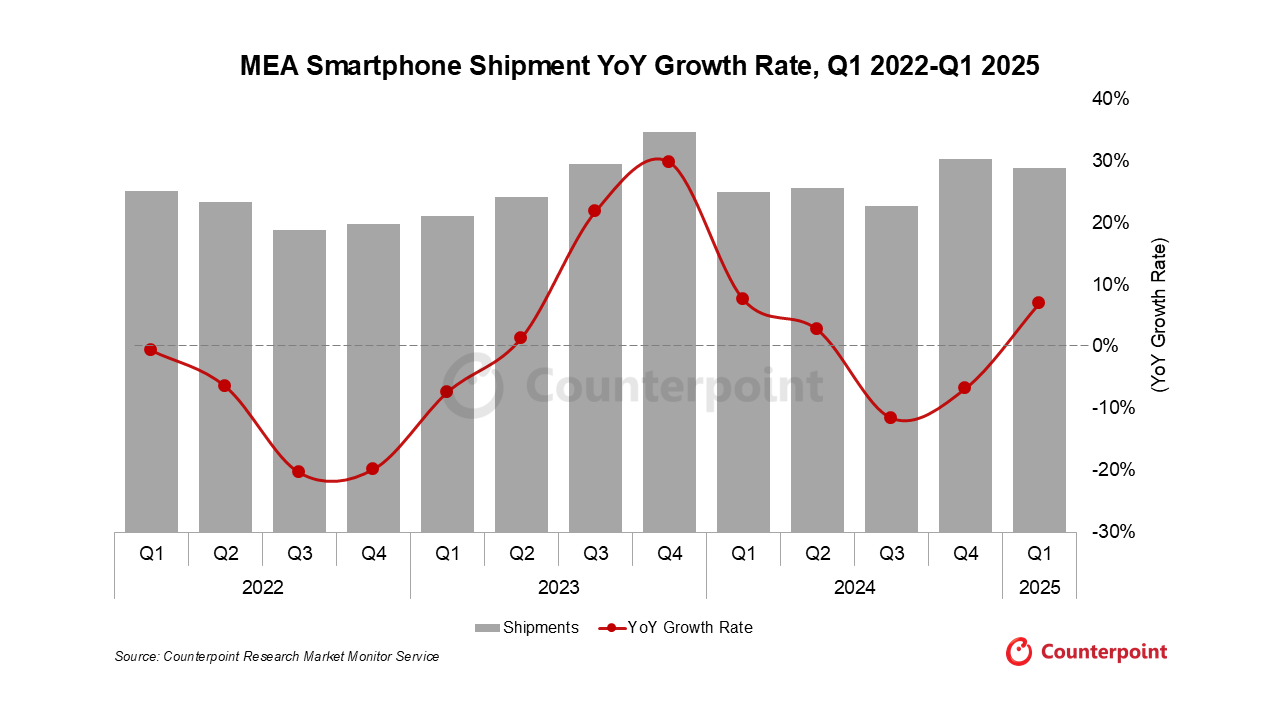

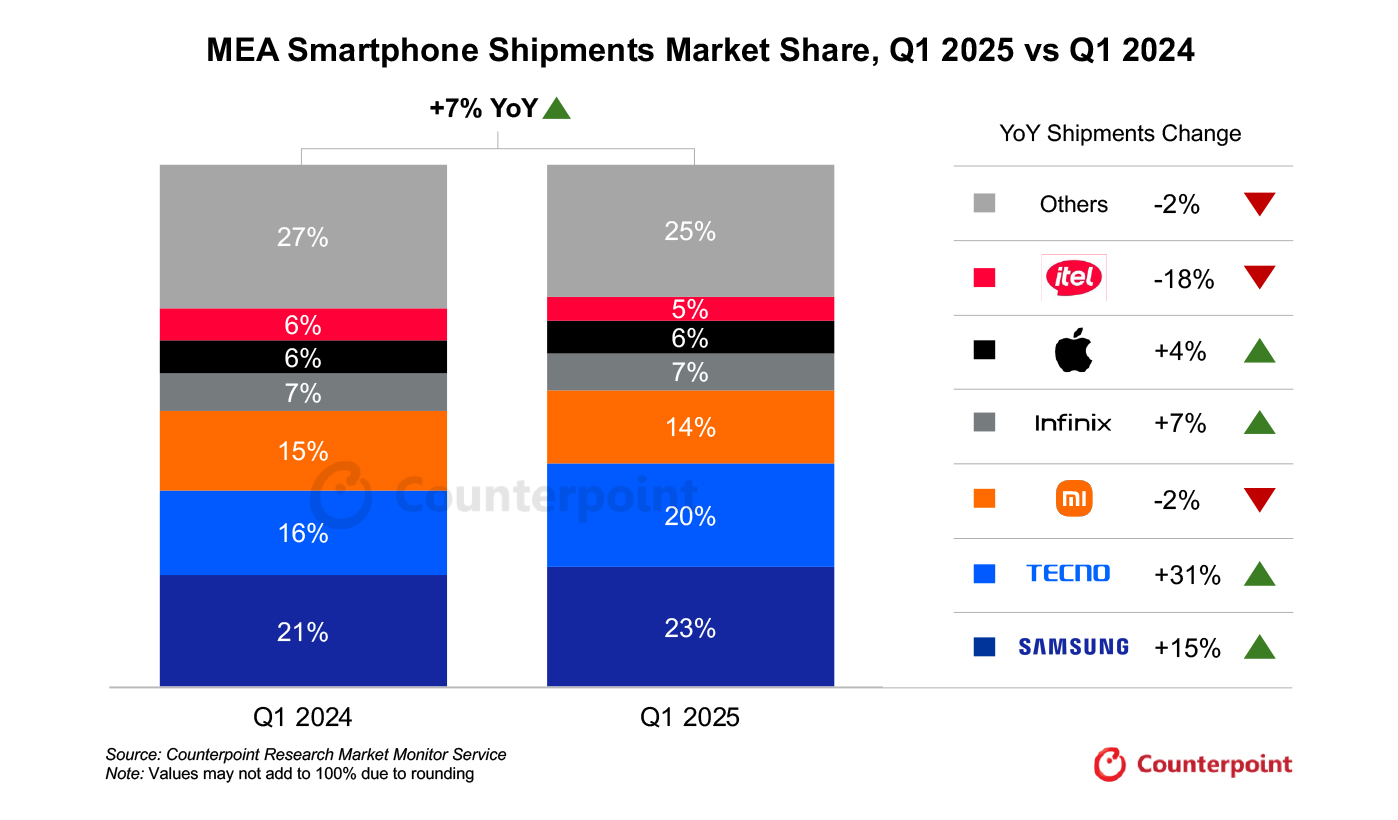

The Middle East and Africa (MEA) market for smartphones has made an impressive comeback in Q1 2025 with a 7% year-over-year growth as per the latest research from Counterpoint launched on 29th May. The improvement is the first quarterly growth in the last two quarters of decline, indicating stabilized consumer sentiment and market recovery in the region. The recovery is indicative of the strength of the demand for smartphones in emerging markets, with Xiaomi earning a robust third rank along with market leaders Transsion and Samsung. The growth pattern is indicative of effective regional market strategies and the widening uptake of affordable but feature-sufficient smartphones catering to varied consumer requirements. The outcome highlights manufacturers adjusting their product lines to suit specific regional demands while continuing to adopt competitive pricing strategies in cost-conscious markets.

Market Leadership and Brand Performance

Transsion has entrenched itself as the leader in the MEA market by achieving a massive 32% market share with its multi-brand strategy. The conglomerate’s success is the result of its regional-focused strategy with TECNO at the forefront with 20% market share and recording impressive 31% year on year growth, and Infinix adding 7% with stable 7% growth.

