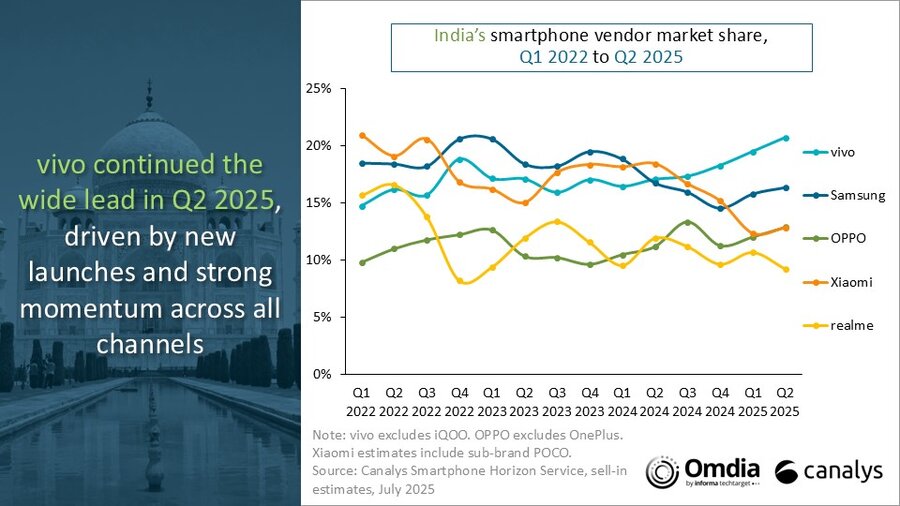

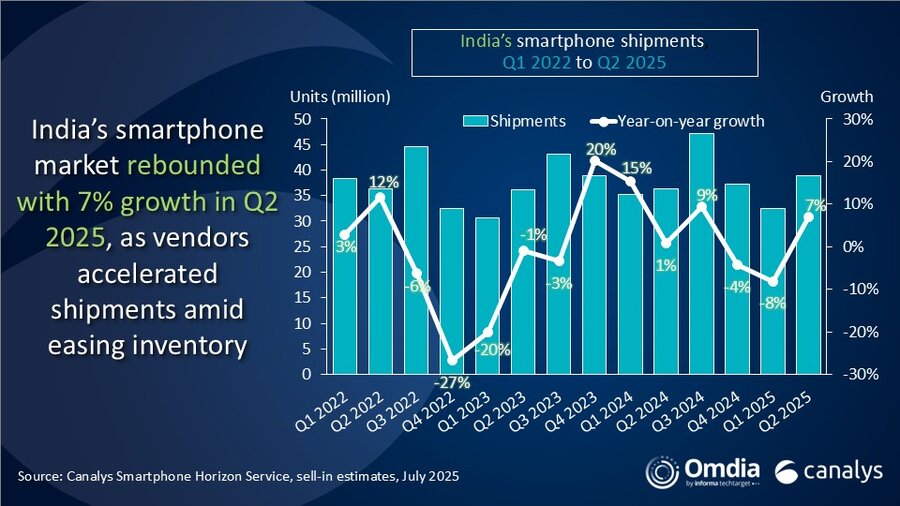

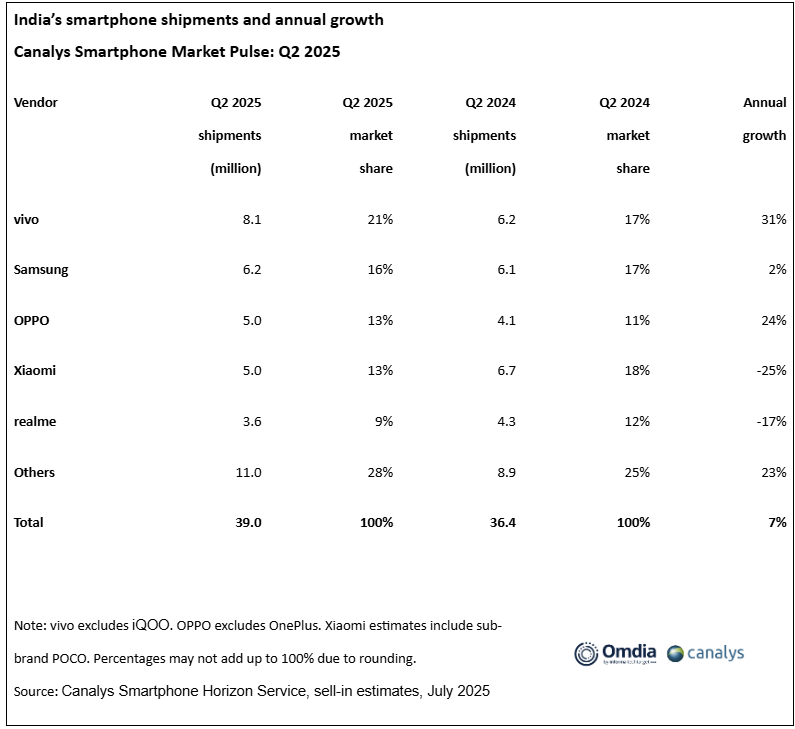

Canalys has released its Q2 2025 report on India’s smartphone market, and the numbers tell a clear story—change is in the air. The market shipped 39 million units, marking a respectable 7% year-on-year growth. But the real headline? Vivo’s meteoric rise. With a remarkable 31% growth, Vivo now leads the pack, while some long-standing players are seeing their dominance slip.

It’s a dynamic environment, with aggressive competitive strategies and evolving regional trends driving fresh momentum. Canalys’ data highlights how Indian consumers are shifting preferences, and these developments are shaping the world’s second-largest smartphone market in real time.

Leadership Shuffle

Vivo has emerged as the market leader, shipping 8.1 million units and capturing 21% market share. Their success comes down to strong distribution, robust channel partnerships, and targeted marketing—especially during peak demand periods. Canalys analyst Sanyam Chaurasia credits Vivo’s ability to position the right products in the right segments and to execute on-the-ground strategies that deliver results.

Brand Performance: Leaders and Laggards

Here’s a breakdown of how the top brands performed in Q2 2025:

- Vivo: 8.1M units (21% share), up 31%

- Samsung: 6.2M units (16% share), up 2%

- OPPO: 5.0M units (13% share), up 24%

- Xiaomi: 5.0M units (13% share), down 25%

- Realme: 3.6M units (9% share), down 17%

Vivo and OPPO demonstrated standout growth, while Xiaomi and Realme faced significant headwinds.

Strategic Moves Behind Vivo’s Success

Vivo’s V50 series gained considerable traction in major cities through extensive promotional campaigns, particularly around wedding season. The Y series proved effective in smaller cities and semi-urban areas, benefiting from deep distribution and local marketing initiatives. Meanwhile, the T series performed well online, enabling Vivo to address diverse consumer needs across channels.

Market Outlook

Despite setbacks for some brands, India’s smartphone market continues to grow, fueled by strong consumer demand and the relentless pace of innovation. The competitive landscape remains fluid, and brands that can adapt quickly—and execute effectively—will be best positioned to capture future growth.

For ongoing updates on market trends, resources like HyperOSUpdates.com and the MemeOS Enhancer app offer valuable insights and tools for both consumers and industry watchers.

Source: Canalys Research

Emir Bardakçı

Emir Bardakçı

رائع جدا لان شاومي تحديتاثها مقرفة جدا عكس فيفو التي تتمتع بتحديث originos السلس و الرائع جدا