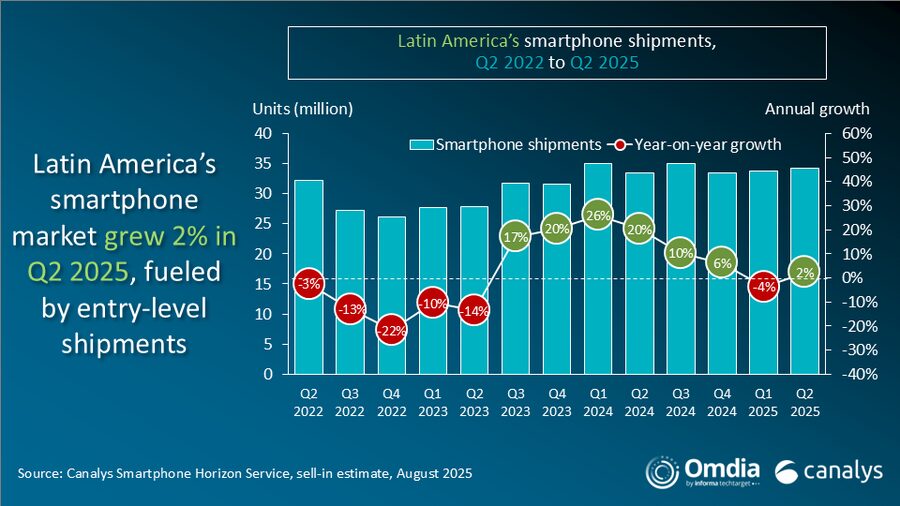

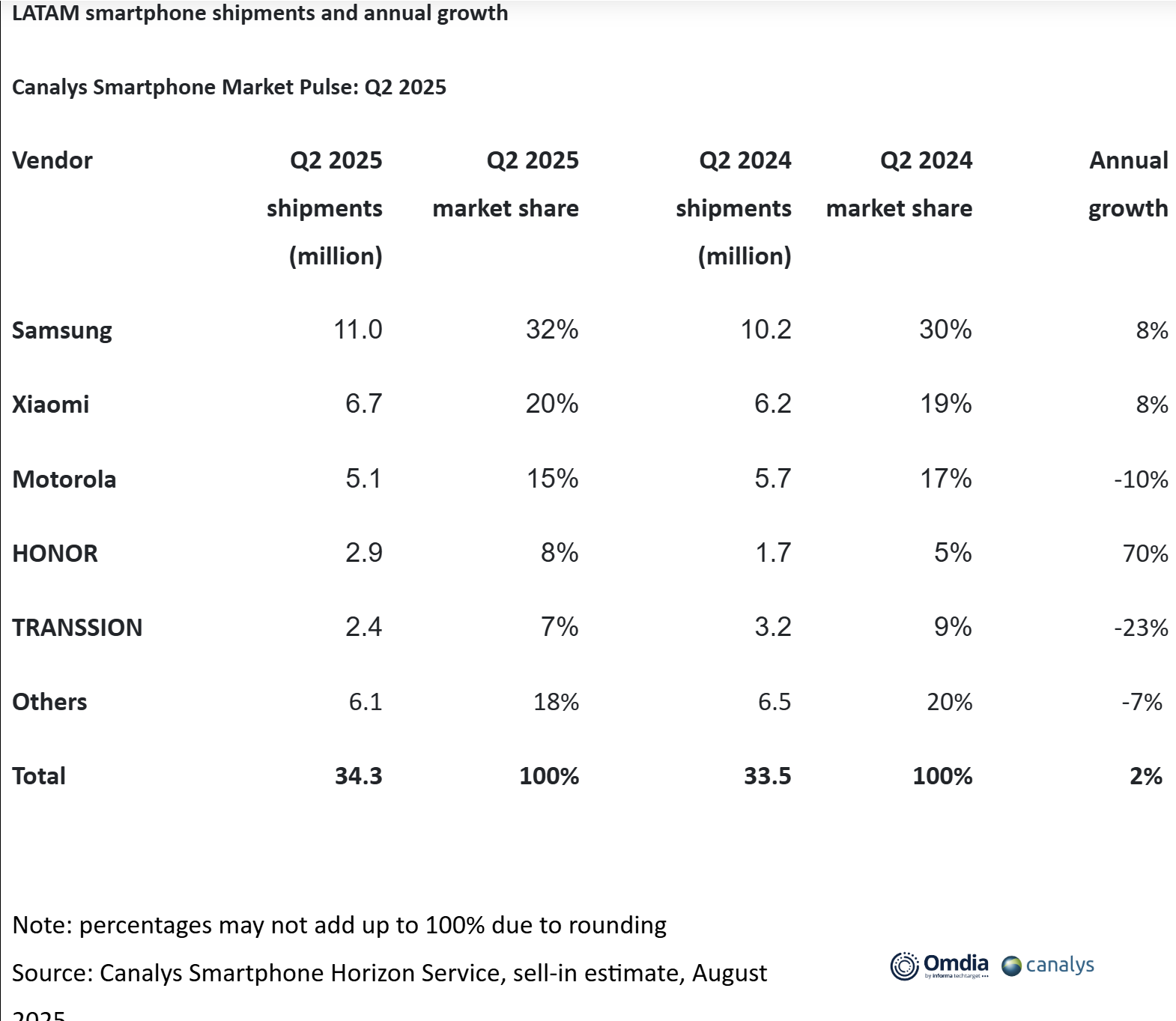

Xiaomi just delivered a seriously impressive performance in Latin America, hitting its highest-ever shipment numbers. The latest Canalys data shows Xiaomi shipped 6.7 million smartphones in Q2 2025—an 8% year-on-year increase. While the overall smartphone market in the region was pretty flat (just 2% growth, reaching 34.3 million units), Xiaomi outpaced the field and locked up the No. 2 spot, right behind Samsung.

What’s fueling this run?

Simple: strong demand for affordable, reliable devices like the Redmi 14C. Xiaomi’s value-for-money strategy continues to resonate, especially in markets like Argentina, Colombia, and Central America. The company’s broader ecosystem—think wearables, smart home gadgets, and everything in between—also reinforces brand loyalty and keeps customers coming back.

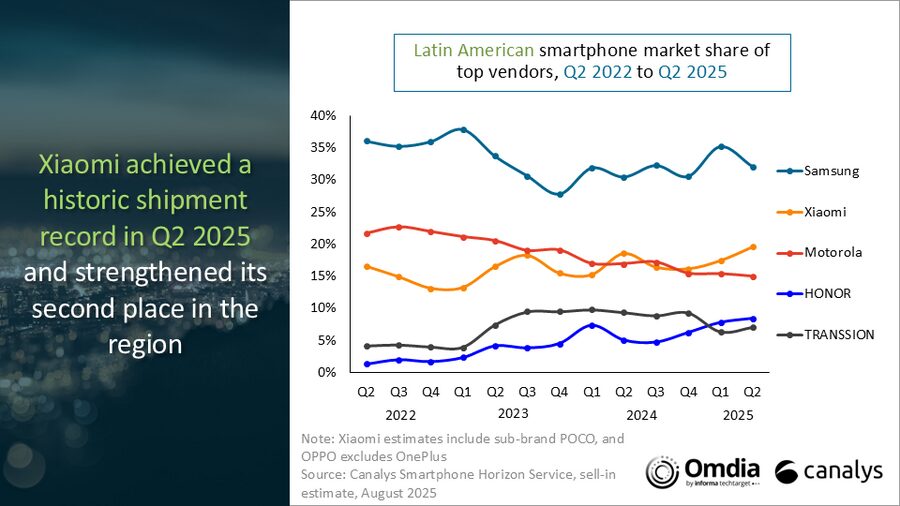

Zooming out, Samsung is still the market leader, shipping 11 million units (up 8%). Motorola sits at third, but their shipments dropped 10%. Honor made the most dramatic leap, notching a massive 70% gain to reach 2.9 million units. Transsion, meanwhile, saw a 23% decline.

Here’s how the top five looked in Q2 2025:

- Samsung: 11.0 million units (+8% YoY)

- Xiaomi: 6.7 million units (+8% YoY)

- Motorola: 5.1 million units (-10% YoY)

- Honor: 2.9 million units (+70% YoY)

- Transsion: 2.4 million units (-23% YoY)

Canalys senior analyst Miguel Pérez attributes Xiaomi’s momentum to its focus on accessible 4G models and aggressive market positioning. The company’s approach to the entry-level segment is clearly a winning formula for expansion across Latin America.

Looking ahead, analysts suggest that long-term growth will depend on moving beyond entry-level devices and building a competitive portfolio in the mid-range and premium segments. Xiaomi’s integrated product ecosystem, powered by Xiaomi HyperConnect, could become a strategic advantage as the market evolves.

Bottom line: Xiaomi has cemented itself as a major player in Latin America’s smartphone landscape, with a scalable strategy that could pay dividends well into the future.

Sources: Canalys

Emir Bardakçı

Emir Bardakçı

Nonsense! Redmi A series especially A3x has a software wallpaper Carousel malfunctioning after several complaints no solution

System update Redmi Pro Redmi Note 9 Pro