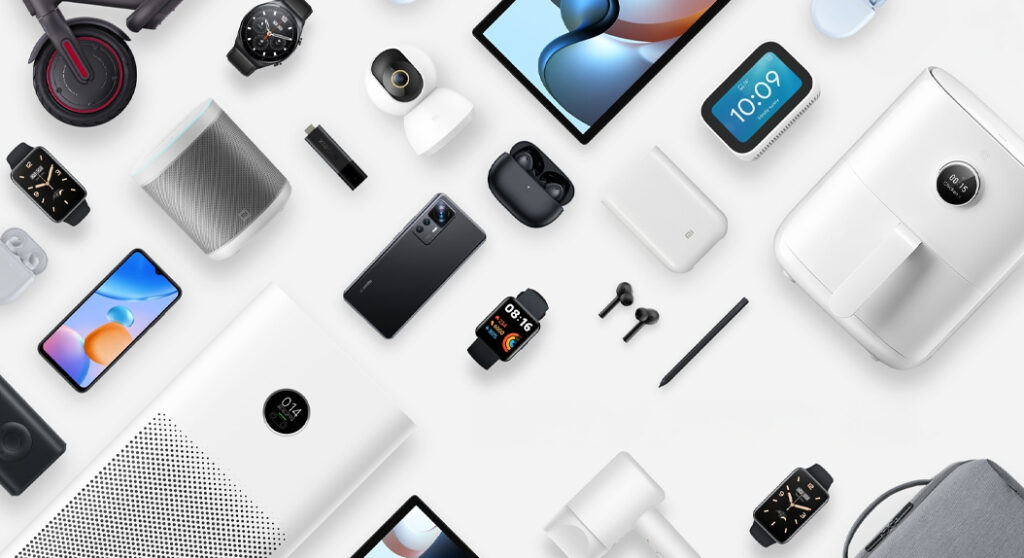

As of October 2025, Xiaomi’s position in the Spanish consumer tech ecosystem remains remarkably strong. The brand doesn’t just compete on price—it’s meticulously engineered a portfolio that aligns with evolving consumer priorities: affordability, robust feature-sets, and reliability. Xiaomi’s omnipresence in both online and brick-and-mortar retail spaces, combined with aggressive pricing strategies and a keen understanding of the Spanish lifestyle, makes it a formidable force in both volume and value segments.

Below is an in-depth look at the ten most influential Xiaomi products currently shaping the Spanish tech landscape, with commentary on why each is resonating with local consumers and what that means for the broader market.

Redmi 14C – The Budget Disruptor

The Redmi 14C is a textbook example of how Xiaomi leverages economies of scale and supply chain efficiency. At approximately €100, the device features a 6.88″ 120Hz LCD, MediaTek Helio G81 Ultra, and a class-leading 50MP dual camera. Most notably, the inclusion of NFC and 8GB RAM at this price point is a strategic differentiator, enabling first-time buyers and budget-conscious families to access premium features.

This device anchors Xiaomi’s mass-market strategy, driving both brand loyalty and volume sales in competitive retail environments like Amazon Spain.

Redmi Note 14 – Value Leadership

Balancing affordability and performance, the Redmi Note 14, with its 6.67″ AMOLED display and 108 MP camera, is engineered to capture the aspirational mid-tier demographic. Priced under €160, it appeals to students, young professionals, and cost-conscious upgraders.

The Note 14 strengthens Xiaomi’s grip on the mid-range, a segment where many global competitors struggle to match both specs and design quality.

Redmi Note 14 Pro 5G – Premium Features, Mass Appeal

With a 200 MP camera and the latest Dimensity 7300-Ultra chipset, the Note 14 Pro 5G targets consumers seeking flagship experiences without the flagship price tag (€240–€250). Its 5G capability also future-proofs the device—an increasingly pivotal factor as Spain’s 5G infrastructure matures.

By democratizing advanced camera and connectivity features, Xiaomi not only attracts tech enthusiasts but also encourages upgrades from older, non-5G devices.

Redmi 13 – Entry-Level Excellence

The Redmi 13, with a 6.79″ FHD+ screen and 108 MP camera, continues Xiaomi’s tradition of elevating the baseline for entry-level smartphones. At roughly €110, it’s a gateway product for digital adoption among older consumers and teenagers alike.

Its price-performance ratio allows Xiaomi to penetrate secondary and tertiary cities, expanding its addressable market.

POCO X7 Pro – Affordable Performance

Under Xiaomi’s POCO sub-brand, the X7 Pro is engineered for power users—boasting a Dimensity 8400-Ultra, 12GB RAM, and 90W fast charging, all under €320. This device blurs the lines between budget and flagship, challenging the premium offerings of established rivals.

POCO’s aggressive specs-to-price formula is a direct play for the youth and gaming segments, which are increasingly influential in Spain’s smartphone market.

