In an impressive display of market leadership, Xiaomi has secured the top position in China’s wireless headphone market for 2024. According to the latest “China Wireless Headset Market Monthly Tracking Report” released by International Data Corporation (IDC), the Chinese Bluetooth headset market reached a staggering 113.53 million units in 2024, representing a significant 19.0% year-on-year growth. This remarkable achievement underscores Xiaomi’s commitment to innovation, quality, and affordability in the audio accessories segment.

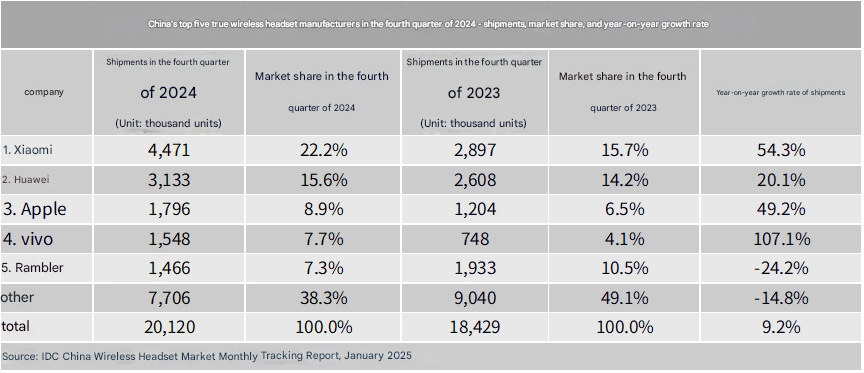

The fourth quarter of 2024 alone saw 30.8 million units shipped, marking a 20.1% increase compared to the same period in the previous year. This robust growth demonstrates the increasing consumer demand for wireless audio solutions in the Chinese market.

Market Segment Breakdown

The IDC report provides detailed insights into various segments of the wireless headphone market:

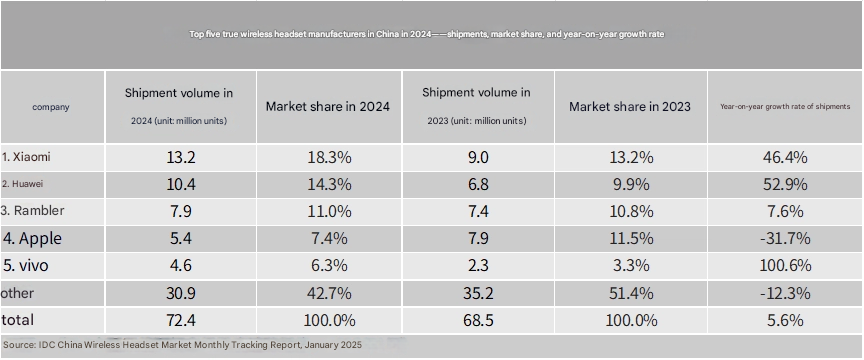

- True Wireless Earphones: Shipments reached 72.35 million units, showing a 5.6% increase year-on-year

- Open-Back Headphones: Experienced explosive growth with 24.92 million units shipped, up by an astonishing 212.0%

- Neck-Worn Headphones: Declined to 9.34 million units, representing a 30.1% decrease

- Over-Ear Headphones: Achieved 6.92 million units, growing by 26.1% year-on-year

Xiaomi’s Path to Market Leadership

Xiaomi’s ascension to the number one position in both overall Bluetooth headset shipments and the true wireless market subcategory can be attributed to several key factors:

- Leveraging technological advancements to offer products at extremely competitive prices

- Consolidating its dominant position in the entry-level true wireless market (below 200 yuan)

- Increasing market share in the sub-200 yuan segment by an impressive 13 percentage points compared to 2023

Competition in the Chinese Market

While Xiaomi leads the pack, other major players are actively competing for market share:

Huawei

Huawei expanded its presence in the entry-level true wireless market in 2024 with products like the Freebuds SE 3. The company has also claimed the top position in the open-type ear clip market, leveraging its brand ecosystem and channel strategy.

Apple

Following the launch of new products in September 2024, Apple saw a boost in shipments. Their introduction of semi-in-ear active noise reduction products addressed consumer demands for both comfort and noise cancellation. However, Apple continues to face competitive pressure in the increasingly price-sensitive market.

vivo

In 2024, vivo strengthened its dual-line strategy in the true wireless market. The company focused on comprehensive user experience through its main brand while emphasizing performance and value through its iQOO sub-brand. This approach, combined with entry-level market offerings, resulted in significant growth in true wireless product shipments.

Edifier

Edifier actively invested in the open market throughout 2024, continuously improving its product portfolio across different form factors and price ranges. The company leveraged its years of experience in true wireless products, from design to marketing strategy and technical specifications. Edifier also achieved first place in shipments in the over-ear headphone market, thanks to its competitive pricing and distinctive design.

As Xiaomi continues to innovate and expand its audio product lineup, the company is well-positioned to maintain its leadership in China’s competitive wireless headphone market in 2025 and beyond.

Source: ITHome

Emir Bardakçı

Emir Bardakçı