Financial disclosures from major semiconductor vendors SK Hynix and SanDisk for Q4 2025 confirm a drastic upward correction in the NAND flash memory market. Both entities report Average Selling Price (ASP) increases exceeding 30% quarter-over-quarter (QoQ), signaling the end of the memory deflation cycle and the onset of a new inflationary pricing trend for storage components in 2026.

SK Hynix Performance Data

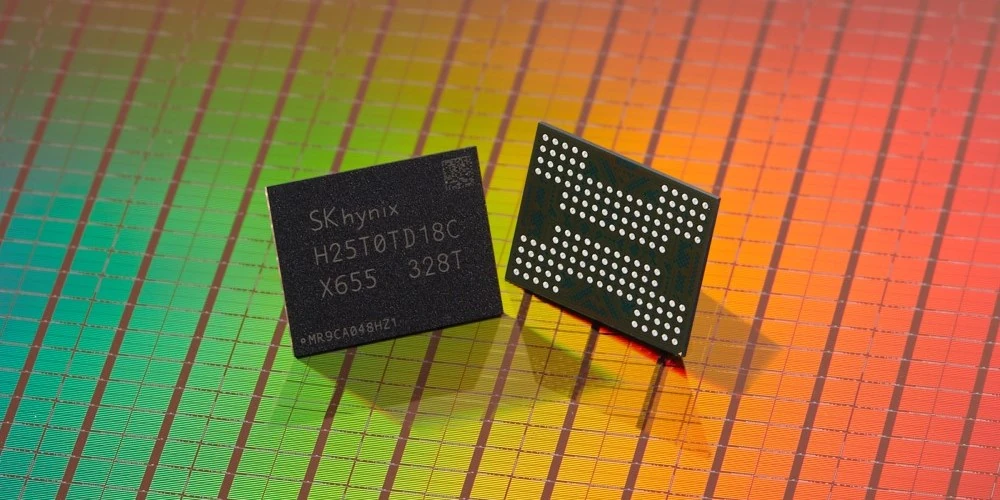

SK Hynix recorded a 10% QoQ increase in total NAND bit shipments. Concurrently, the ASP for these units rose by just over 30%. This disproportionate rise in price relative to volume indicates strong supplier leverage and a successfully tightened supply chain.

SanDisk Market Validation

SanDisk reported a similar trajectory, with a marginal QoQ increase in shipment volume but a significant ASP surge of approximately 35%. The synchronized price action between these two distinct market leaders corroborates a systemic industry-wide shift rather than an isolated vendor strategy.

2026 Demand Forecast

Looking ahead, SK Hynix projects “high double-digit” percentage growth for NAND demand in 2026, estimated at around 18%. This forecast suggests that despite the sharp rise in component costs, downstream demand from enterprise storage and high-capacity mobile sectors remains inelastic and robust.

Source: ITHome

Emir Bardakçı

Emir Bardakçı