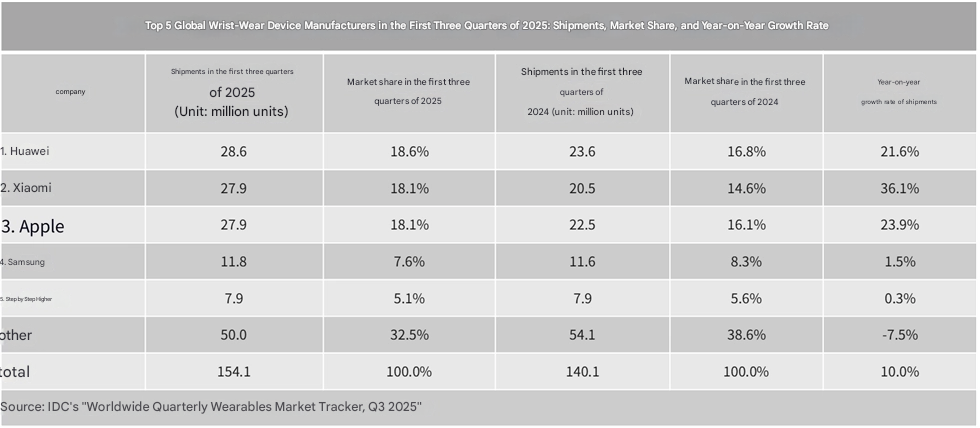

*As reported in the latest Worldwide Quarterly Wearable Device Tracker by International Data Corporation (IDC), the worldwide market for wearable wrist devices continued its positive trend in the first three quarters of 2025. A cumulative shipment of 150 million units was recorded, reflecting a 10% growth from the previous year.

Global Wearable Technology Market in 2025: An Overview

The wrist wearable segment comprises smartwatches and fitness trackers, both of which have made a positive contribution to the growth of the overall market. The IDC statistics reveal a well-balanced growth, with the maturing and emerging markets providing equal contribution, China being a leading contributor globally.

Worldwide shipments of the total smartwatch segment were around 120 million units within the initial three quarters of 2025. This marked an incremental growth of 7.3%. Interestingly enough, the fitness trackers touched the 32.86 million units mark and were growing at the rate of 21.3%.

China Market Performance and Growth Dynamics

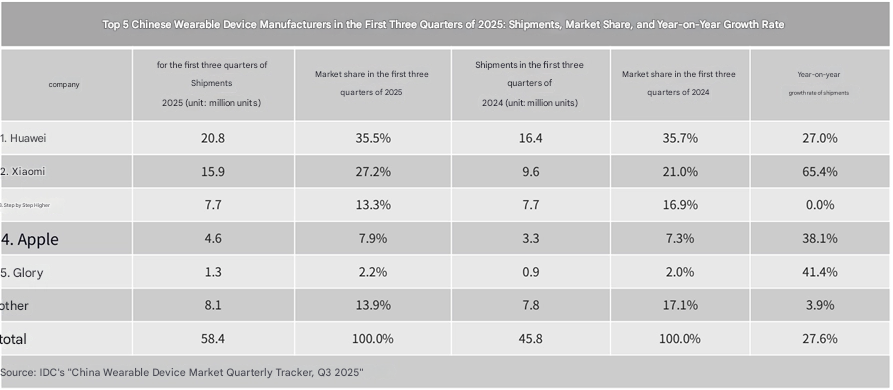

China emerges as a leading player in the global growth story, registering a cumulative shipment of 58.43 million wrist-worn devices, an increase of 27.6% year-over-year. The shipment of smartwatches and fitness trackers in China is reported to be 40.04 million and 18.39 million units, respectively, registering robust growth.

This is supported by the expanding offline presence of retail stores, awareness of health-related features, and competitive prices of the entry-level and mid-range segments. Xiaomi directly benefited from the above-mentioned factors because of the existing distribution channel and brand presence in the region.

Position of Xiaomi Among the World’s Top Brands

Xiaomi was the second-biggest brand worldwide in cumulative deliveries during the first three quarters of 2025, registering the fastest growth among the top five brands. The combined shipment volume was 27.9 million units, driven by its popular models “Xiaomi Band 10” and “Redmi Watch,” which emphasize “cost performance and basic smartness.”

The key regions that drove the growth for Xiaomi were China, Latin America, and Southeast Asia. The model adopted by the company, which involved online sales combined with offline sales of smartphones, enhanced the visibility and accessibility of the company. The ecosystem offerings combined with software support through Xiaomi HyperOS helped in retaining consumers.

Competitive Scenario & Market Forecast

Huawei continued its leadership in the global market, while Apple led in the mid-to-high-end market through integration and expanded pricing incentives. Samsung resumed its growth with new product offerings, while BBK Group continued to perform well in the children smartwatch market.

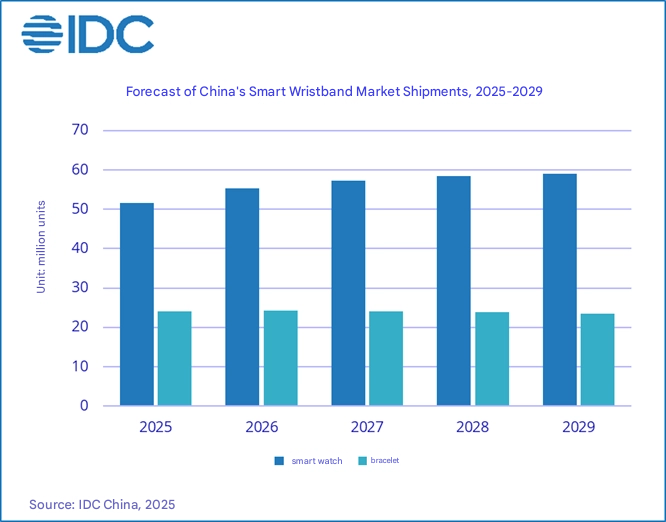

Moving forward, IDC predicted the market size of smartwatches in China to reach 79.58 million units in 2026. The moderate but stable growth in the sector encompasses the overall smartwatches used by adults, smartwatches designed for children, as well as wearable sports tracker watches. This category still relies on the crucial contributions of the brand, Xiaomi.

Emir Bardakçı

Emir Bardakçı