Currently, TSMC is under severe capacity pressure with its CoWoS advanced packaging production lines, which directly influences the global supply of chips for major technology brands. Industry reports suggest that rapid growth in the shipment of artificial intelligence processors and flagship mobile chipsets has pushed demand beyond existing manufacturing limits. This development is of particular interest to brands like Apple, Nvidia, and Xiaomi, whose high-performance products depend much on TSMC’s manufacturing ecosystem.

CoWoS capacity shortage changes global chip supply dynamics

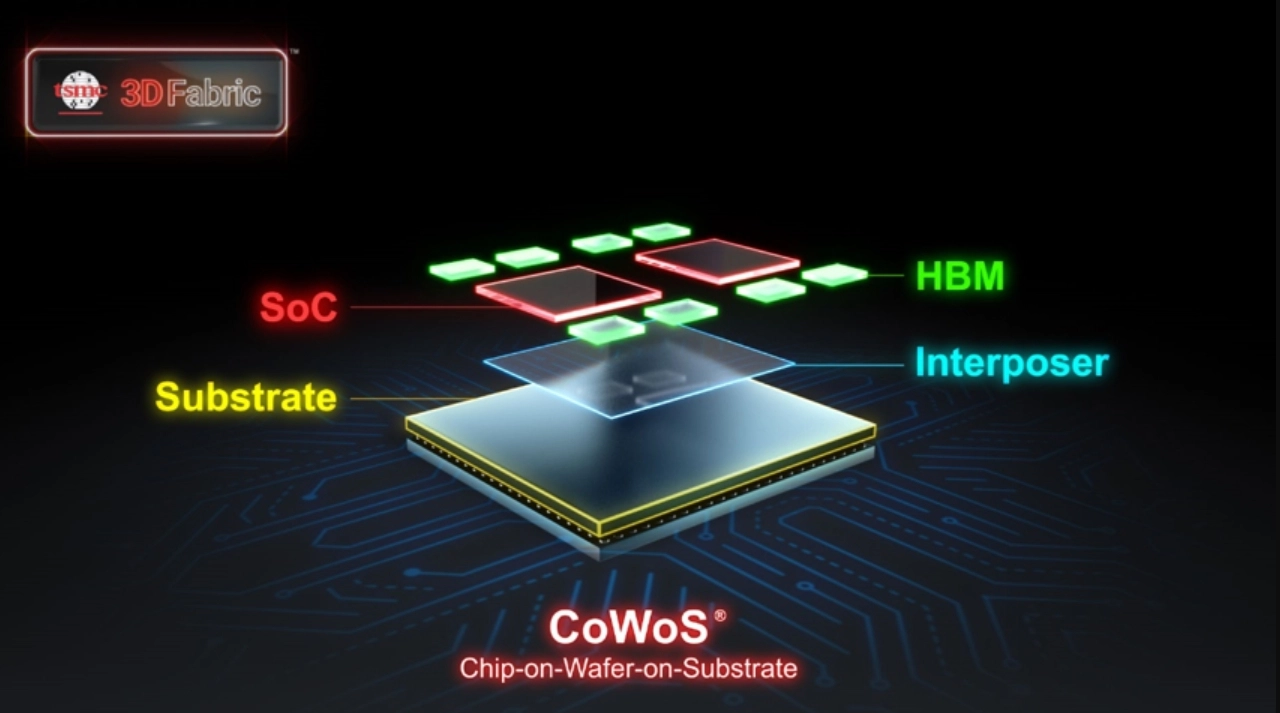

The shortage now affects CoWoS, or Chip-on-Wafer-on-Substrate, technology that allows multiple chiplets to be integrated into a single advanced package. The manufacturing process is crucial for making high-performance AI accelerators and modern smartphone processors. Strong global demand for AI computing has fully booked TSMC’s CoWoS lines, creating serious delivery delays for key customers and forcing a strategic shift in production planning.

TSMC accelerates outsourcing to ASE and SPIL

It is for this reason that TSMC has begun to outsource some of its advanced packaging work to leading partners such as ASE Technology and SPIL to handle overflow demand. The decision will help unused external capacity to be brought online more quickly, hence reducing delivery times to major clients. These firms have invested several billions of USD in new facilities and equipment, enabling them to perform advanced packaging tasks in high volume. This collaborative model of production has now emerged as an important pillar in the global semiconductor supply chain.

Direct impact on Snapdragon Chip Production of Xiaomi

Snapdragon chipsets power the flagship and upper-midrange smartphones at Xiaomi, manufactured by the Taiwan Semiconductor Manufacturing Company. Advanced platforms such as Snapdragon 8 Elite are highly dependent on technologies linked to advanced wafer production and packaging. The indirect benefit for Xiaomi is that the acceleration of outsourcing and capacity expansion will stabilize the delivery of processors it uses in devices running Xiaomi HyperOS, ensuring more predictable launch timelines and consistent product availability across markets without disrupting Xiaomi’s long-term hardware roadmap.

Competitive pressure strengthens TSMC’s strategic position

This outsourcing also represents a defensive step against widening competition. Intel especially has invested much more in advanced packaging in its attempt to lure high-end customers such as Apple and Qualcomm. Increasing effective capacity through trusted partners minimizes the possibility that customers may abandon TSMC due to long wait times. Meanwhile, TSMC is still building new in-house packaging plants, but these in-house plants represent a long-term solution and not an immediate fix.

This strategy keeps the premium chipset ecosystem balanced, which Xiaomi also depends on and supports healthy growth across the broader mobile and AI industries.

Emir Bardakçı

Emir Bardakçı