Global OLED smartphone panel shipments showed strong momentum in the third quarter of 2025, supported by seasonal smartphone demand and rapid expansion in advanced display technologies. According to recent market analysis, worldwide OLED panel shipments increased significantly, reflecting the growing importance of premium smartphone models in the supply chain. This trend is especially relevant for brands such as Xiaomi 15, the software ecosystem developed around Xiaomi HyperOS, and the expanding smart device connectivity layer powered by Xiaomi HyperConnect.

Global OLED Panel Market Performance in Q3 2025

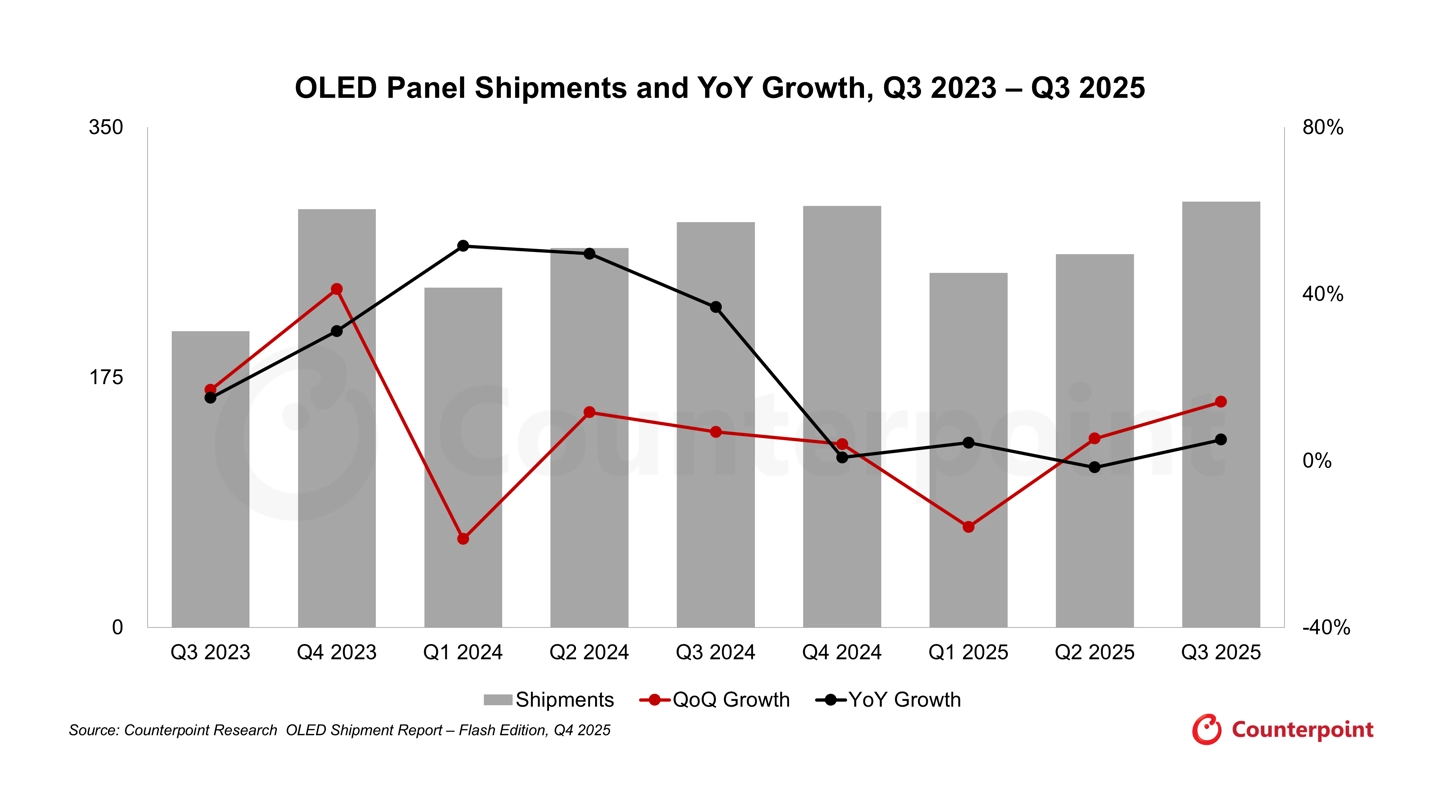

The third quarter of 2025 marked a clear acceleration in the global OLED panel market. Overall shipments rose by 14% quarter-over-quarter and 5% year-over-year, reflecting stable growth across multiple product segments. The main driver behind this trend was the strong seasonal demand for flagship smartphones, which traditionally peaks during this period. The data confirms that OLED technology is becoming the standard in premium and upper-midrange mobile devices, improving display quality and energy efficiency across the industry.

Market researchers highlighted that smartphone-focused OLED panels continued to be the most dynamic part of the market. Growth was not limited to mobile phones, as IT-focused OLED displays also delivered notable expansion, confirming the long-term structural shift away from LCD solutions.

Smartphone and IT Panels Show Strong Expansion

Smartphone OLED panels recorded a 16% quarter-over-quarter increase and a 6% year-over-year gain. This was largely attributed to the high demand for Apple’s iPhone 17 Pro series, which significantly increased panel orders throughout the quarter. At the same time, OLED panels designed for IT products, including monitors and professional displays, delivered even stronger results.

Shipments of display panels for IT devices increased by 21% month-over-month and surged by 55% year-over-year. This performance illustrates how quickly OLED technology is penetrating the notebook and monitor sectors. For smartphone brands such as Xiaomi, this broader ecosystem development is important, as it enables more consistent panel quality and supply stability for future flagship and upper-segment devices.

