If you were planning to pick up a budget-friendly flagship killer next year, you might want to rethink your strategy. New data from Counterpoint Research suggests 2026 will be a turbulent year for the smartphone industry, marked by a frustrating paradox: shipment volumes are crashing, but prices—and manufacturer revenues—are skyrocketing.

The culprit? A massive shortage in memory chips driven by the AI boom, which is forcing major players like Qualcomm and MediaTek to scale back shipments. While the “budget” sector takes a hit, one giant is bucking the trend with a surprise technological leap.

TL;DR

- Global Shipments Down: MediaTek (-8%), Qualcomm (-9%), and Apple (-6%) are all forecasted to ship fewer units in 2026.

- Samsung Surges: Unlike its rivals, Samsung is projected to grow by 7%, driven by its new 2nm Exynos 2600 chip.

- Memory Crisis: Rising costs for RAM (due to data centers hoarding HBM) are making sub-$150 phones nearly impossible to produce profitably.

- The AI Divide: Flagships will get on-device AI (100 TOPS), while mid-range phones will rely on cloud processing due to hardware limitations.

The Great Chip Slump of 2026

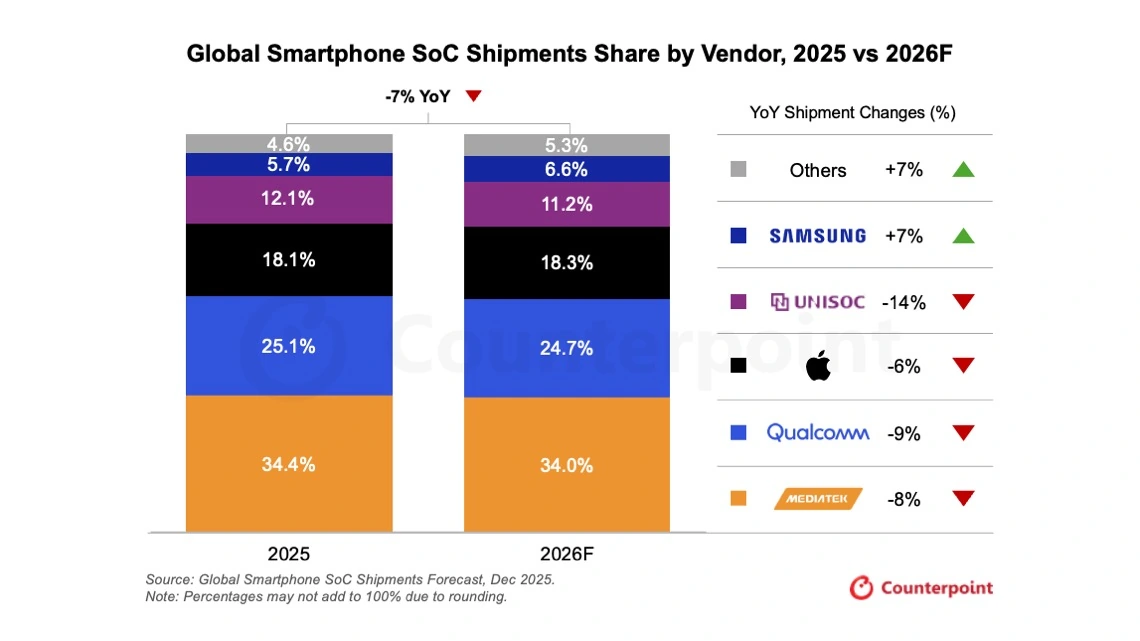

According to Counterpoint’s latest forecast, the global mobile chip market is polarizing. The total number of chips shipped is expected to drop by 7% year-on-year, yet total revenue will see double-digit growth. This means fewer phones are being sold, but they are significantly more expensive.

Here is the projected breakdown for 2026:

- MediaTek: 34.0% share (Shipments down 8%)

- Qualcomm: 24.7% share (Shipments down 9%)

- Apple: 18.3% share (Shipments down 6%)

- UNISOC (Tsinghua): 11.2% share (Shipments down 14%)

- Samsung: 6.6% share (Shipments up 7%)

Why Are Shipments Crashing?

The core obstacle is the skyrocketing price of memory. Semiconductor foundries and suppliers are prioritizing High Bandwidth Memory (HBM) to support the massive data center expansion required for Generative AI.

This leaves “regular” memory—the kind used in your smartphone—in short supply. For the low-end market (devices under $150), this cost pressure is catastrophic. Manufacturers simply cannot build cheap phones with adequate specs, leading to a “pruning” of budget lineups.

Samsung’s 2nm Gamble Pays Off

While the rest of the market contracts, Samsung is the outlier. The company is expected to see a 7% increase in shipments, largely due to its aggressive transition to next-generation manufacturing.

Samsung preemptively launched the world’s first 2nm smartphone chip, the Exynos 2600, in December 2025. This technological lead allows Samsung to solidify its position in the premium market with the upcoming Galaxy S26 series, offering a viable alternative to the increasingly expensive silicon from competitors.

The “AI Divide” Is Real

The report highlights a growing gap between premium and mid-range devices, defined entirely by AI capabilities.

-

Flagships (>$500): Will feature powerful NPUs capable of 100 TOPS (Trillion Operations Per Second), allowing for on-device AI that is fast, private, and offline.

-

Mid-Range ($100-$500): Due to the high cost of RAM, these devices won’t have the memory bandwidth for local AI. They will rely on Cloud AI, which creates a slower, less seamless user experience.

What’s Next For You?

If you are holding out for a price drop on premium devices like those powered by the Snapdragon 8 Elite, you might be waiting a while. The data suggests that 2026 will be the year of the “Premium Trap”—you’ll either have to pay top dollar for a future-proof device or settle for a mid-ranger that relies heavily on cloud connectivity.

Emir Bardakçı

Emir Bardakçı