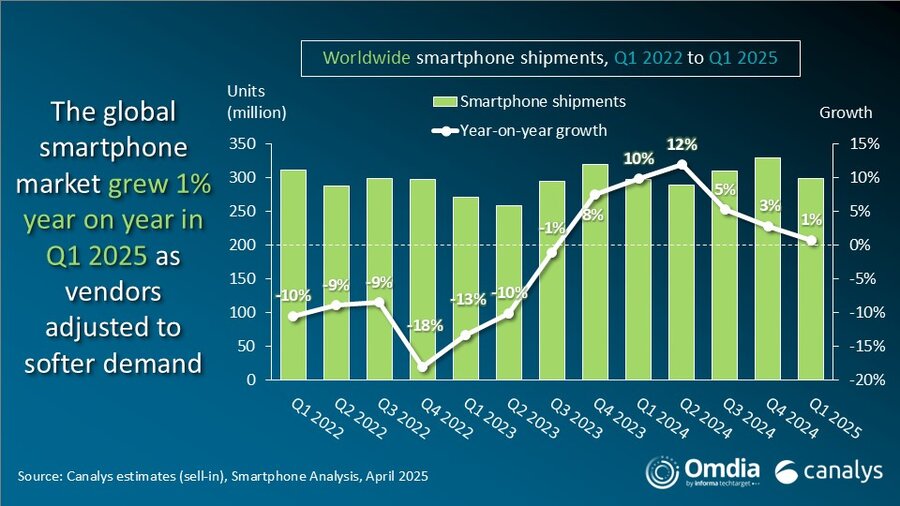

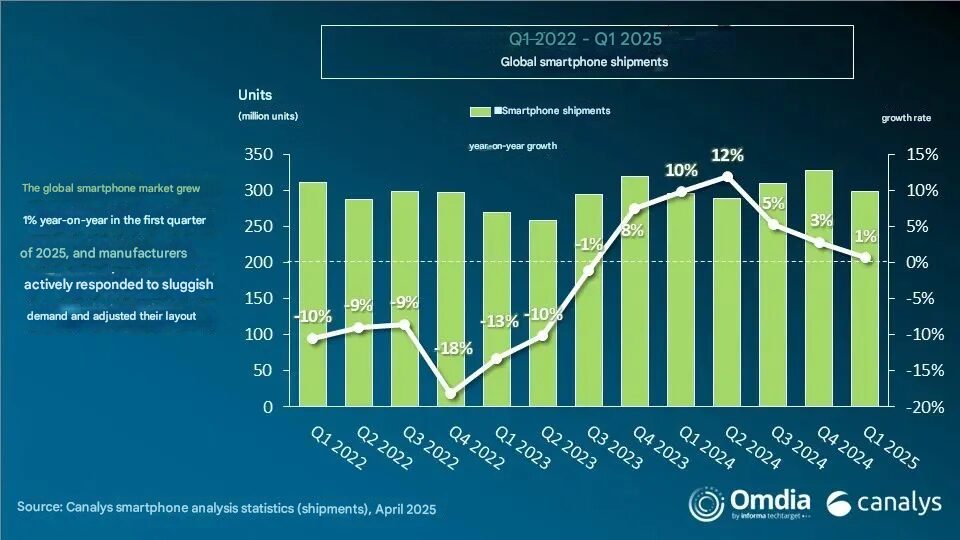

In a new report released on April 15, 2025, by Canalys, the worldwide smartphone market posted a 1% year-over-year growth in Q1 despite several challenges it faced. Macroeconomic pressures, low consumer confidence, and channel shipment postponements were still influencing the market, but the top manufacturers were still able to keep up the competition.

