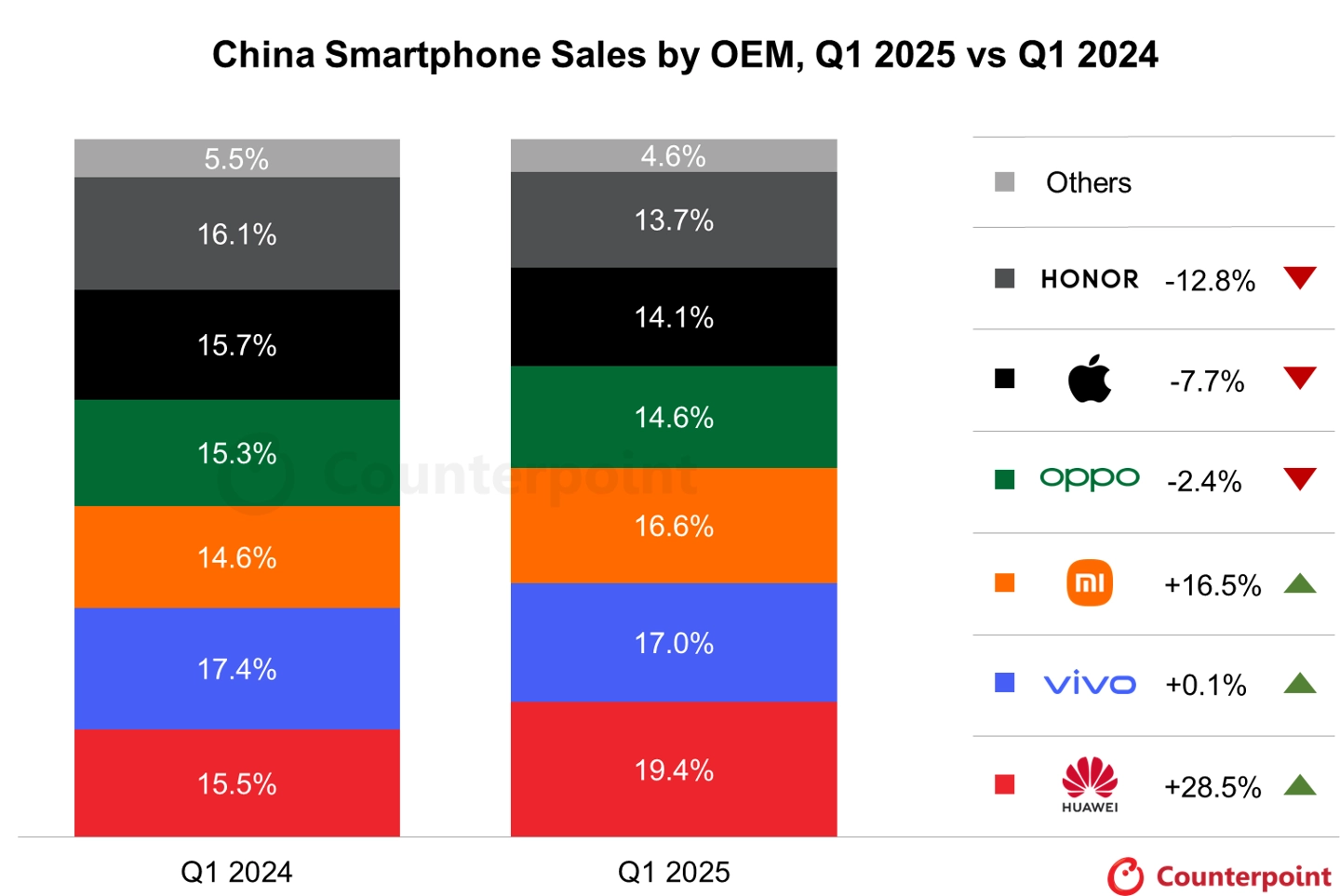

The most recent market research from CounterPoint Research indicates that China’s smartphone market posted a sturdy 2.5% growth annually in Q1 2025, as Xiaomi achieved remarkable 16.5% growth and moved into the third position of the top smartphone brand in the nation. This remarkable success follows as Xiaomi continued to grow its high-end market presence with moves such as venturing into the electric vehicle market and aggressive offline retail moves. The development coincided with China’s national subsidy measures that have rejuvenated the general smartphone market.

Market Leaders and Key Performance

The Chinese smartphone market currently has Huawei at number one position with a market share of 19.4%—its best since 2021. The brand’s 28.5% year-over-year growth was boosted by high demand for the Nova 13 range and flagship Pura 70 line, in addition to price cuts on bestseller models.

Vivo took the second position at 17% market share, registering a minor 0.1% growth from the previous year. Its affordable Y series was responsible for most of the sales, while its high-end X200 series received consumer acclaim based on its camera capabilities that were boosted after the partnership with Zeiss.

Xiaomi’s Strategic Growth

Xiaomi was the second-fastest growing brand in the market in China with a market share of 16.6%. The company’s remarkable growth can be explained as follows

- Broadspectrum coverage of the subsidy policy over all major product lines

- Effective entry into the high-end smartphone market

- Increased market presence via offline retail expansion Synergies of its entry into the market for electric vehicles

Industry Trends Influencing the Market

Based on CounterPoint Research, Chinese smartphone OEMs have embraced a “high configuration and competitive price” strategy in earnest, sharply boosting the combined market share of the mid-to-high-end market tiers.

Some other significant market trends are:

- Around 40% of models currently backing GenAI technology

- Integration of DeepSeek’s sophisticated AI models for improved device experiences

- Increased popularity of foldable form factors

- Battery life as a major product differentiator

The Chinese market remains the arena of innovation, with the likes of OPPO unveiling the ultra-slender Find N5 foldable and Huawei debuting its unique Pura X clamshell starting at $1,055 (7,499 RMB). Source: CounterPoint Research (https://www.counterpointresearch.com), XiaomiOfficial (https://twitter.com/xiaomi)

Emir Bardakçı

Emir Bardakçı

good phone

Xiaomi 14T mobile phone is excellent 👆 but

Screen recorder is not working means not recording video call sound 🔊 if you don’t mind please let me know how to record ⏺️ video call 📞 sound

Thankyou and best regards,

Mohammad Rafiq Manzoor Ahmad

Jhelum punjab Pakistan 🇵🇰