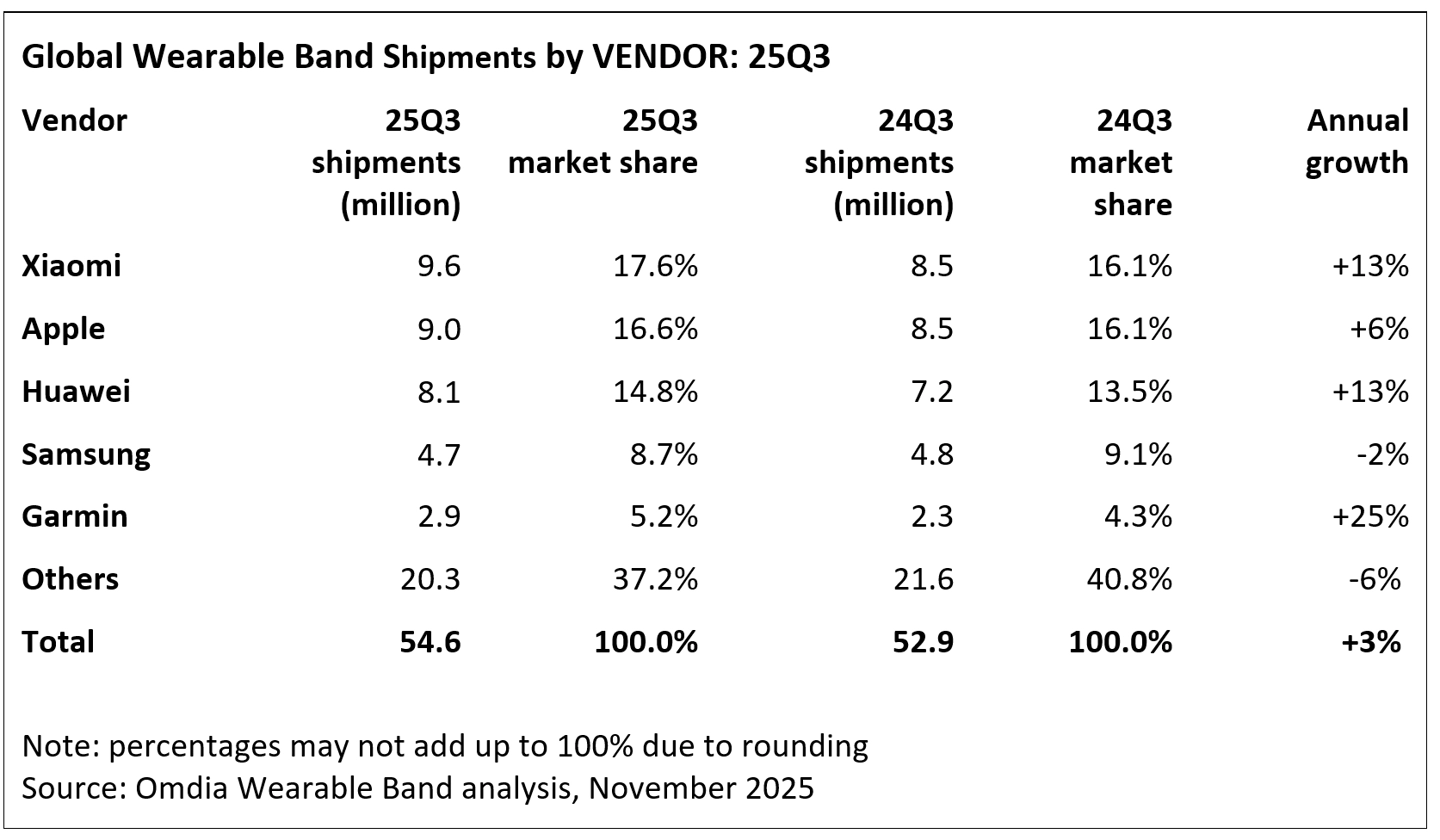

Global market research company Omdia has provided its latest figures for Q3 2025, demonstrating a striking “stable volume with rising price” for wearable wristbands. The total shipments reached 54.6 million units for a more modest growth of 3%, while the value of the total output increased by 12% and reached an astonishing $12.3 billion. Meanwhile, Xiaomi continues to prove itself in this changing environment and has achieved an incredible 13% year-on-year growth, together with other leading brands, which may finally establish the company’s status as an important participant in the global smart ecosystem.

Dominance of Top Manufacturers

The report points out that the top five manufacturers in the sector, Xiaomi, Apple, Huawei, Samsung, and Garmin, jointly contribute to 63% of market shipments and a whole 84% of the total value share. Industry leaders are making use of the huge financial resources and potential for research to establish high competitive barriers. It is thus becoming increasingly hard for smaller brands to compete by simply attempting price wars.

