The Indonesian smartphone market has experienced a significant shift in 2023, with BBK Electronics Corporation’s brands, namely Vivo, Oppo, and Realme, emerging as the top-selling smartphone brands. These brands have surpassed the once-dominant Samsung, signaling a remarkable transformation in consumer preferences and market dynamics. This article will explore the factors behind BBK’s success and discuss the implications for Samsung in Indonesia.

Changing Tides

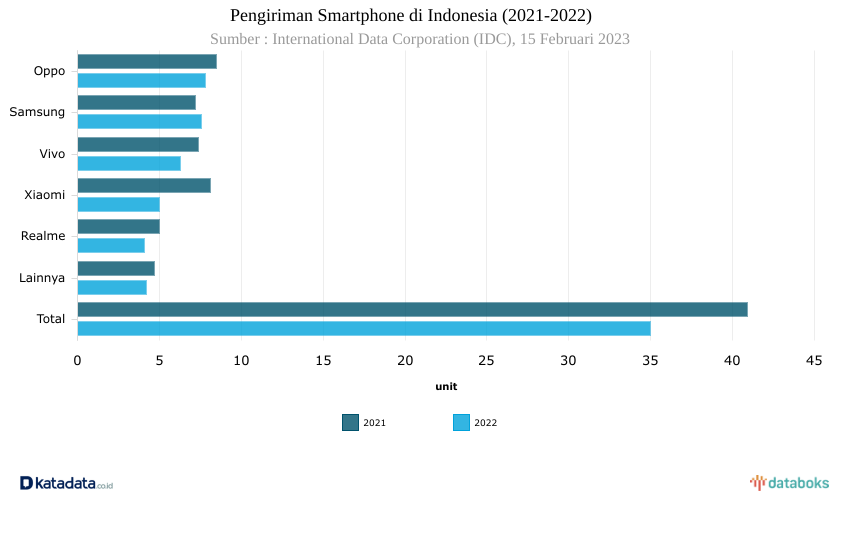

BBK’s Rise: Over the past few years, BBK Electronics Corporation, a Chinese multinational conglomerate, has made substantial inroads into the global smartphone market. In Indonesia, the trio of BBK brands, Vivo, Oppo, and Realme, has captured the attention of consumers with their competitive pricing, innovative features, and aggressive marketing strategies. Their concerted efforts have resulted in a surge in sales, catapulting BBK to the forefront of the Indonesian smartphone market.

Affordability and Feature-Rich Offerings

One of the primary factors contributing to BBK’s success is the affordability of their smartphones. Vivo, Oppo, and Realme have positioned themselves as budget-friendly alternatives without compromising on performance and features. By offering high-quality devices at attractive price points, BBK brands have resonated with price-conscious Indonesian consumers, who prioritize value for money.

Aggressive Marketing and Brand Awareness

BBK’s success can also be attributed to their aggressive marketing campaigns, extensive brand visibility, and strategic partnerships. These brands have invested heavily in advertising, celebrity endorsements, and sponsorships, allowing them to increase brand awareness and reach a wider audience. Their presence in retail stores, e-commerce platforms, and exclusive outlets across the country has further solidified their market position.

Localized Approach and Adaptation

Another crucial aspect of BBK’s triumph is their understanding of the local market and consumer preferences. These brands have focused on tailoring their products to Indonesian consumers’ needs, incorporating regional language support, localized user interfaces, and culturally relevant features. This approach has fostered a stronger connection with Indonesian users, enabling BBK brands to gain an edge over their competitors.

Samsung’s Decline and Competitive Challenges

While BBK’s ascent has been remarkable, Samsung has experienced a decline in market share and influence in Indonesia. Once a dominant player, Samsung’s position has weakened due to intense competition from BBK’s brands. The Korean tech giant has struggled to keep pace with the aggressive pricing, diverse product portfolio, and localized strategies employed by BBK. Consequently, Samsung now faces the challenge of repositioning itself in the Indonesian market and regaining lost ground.

Future Implications and Conclusion

As the Indonesian smartphone market continues to evolve, BBK’s Vivo, Oppo, and Realme are poised to maintain their dominance in the foreseeable future. Their ability to provide affordable yet feature-rich smartphones, coupled with effective marketing strategies, has won the hearts of Indonesian consumers. On the other hand, Samsung’s decline serves as a cautionary tale for established brands that may underestimate the changing dynamics of the market.

To remain competitive, Samsung must reevaluate its pricing strategies, strengthen its product offerings, and invest in localized approaches to regain consumer trust. The battle for supremacy in Indonesia’s smartphone market is fierce, and only those brands that can adapt to evolving consumer demands and preferences will thrive in this dynamic landscape.

In conclusion, BBK’s Vivo, Oppo, and Realme have emerged as the dominant smartphone brands in Indonesia in 2023, surpassing Samsung in terms of sales and market share. Their affordability, feature-rich devices, aggressive marketing, and localized approach have propelled them to the forefront of the Indonesian smartphone market. As BBK’s dominance continues, Samsung faces the challenge of reinventing itself to regain its once unassailable position in the Indonesian market.

Emir Bardakçı

Emir Bardakçı