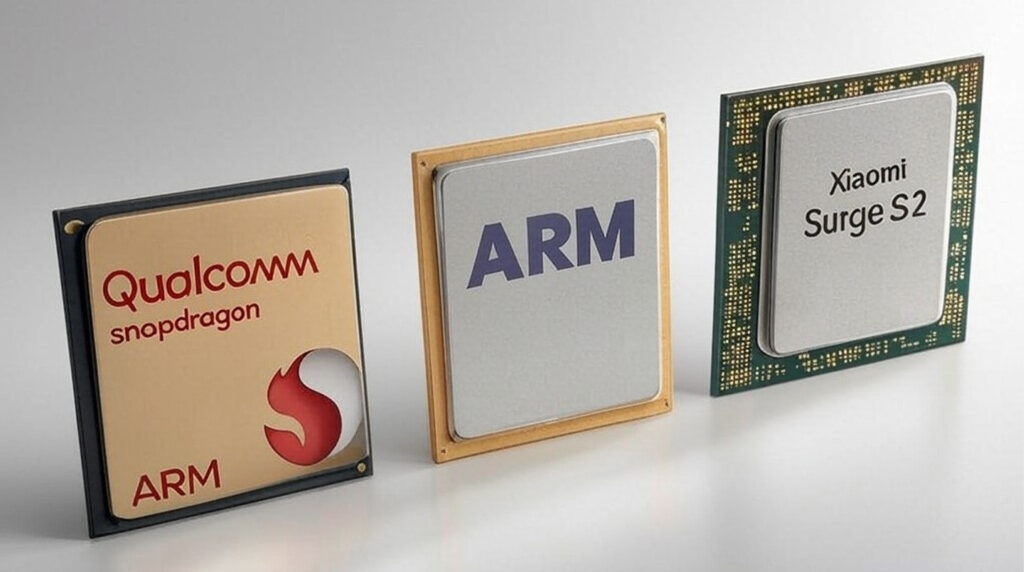

Ambitious it is, for Xiaomi plans to equip the Xiaomi 15S Pro with its own in-house SoC. This is going to be a make-or-break moment for the company-its second major foray into custom chip development since the Surge S1 SoC first hit the market on the Mi 5C back in 2017. The resurgence of Xiaomi’s chip ambitions comes as tensions between chipmakers intensify, with the current legal spat between Qualcomm and Arm unfolding in the United States.

With the Qualcomm-Arm dispute raising very fundamental questions about who owns what when it comes to chip design intellectual property, a question lingers on how this whole legal and strategic conflict could influence Xiaomi’s custom SoC efforts.

The Qualcomm-Arm Dispute: Who Owns Innovation?

At the center of the Qualcomm-Arm lawsuit is whether or not Qualcomm, by buying Nuvia, can legally use computing core designs based on Arm architecture. Arm claims that the designs by Nuvia are derivative of its technology and hence fall under the ambit of its licensing agreements. Contrarily, Qualcomm maintains that the Arm technology makeup constitutes an insignificantly minute portion of Nuvia’s work.

Or take Arm, licensing its architecture to companies including Qualcomm-for billions of dollars a year. A wide ruling for Arm could upend licensing agreements throughout the semiconductor industry, with lots of ramifications for innovation and competitiveness writ large.

This case indicates the legal and financial risks due to heavy reliance on third-party architecture. This is a cautionary story for firms like Xiaomi working out the kinks of such a market with a strong control by a few key players like Arm.

The Shifting of Xiaomi to In-House SoCs

The decision to make its own SoC reflects a broader industry trend of reducing reliance on outside suppliers. Until now, Xiaomi has sourced processors chiefly from Qualcomm and MediaTek; making an in-house chip has several strategic advantages:

- Cost Efficiency: Custom SoCs would reduce dependencies on costly licensing agreements, which is also the idea behind Qualcomm’s acquisition of Nuvia.

- Optimization: It will be easy for Xiaomi to optimize its chips for better integration with its software ecosystem, such as HyperOS, and hardware like AI cameras for efficiency and performance.

- Brand Differentiation: Proprietary technologies within Xiaomi create a very effective advantage to make it be further promoted as an innovation brand, together with all the other brands like Apple or Huawei, which had already independently designed their SOCs.

Xiaomi Surge S2 may use the similar modem structure as Google Pixel 10

Lessons from Qualcomm’s Legal Risks

Xiaomi’s re-entry into the custom chip arena raises critical questions:

- Most specifically, licensing risks-is Xiaomi now going to put heavy reliance on the ‘Arm’ architecture? Might any pre-empting be done on disputes along lines of the Qualcomm impasse?

- Ownership of Innovation: For example, Xiaomi could want to reduce potential patent litigation by engineering chips to rely as little as possible on existing architectures, seeking more innovation from within its own walls.

The case of Qualcomm-ARM underlines how much clear licensing agreements and strategic vision that minimizes dependence on third-party technologies m- an.

Implications for Xiaomi’s Future

The custom SoC drive by Xiaomi may redefine the company’s device roadmap in the future, especially concerning premium products such as the Xiaomi 15S Pro. In return, this is to require significant investment in research and development and also pay close attention to legal aspects.

If successful, Xiaomi would emerge as a significant semiconductor player and bring down its dependence on both Qualcomm and MediaTek. The lessons from the legal tussle between Qualcomm and China suggest that Xiaomi has to tread chip development carefully, keeping itself compliant with licensing agreements without giving up on independent innovations.

The global semiconductor industry is going through a period of transformation, and the move by Xiaomi to develop its own SoC is consistent with the wider trend toward vertical integration. But the ongoing dispute between Arm and Qualcomm remains a timely reminder of how tricky it is to work around licensing agreements and intellectual property. Of course, assuming these challenges are overcome and Xiaomi could establish sound legal and technical footing in this regard, its ‘in-house’ SoC may well serve to redefine not just the brand but also its positioning in the modern context of the smartphone domain, as new dimensions open up-for instance, on performance and differentiation-against the backdrop of an expanding competitive landscape.

Emir Bardakçı

Emir Bardakçı