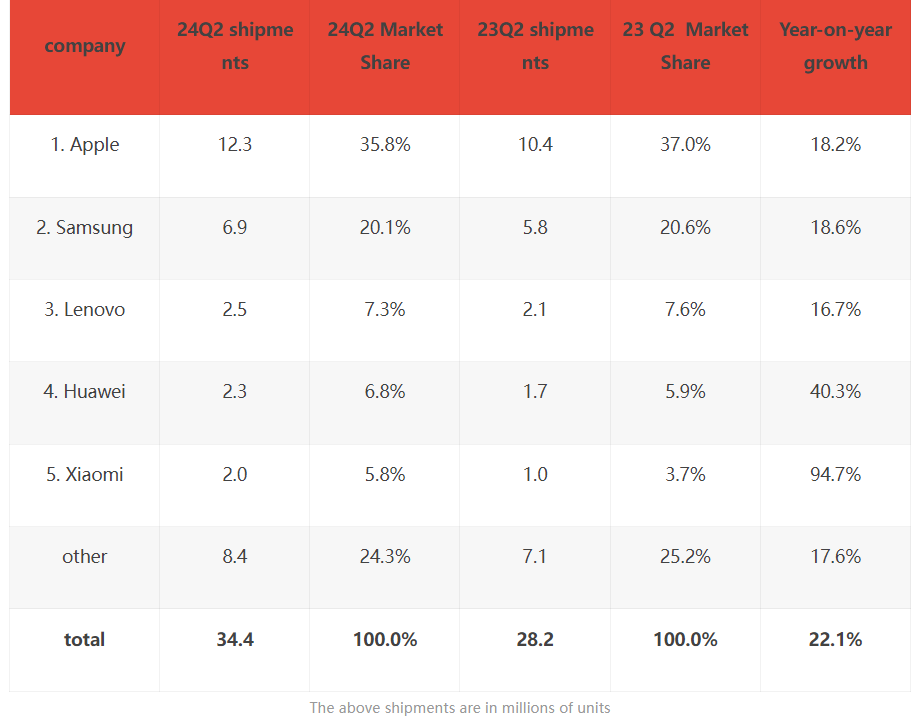

According to the latest market insights by IDC, the global tablet market has reached a significant milestone in the second quarter of 2024, with shipments totaling 34.4 million units, marking growth of 22.1% compared to the same period last year. This surge points at a strong growth trajectory at work and marks the first time the market has crossed pre-pandemic shipment levels of 32.5 million units seen in the second quarter of 2019.

Detailed Overview of Key Players

Apple Continues to Lead the Market

The brand is continuing its commanding lead in the tablet marketplace with a sale of 12.3 million units—up 18.2% year over year. The Apple “shot on the block,” the new 11-inch and 13-inch iPad Air and iPad Pro models, seems to have paid off for the tech giant. It has also managed to keep up its global sales growth in other regions and has continued to maintain this momentum. • Market Share: Apple has 35.8 percent market share versus 37.0 percent from the previous year, signifying a more competitive market this year.

- Key Takeaways: This minor market share loss is compensated for by volume growth, signaling Apple’s strategic positioning remains strong amid toughening competition.

Samsung Secures Second Place

Samsung maintained second place with volumes of 6.9M shipping units, an 18.6% increase compared to last year. What’s so remarkable about this is growth generated without the launch of key new products in the quarter. Instead, Samsung benefited from commercial deployments that were stronger and from gaining a softer base compared to the same period last year.

- Market Share: With a market share of 20.1 per cent, Samsung is just off its pace of 20.6 per cent a year ago.

Key Insights: Very consistent performance from Samsung, with no new launches, shows great brand loyalty.

Lenovo Shows Steady Growth

Lenovo remains in third with shipments of 2.5 million units, which represent growth of 16.7% annually. Detachables in this company has represented very strong, with it observant growth at a rate of 39.7% on a yearly basis, outperforming traditional tablets.

- Market Share: Lenovo enjoys a 7.3 percent share, down from 7.6 percent.

- Key Insights: Detachable tablets are growing in importance, thereby driving a consumer trend and putting Lenovo in a strong position to push it in this fast-emerging category.

Huawei Makes Impressive Gains

Huawei proved to have the most remarkable development within the top five companies, with its shipments surging by 40.3% to 2.3 million units. The launch of the MatePad 11.5S has again reportedly proven successful this time, in China, online sales promotions causing a here-to-now surge in sales during June. – Market Share: The market share of Huawei increased from 5.9 percent to 6.8 percent. – Key Insights: Huawei did well, portraying a recovery and an adjustment to its competitive environment in the Chinese market.

Xiaomi’s Incredible Rise

Xiaomi launched with the highest growth rate among the top OEMs, where shipments skyrocketed 94.7% to 2 million units. The stunning level of growth in this instance is driven by strong sales in China, APEJ, and an immense European expansion in the markets of Russia, France, Germany, Italy, and Spain.

- Market Share: Xiaomi’s market share surged from a puny 3.7% to a strong 5.8%.

- Insights: The aggressive expansion by Xiaomi and successful penetration of markets in various regions outline in their entirety, the rising influence it has had so far over the global tablet market.

Other Market Players

Other vendors shipped in total 8.4 million units, corresponding to 24.3% of the market, which shows a good segment with a growth rate of 17.6%, signaling a competitive environment in the industry where the smaller players also find room for surge.

Given the Q2 2024 global tablet market was truly picking up growth, it gives a fair signal within the context of an industry both resilient and adaptive. As total shipments cross the pre-pandemic level, market dynamics point to skinny competition and a sea of options for consumers as corporates like Apple and Samsung have the biggest sway on share, though Huawei and Xiaomi are great inroads into key markets outside the United States. As the market itself is changing relatively fast, innovation and strategic expansion will soon have to be realized in order to sustain this growth trend.

Emir Bardakçı

Emir Bardakçı