According to a new report from Omdia, global TV shipments are forecasted to reach 52.5 million units in Q3 2025 – a minor 0.6% year-on-year decline. However, in a vastly different trend, the Chinese market recorded a 12.2% year-on-year drop in the same quarter. This development marks a clear regional divergence and underlines the shifting TV consumption patterns across the globe.

Why China’s TV Shipments Declined

China’s sharp decline is related to the rapid growth last year due to government subsidy programs. These subsidies accelerated TV upgrades, particularly in mainstream families, and effectively brought forward future demand. Since most users have completed their upgrades, Q3 2025 entered a natural cooling phase.

With demand normalization, manufacturers like the major Xiaomi TV segments saw measurable shipment volume slowdowns as the domestic market adjusted to last year’s surge.

Diverging Trends Emerge in Global Markets

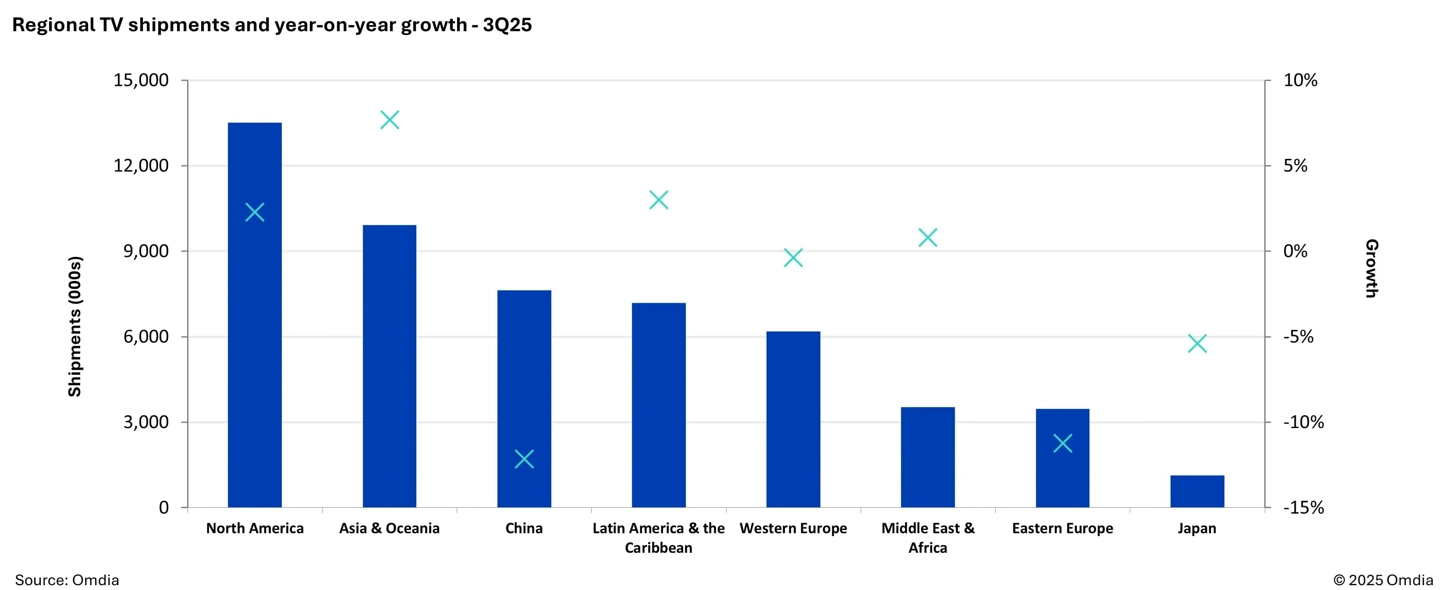

While China contracted, the other regions put in a far more balanced performance. North America registered a 2.3% year-on-year increase, reflecting stable consumer confidence in the region. The Asian and Oceanian markets proved even stronger, growing 7.7% year-on-year.

These markets have now become strategic pillars for Chinese brands in search of new growth opportunities. With the weakening domestic momentum, companies are focusing on neighboring regions where the smart TV penetration continues to rise.

Impact on Large-Screen TV Categories

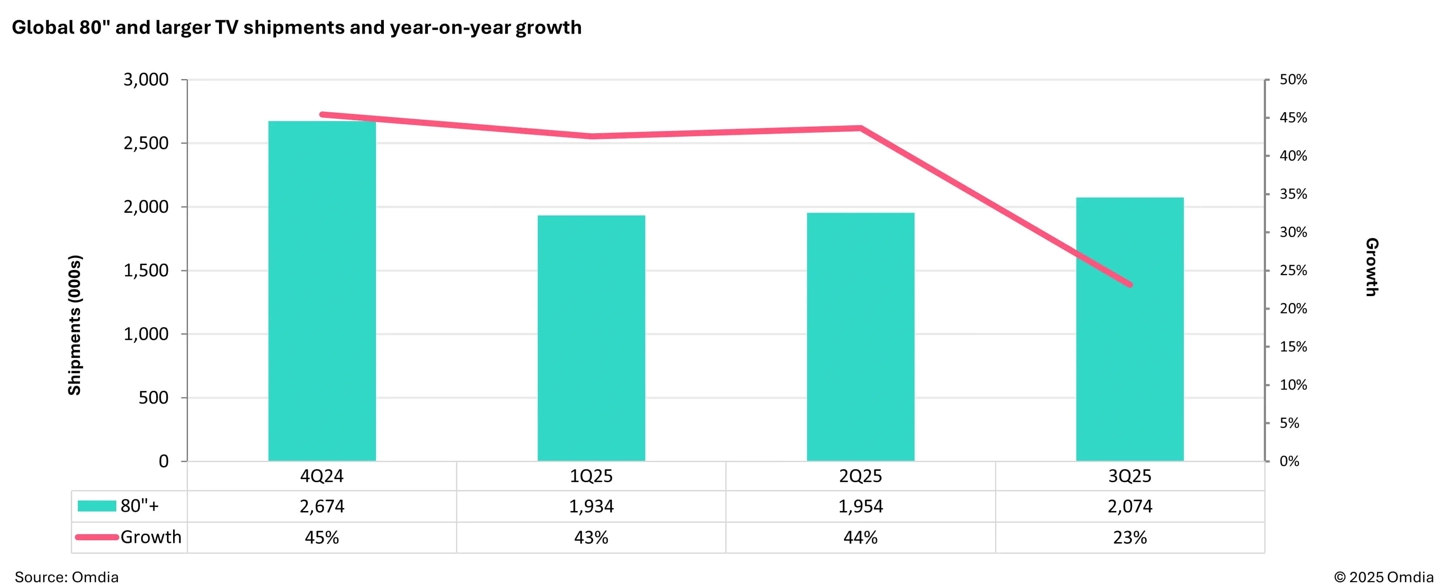

The slowdown in China directly weighed on large-format television shipments. Omdia’s data has the 80-inch and above category seeing its quarterly growth rate fall from more than 40% last year to 23.1%. Similarly, the segment of 70–79 inches cooled to 1.1%, reflecting the broader market saturation. This indicates that even the high-end segments, which always remained resilient due to strong premium consumers, are also starting to stabilize. For brands planning future display innovations—such as Xiaomi’s premium TV lineup—recalibration in the market is going to be key to product positioning.

Emir Bardakçı

Emir Bardakçı