of the smartphone market proves that innovation and accessibility lie at the heart of consumer demand, with companies like Xiaomi playing the lead role in shaping this evolving landscape.

Emir Bardakçı

Emir Bardakçı