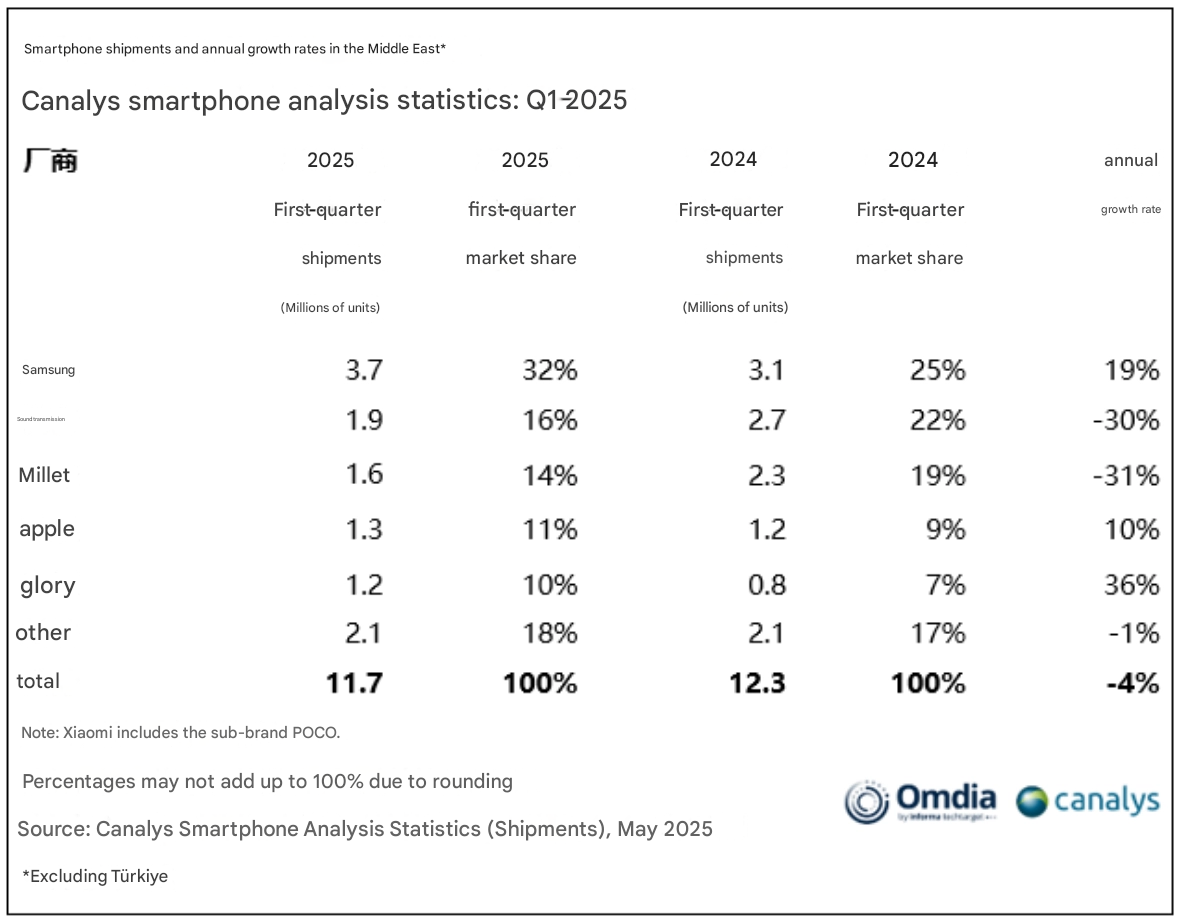

The Middle Eastern smartphone market slipped somewhat during the first quarter in 2025, with shipments down 4% year-on-year at 11.7 million units, according to Canalys data. Despite this unfavorable market condition, top vendors such as Xiaomi kept major market share while evolving to keep up with changing consumer preferences throughout the region. The market trends indicate hesitant consumer spending habits and decelerating retail demand, a far cry from the strong recovery seen through 2024. Industry insiders comment that this drop signifies a transitional phase while the mobile phone industry continues to develop due to regional economic conditions.

Market Leadership and Brand Performance

Samsung became clearly the market leader during the first quarter, gaining impressive traction despite market-wide difficulties. The Korean giant showed exceptional steadiness coupled with smart positioning in numerous Middle Eastern markets.

Top Performing Brands

Q1 2025 Middle East smartphone rankings showed dramatic market positioning shifts

- Samsung: 3.7 million units shipped (32% market share) – a 19% year-on-year gain

- Transsion: 1.9 million units shipped (16% market share) – decreased by 30% year

- Xiaomi: 1.6 million units shipped (14% market share) – declined by 31% year-on-year

- Apple: 1.3 million units shipped (11% market share) – a 10% year-on-year increase

- Honor: Shipped 1.2 million units (10% market share) – a year-on-year growth of 36%

Regional Performance Analysis

Saudi Arabia remained the largest smartphone market in the Middle East, with a share of 26% in total shipments. The country saw a year-on-year fall in device shipments by 12%, in line with overall regional trends.

Iraq experienced a comparable issue with a year-on-year drop by 11%, while the UAE remained relatively more stable with a minor decline by a mere 1%. These findings shed light on disparate consumer confidence rates in different Middle Eastern markets.

Growth Bright Spots

Encouraging market signals came from Kuwait and Qatar with positive growth trends. Kuwait experienced robust 13% shipment growth, while Qatar took regional leadership with impressive year-on-year expansion at 16%, showing strong consumer demand for newer smartphone technologies.

Users looking for Xiaomi software programs and operating system updates can retrieve the latest releases at HyperOSUpdates.com or get MemeOS Enhancer from the Play Store for additional device control options.

Emir Bardakçı

Emir Bardakçı