Xiaomi Smart Band 10 – Wearable Market Disruptor

At €49.99, the Smart Band 10 offers a full AMOLED display, heart rate and sleep tracking, and a 21-day battery life. Its lightweight build and waterproof rating make it an attractive option for Spain’s active, health-conscious population.

The Smart Band series consistently dominates the wearables category, introducing new users to Xiaomi’s broader ecosystem.

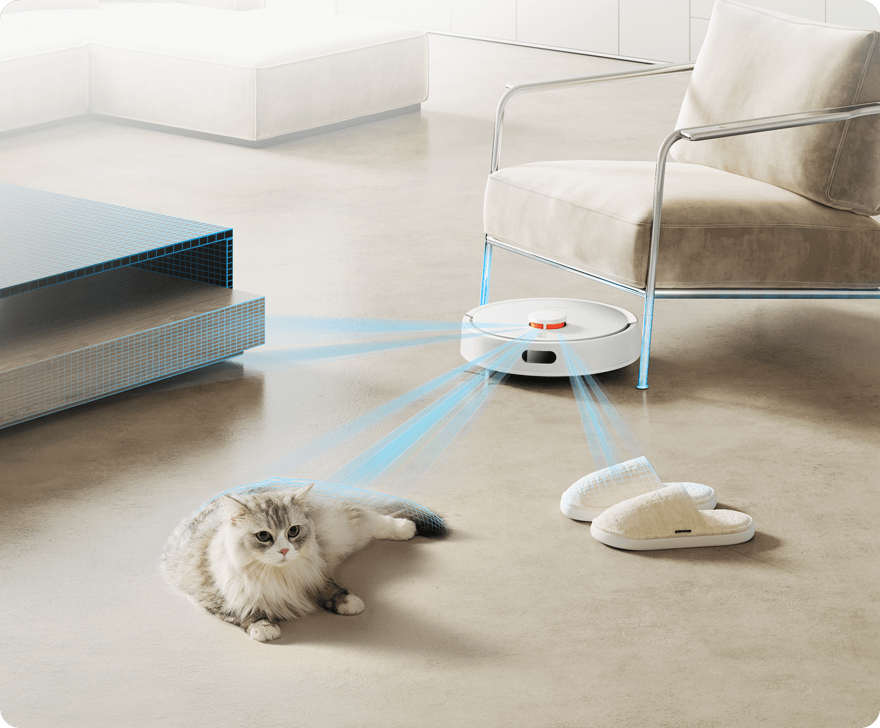

Xiaomi Robot Vacuum S20 – Affordable Automation

The S20, with its 5000 Pa suction, mopping capabilities, and smart navigation system, retails at just €115–€120. For Spanish households seeking convenience without a premium price, this product is a standout.

This vacuum not only enhances Xiaomi’s smart home portfolio but also encourages cross-selling of other IoT devices through the Xiaomi Home app.

Redmi Buds 5 Pro – Competitive Audio Solution

Redmi Buds 5 Pro have made significant inroads in the under-€170 wireless earbuds segment, thanks to LDAC, ANC, and 38-hour battery life. Ergonomic design and sound clarity are commonly cited in positive reviews.

With the shift toward remote work and on-the-go lifestyles, demand for reliable, affordable audio solutions is surging—Xiaomi is well-positioned to capitalize.

Xiaomi Electric Scooter 4 Pro – Urban Mobility Leader

The Scooter 4 Pro, with a robust 700W motor and a 45km range, is priced between €550 and €600. It’s popular among daily commuters and urban professionals seeking cost-effective, eco-friendly mobility.

As Spanish cities push for greener transport, Xiaomi’s e-scooters are capturing market share from both traditional scooters and public transit.

Xiaomi Electric Scooter 4 Lite 2nd Gen – Democratizing Micro-Mobility

For €250–€300, this model delivers essential features with a lighter build, making it accessible to students and casual riders. Foldability and portability are major selling points.

By catering to price-sensitive segments, Xiaomi reinforces its leadership in the fast-growing micro-mobility market.

Why Xiaomi Dominates in Spain

Xiaomi’s Spanish success is rooted in a relentless focus on value, local market adaptation, and omnichannel retail strategy. The company consistently outpaces competitors by offering high-end features at accessible prices, backed by aggressive marketing and robust after-sales support.

By integrating smartphones, wearables, home appliances, and mobility solutions into a seamless ecosystem, Xiaomi drives repeat purchases and long-term customer retention.

For Spanish consumers and channel partners alike, Xiaomi’s product range offers a compelling value proposition—combining innovation, design, and affordability. The brand’s dominance isn’t just about low prices; it’s about anticipating consumer needs and delivering market-relevant solutions at scale.

Emir Bardakçı

Emir Bardakçı

oppo a5s