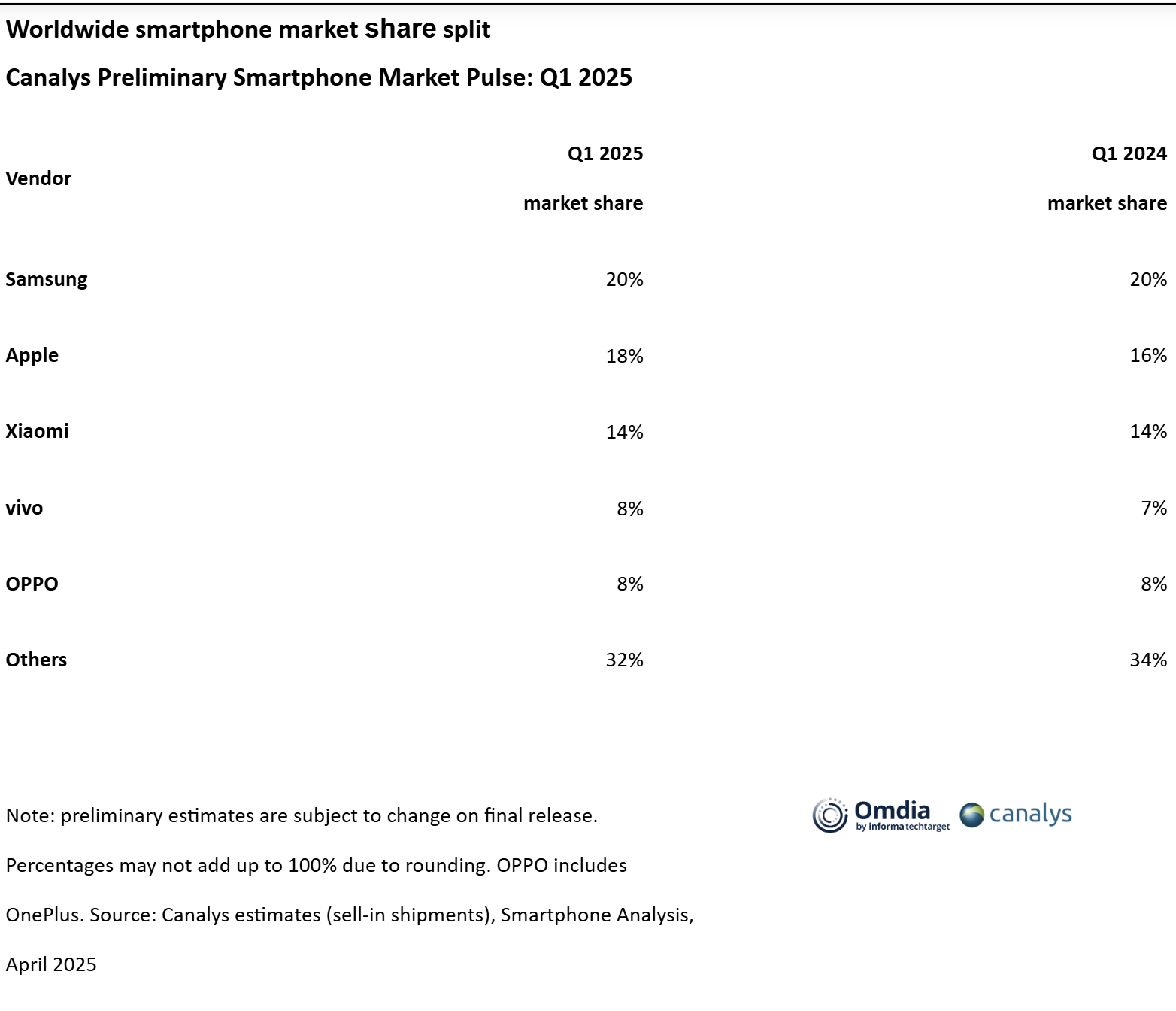

Xiaomi remained the third-largest smartphone brand in the world and retained a similar 14% market share versus the prior year’s same period. For comparison, Samsung regained the top rank with a market share of 20%, and Apple was hot on its heels at 18%. Read our earlier analysis of Xiaomi’s quarter in Q4 2024.

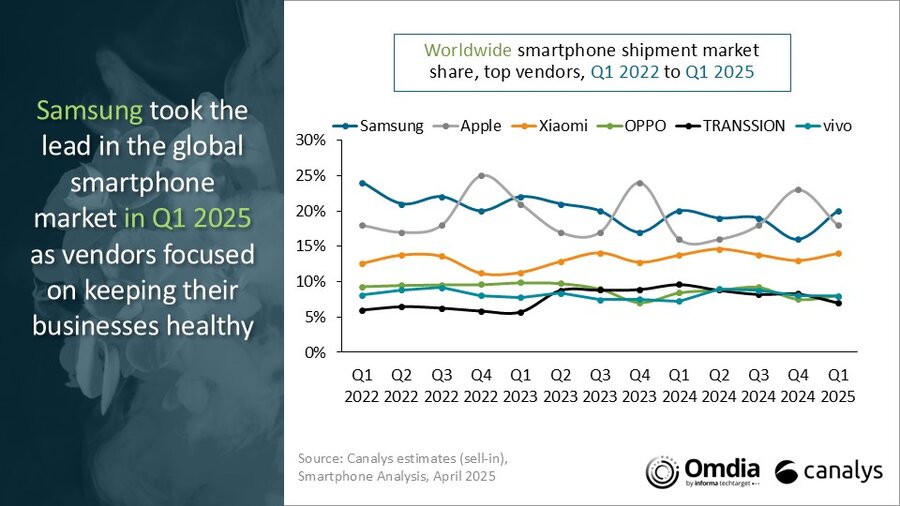

Global Smartphone Market Share – Q1 2025

- Samsung: 20

- Apple: 18

- Xiaomi: 14%

- vivo: 8%

- OPPO: 8%

This performance demonstrates Xiaomi’s resilience and its capacity to keep its ground strong in the presence of global uncertainties. With its extensive lineup of products—most notably in the mid-market category—and its more recent efforts at integrating AI and building the HyperOS ecosystem, Xiaomi is keeping its place in the global market strong.

Industry Challenges Remain in the Year 2025

Amber Liu, a manager of research at Canalys, underlined that the first quarter of 2025 was more turbulent than anticipated. Even though 2024 was capped by robust sales, the beginning of 2025 experienced a decline in actual sell-through which decelerated shipment momentum in all top-tier brands. In place of price wars and sheer mass market volume of the previous year, the recovery in this year was more sluggish and delicate.

This change is particularly important to brands like Xiaomi that are highly active in price-sensitive markets where sluggish goods movement can cause a more significant drag on profitability and forward planning.

Global Trade Tensions and Supply Chain Adjustments

The report also mentions increased trade tensions at a global level, which are refocusing supply chain strategies of all technology companies worldwide. Liu Yixuan of Canalys also mentioned that increasing tariffs in the U.S., in particular, are prompting manufacturers to think ahead and change their logistics and procurement models.

Apple already started delivering products earlier so that it will not have to increase costs in the future. In reaction to these pressures, Xiaomi and others are accelerating diversification efforts, including relocating production bases and rationalizing supply chains. This strategic agility will be a decisive factor in Xiaomi’s resilience to withstand global shocks and register stable growth in 2025 and beyond.

Source: Canalys

Emir Bardakçı

Emir Bardakçı

very high rates of Apple & Samsung’s.