Samsung held its robust second place with 23% market share, showcasing impressive operating efficiency in simplifying its smartphone range from 103 to 76 phones. This consolidation helped drive 15% year-over-year shipment growth and reinforced premium segment volumes over $400 as well as middle segment Galaxy A series volumes.

Strategic Market Position of Xiaomi

The brand took the number three spot in the MEA smartphone market with a firm 14% market share, reflecting the firm’s robust regional footprint despite suffering a slight 2% y-o-y shipment reduction. This reflects the strength of Xiaomi in competitive emerging markets as well as its capacity to sustain significant market share in varied price segments.

Key Market Rankings Q1 2025:

- Transsion: 32% market share (29% in 2024)

- Samsung: 23% market share (+15% YoY growth)

- Xiaomi: 14% market share (-2% YoY)

- Apple: 6% market share (+4% YoY growth)

Regional Growth Drivers and the Outlook

The MEA market recovery reflects broader economic stabilization and increasing smartphone penetration across emerging economies. Consumer preferences continue favoring value-oriented devices that balance performance with affordability, creating opportunities for brands like Xiaomi to leverage their competitive positioning.

The positive Q1 2025 results lay the groundwork for growth to continue in the coming year, with manufacturers prioritizing regional tailoring and strategic portfolio management to take advantage of emerging market opportunities.

Source: Counterpoint Research

Emir Bardakçı

Emir Bardakçı