Manufacturer Performance and Xiaomi-Linked Supply Trends

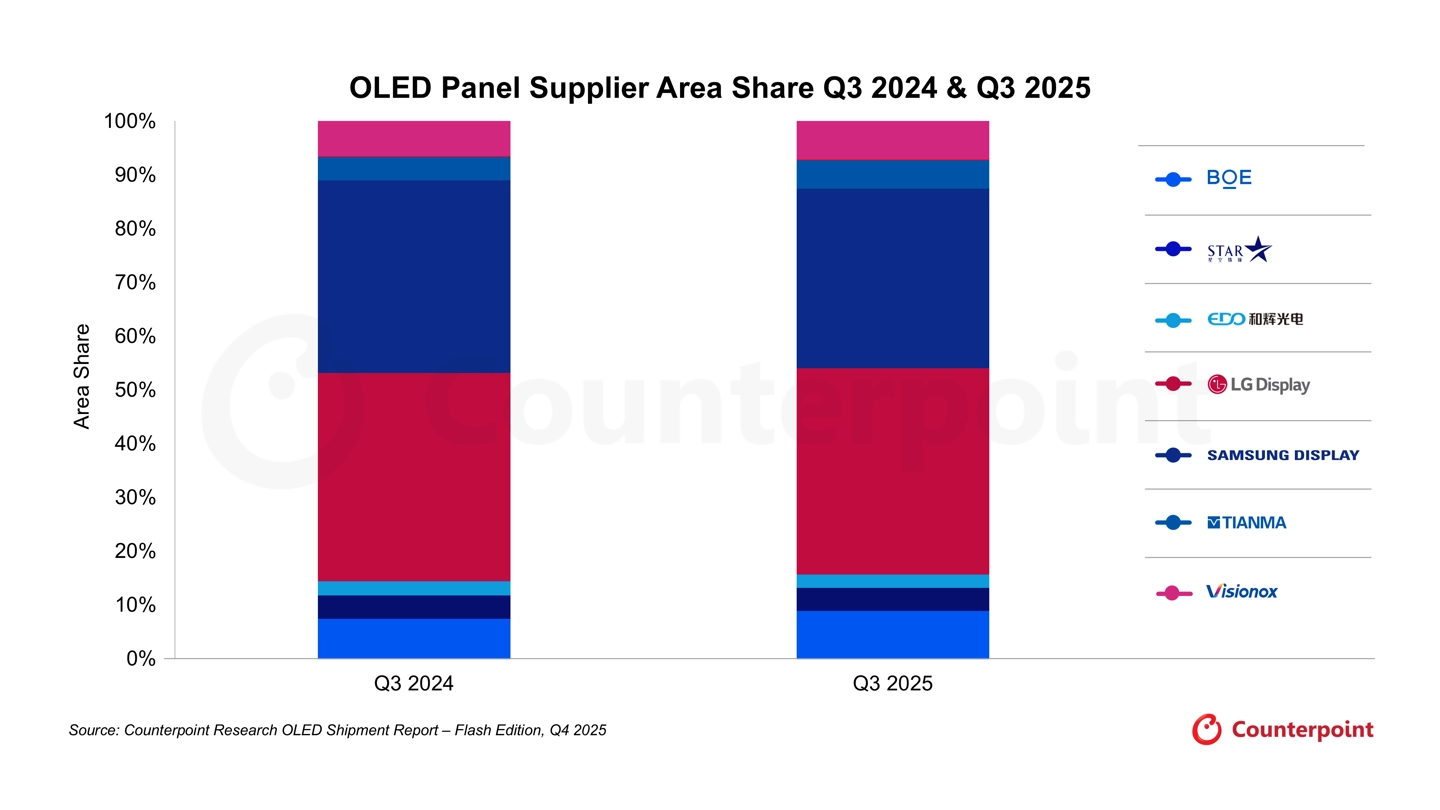

South Korean display manufacturers showed contrasting results during the quarter. LG Display achieved a 59% quarter-over-quarter surge in smartphone OLED panel shipments, driven mainly by large-scale orders linked to high-end smartphone production. Its smartwatch panels also expanded rapidly, with shipments growing by 121% quarter-over-quarter. As a result, LG Display maintained an industry-leading 38% area market share.

Samsung Display managed a 40% year-over-year increase in its display business, supported by strong demand for 27-inch QD-OLED panels. However, its OLED TV panel segment declined by 12% both quarter-over-quarter and year-over-year, reducing its total market area share to 33%.

Chinese manufacturers continued to strengthen their positions in the global supply chain. BOE registered 40% year-over-year growth in notebook OLED panels and 27% in smartphone panels, maintaining a stable 9% market share. Visionox improved its market position with 31% quarter-over-quarter growth, increasing its share from 6% to 7%. Tianma also expanded steadily, supported by growing demand from brands such as Honor and Xiaomi, achieving 11% quarter-over-quarter and 28% year-over-year shipment growth while holding a 5% market share.

Outlook for Xiaomi and the OLED Industry Toward 2026

Analysts expect the OLED industry to continue its expansion into 2026, with IT panels, especially monitors, becoming the primary growth engine. Although the OLED TV market remains relatively weak, the smartphone and IT categories are compensating through rising adoption rates and improved manufacturing efficiency.

For Xiaomi, this industry-wide growth creates favorable conditions for long-term product planning. Stable supply from Chinese manufacturers such as BOE and Tianma, along with ongoing investments in advanced OLED production, will support future Xiaomi flagship smartphones and smart devices. As OLED technology becomes more accessible, Xiaomi is expected to further enhance visual performance across its ecosystem while maintaining strong cost efficiency.

Emir Bardakçı

Emir Bardakçı