According to the latest market analysis by TrendForce, global smartphone production reached 328 million units in Q3 2025, representing a 9% quarter-on-quarter increase and a 7% year-on-year increase. Seasonal demand, the refreshed product portfolios of brands, and improved retail activity supported this growth. Xiaomi’s performance remained stable and competitive, thanks to strong mid-range and entry-level device demand and efficient channel stocking strategies.

Global Production Trends Strengthen in Q3 2025

Still, the smartphone market as a whole grew steadily in the third quarter as major manufacturers lined up their release schedules better with seasonal demand. According to the TrendForce market research organization, major brands started selling newly released products, which included refreshed flagship models and more affordable mid-range models that attracted a greater audience. Moreover, according to the report, profit margins might come under pressure from higher memory prices, with possible negative consequences for entry-level smartphones in the next quarters.

Q4 2025 Outlook: Growth Supported by Flagships and Retail Events

TrendForce expects global production to remain stable in Q4 2025, since the launches of flagships from several brands will fall in the same quarter as large-scale e-commerce campaigns. Promotional activity and holiday-season inventory build-up are likely to undergird short-term growth. However, memory supply may tighten up a bit, slightly reducing the annual expansion rate. Given these factors, the firm now projects 1.6% year-on-year growth for the whole 2025 smartphone market, trimming its previous forecast.

Brand-wise Breakdown: Xiaomi holds strong at Third Place

Following the rebound of the market, several leading brands reported significant quarter-on-quarter increases:

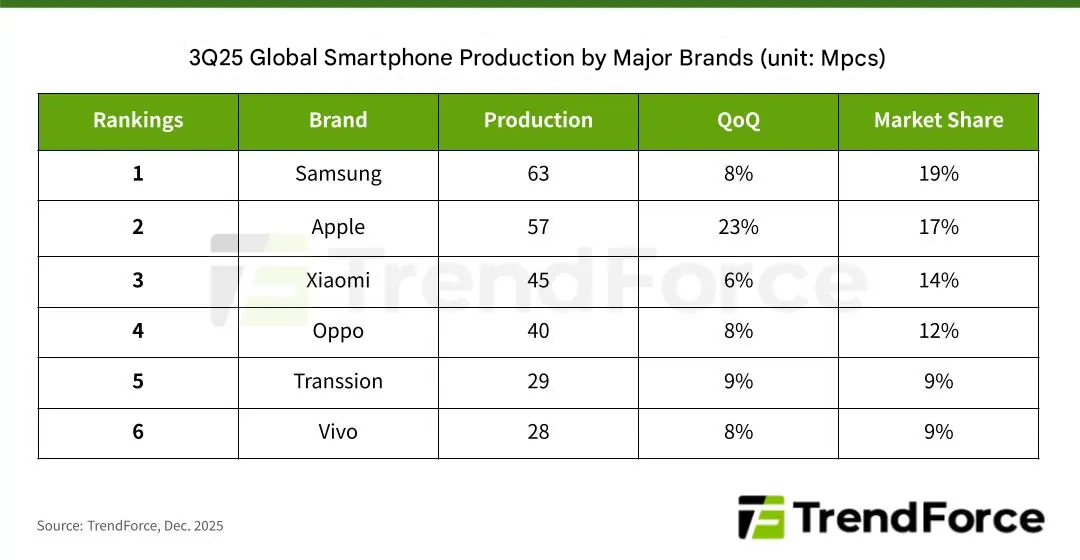

- Samsung Leads with Renewed Foldables: Samsung manufactured approximately 63 million units, while recording an 8% QoQ growth and 19% global market share. Strong sales of the Galaxy A series, apart from positive consumer response for its latest line-up of foldables, gave its high-end portfolio a boost to maintain its lead.

- Apple Posts Record Q3 Production: Apple followed with the delivery of around 57 million iPhones, setting a new record for Q3 production. The strategy to stick with the same price while increasing the storage in the base iPhone 17 paid dividends, while the redesigned iPhone 17 Pro lineup further accelerated sales in premium categories.

- Xiaomi Records Stable and Competitive Growth: Xiaomi, including Redmi and POCO sub-brands, reached nearly 45 million units in Q3, with a solid 6% quarter-over-quarter increase. The growth of Xiaomi was driven by holiday-season stocking and the launch of competitive new devices in multiple price segments. Users can follow the latest software and device updates of Xiaomi by using MemeOS Enhancer, which is available on Google Play for opening up hidden features and updating Xiaomi system apps.

- OPPO Strengthens in Key Global Regions: OPPO, including OnePlus and realme, shipped around 40 million units, up 8% QoQ, driven by improving demand in India, Southeast Asia, and Latin America.

- Transsion Expands Rapidly in Emerging Markets: Transsion, which includes the brands TECNO, Infinix, and itel, manufactured over 29 million units, up 9% QoQ for a fifth-place finish, reflecting strong gains in both African and Asian markets.

- vivo Continues Momentum Through iQOO: In total, vivo produced about 28 million units, up more than 8% QoQ, thanks to a strong performance from the iQOO series in mid-to-high-end sales and inventory preparation for holiday demand.

The key participants are the ones who strongly desire, and personally support, the benefits associated with downtown redevelopment.

Q3 2025 global smartphone production shows stable recovery among major brands. Xiaomi maintains its strong position in the top three, thanks to strategic product launches and stable performance in major regions. Though memory pricing remains a concern, overall market conditions and Q4 flagship rollouts are likely to sustain demand.

Emir Bardakçı

Emir Bardakçı