True Wireless Stereo earbuds have shipped 92.6 million units in the third quarter of 2025, as shown in recent data released by Omdia. Despite a marginal growth rate of 0.33%, there was a marked transition towards Open-Back Wireless Systems. The market had broken the 10 million unit milestone for these wireless systems, thus compensating for the 4% drop witnessed in regular True Wireless Stereo earbuds.

TWS Sales: Apple Maintains Lead, Xiaomi Fastest Growing

As revealed in this report, traditional TWS shipments reached 82 million units, owing to changes in user behavior. Not withstanding this change, market leaders continued to perform well.

Key Results – Shipment

- Apple: 18.9 million units (-4% YoY), 20% market share

- Xiaomi: 8.6 million units (+24% YoY), 9% market share

- Samsung: 7 million units (-16% YoY), 8% market share

- boAt: 6.7 million units (-11% YoY), 7% market share

- Huawei: 5 million units (+35% YoY), 5% market share

Xiaomi suffered among the fastest rates among major brands, indicating a strong focus on demand for audio products and an even more prominent role within ecosystems.

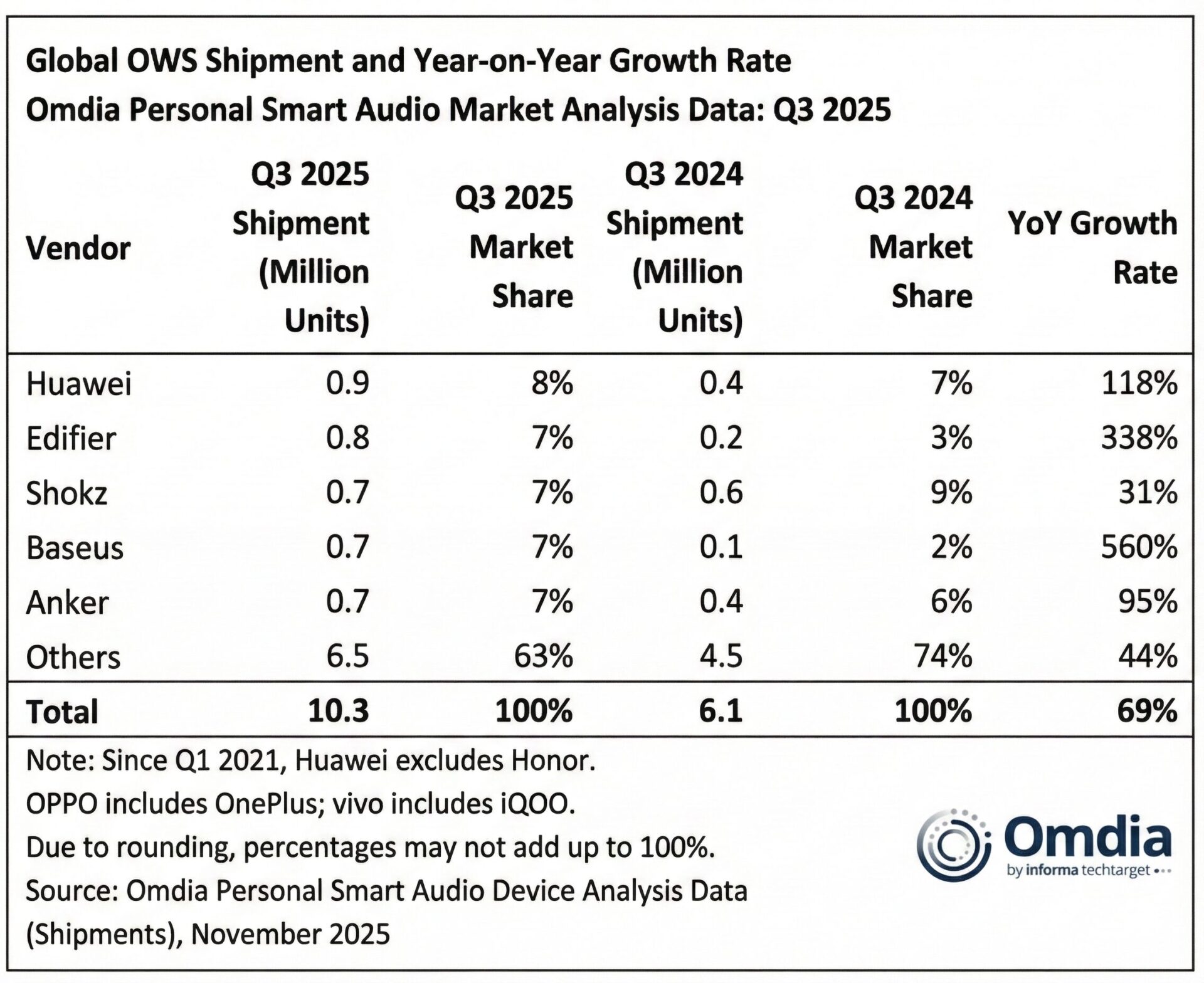

Strong Rise of Open-Back OWS Earphones

Open-back wireless systems (OWS) experienced outstanding performance, which boosted market presence within the category. Various brands were recognized as leaders within the market, as identified by research firm Omdia

OWS Shipment Highlights

- Huawei: 900,000 units (+118% YoY), 8% market share

- Edifier: 800,000 units (+338% YoY), 7% market share

- Cena: 700,000 units (+31% YoY), 7% market share

- Baseus: 700,000 units (+560% YoY), 7% market share

- Anker: 700,000 units (+95% YoY), 7% market share

The fact that there was consistent growth across various brands shows that there is an emerging demand from consumers for comfort-centric and non-in-ear audio solutions.

Market Outlook: OWS will attain 40 Million Units by 2026

According to a forecast by Omdia, 40 million units of OWS will be shipped in 2026, accounting for 10% of the overall True Wireless Stereo market share. Notable among these changes will be:

Key Trends To Watch

- AI-driven personalized sound profiles

- Cross-device ecosystem integration, especially in multi-device environments

- Comfort-centered product design

- Greater energy efficiency and improved microphones for clear communication

As Xiaomi continues expanding its AI and ecosystems strategy, it will be perfectly poised with its offerings within the TWS and OWS product lines.

Emir Bardakçı

Emir Bardakçı