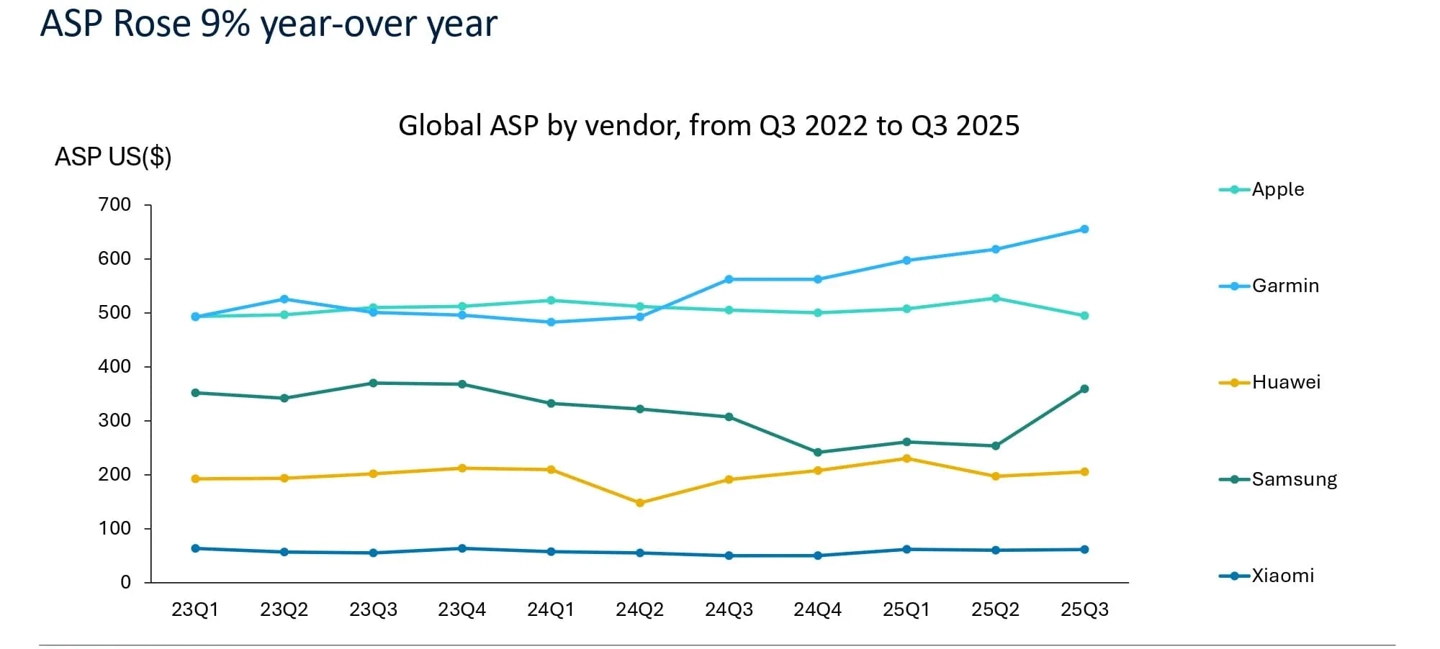

The average selling price (ASP) of wearable wristband devices globally reached $225 in the third quarter of 2025, marking a 9% increase compared to the previous year. This rise indicates a clear consumer shift toward premium and feature-rich devices rather than basic alternatives.

Strategic Growth Across Market Segments

Major players in technology are trying a “dual strategy” to target the price demographics effectively and allow growth in all directions.

Entry-Level and Mid-Range Expansion

Brands like Xiaomi, Huawei, and Samsung are taking advantage of their diversified product portfolios in the entry-level market. This has contributed to a 12% year-on-year growth in the basic fitness tracker category, in which devices from the series like Xiaomi Band continue to perform well.

Meanwhile, the mid-range segment, between $200-$300, saw explosive growth, up 21%. And manufacturers are steadily pushing flagship features into this space: for example, health monitoring and cellular connectivity have made their way to state-of-the-art smartwatches. This situation has already put strong pressure on the market share of functional fitness trackers whose prices range between $50 and $99.

High-End Market Evolution

The high-end segment (above $500) has become the primary engine for revenue generation. Specifically, devices priced above $700 saw an annual growth rate of 34%. Innovation in this tier focuses heavily on connectivity and intelligence. The introduction of 5G capabilities in devices like the Apple Watch Series 11 and emergency satellite communication features in flagship outdoor watches from Garmin and Apple highlights this trend.

The Era of AI and Ecosystem Integration

Generative AI is becoming a utility rather than just a marketing concept in the wearable industry. Inclusion of top-of-the-line voice assistants, like Gemini on the new Galaxy Watch, illustrates the future of AI agents within health management applications. Overall smartwatch shipments grew by 1%, but its value increased by 8%, confirming the success of the industry’s premiumization strategy. According to the Omdia analyst, Jack Leathem, the future of smartwatches lies in the development of immersive, cloud-based generative AI health coaches. For full realization of device potential, either native software or integration with third-party services needs strengthening by their makers. Further, incorporating non-wrist devices like smart rings and TWS earbuds into an overall health ecosystem will be tantamount for enabling cross-selling opportunities and demonstrating the superior value of smartwatches.

Emir Bardakçı

Emir Bardakçı