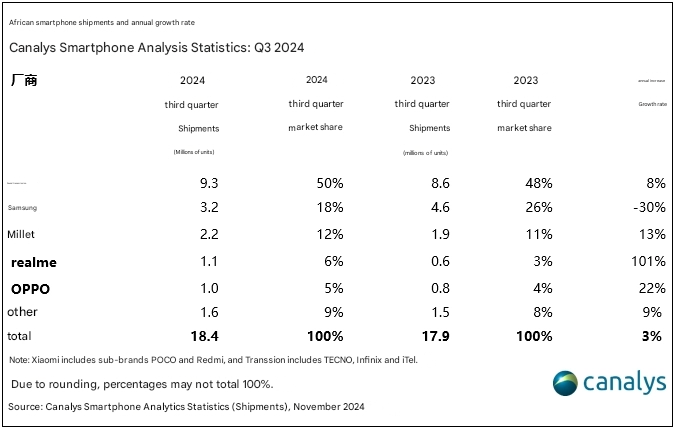

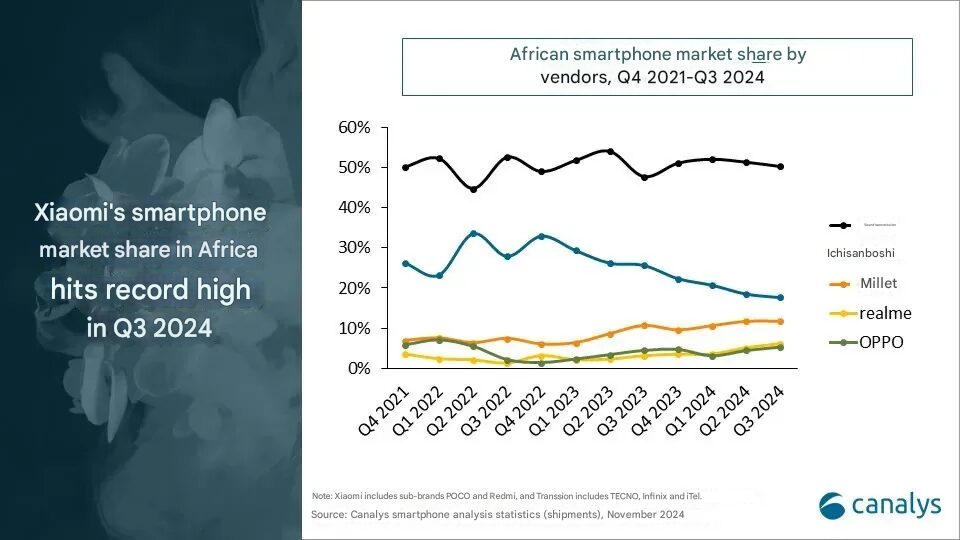

According to Canalys data, the smartphone market in Africa continued to trend upward in Q3 2024, recording a 3% year-on-year growth as it reached a total shipment of 18.4 million units shipped. Confronted by various challenges like declining average selling prices (ASPs), along with the heavy adoption of feature phones across markets, several brands gained key growth and success across the continent.

Market Leaders and Highlights

- Transsion: Retained the market leader position with 50% market share. Despite this, the company achieved an 8% year-on-year growth ratecourtesy of a strong focus on low-cost devices under banners such as Tecno, Infinix, and Itel.

- Samsung It has witnessed a 30% decline in shipment mainly on the back of weak demand in South Africa, one of its key markets.

- Xiaomi Reached their newest market share high of 13%, while marking a 10% ASP drop, this was beneficial due to strong demands for the more ‘affordable models’ such as the Redmi 14C in both Nigeria and Egypt. Continues to build its presence in key African markets through the pursuit of cost-effective strategies.

- Realme Witnessed an impressive 101% growth rate by leveraging its reputation for feature-rich, yet affordable smartphones.

- OPPO: Realized a growth rate of 22%, with success leaders being in the A60 and A3 series.

- Honor: Surged with an astonishing 287% growth, capitalizing on its premium yet competitive offerings.

Market Challenges

- Declining ASPs: Smartphone ASPs across Africa declined by 6% in Q3 2024 as the region showed continued demand for affordability.

- Dominance of Feature Phones: Given the increases, feature phones still accounted for a total of 55% shipments during this quarter; hence, it can be considered a huge act of barrier to the adoption of smartphones.

Opportunities for Growth

As the senior analyst of Canalys, Manish Pravinkumar, put it: “Africa’s smartphone market has tremendous potential.” Shipments continued to rise in the region for the sixth consecutive quarter, opening more possibilities for aspiring manufacturers who are in on value-for-money, durable, and innovative products. But a host of other challenges remain there, right from the widespread usage of feature phones to economic constraints.

Overview of Shipment Data for Q3 2024

| Brand | Market Share | Growth Rate | Key Drivers |

|---|---|---|---|

| Transsion | 50% | +8% | Affordable devices under Tecno, Infinix, Itel |

| Samsung | Decline | -30% | Weak demand in South Africa |

| Xiaomi | 13% | +13% | Redmi 14C in Nigeria, Egypt |

| Realme | N/A | +101% | Cost-effective strategy |

| OPPO | N/A | +22% | A60 and A3 series |

| Honor | N/A | +287% | Competitive premium offerings |

The African smartphone market has witnessed growth with untapped potential and, therefore, turns out to be a cool region where manufacturers can innovate and capture demand. If brands like Xiaomi, Realme, and Honor further expand their presence, then the competition will increase with more innovative devices at affordable prices.

Emir Bardakçı

Emir Bardakçı