The Indian smartphone market declined substantially in the first quarter of 2025, shipments decreasing by 7% sequentially year-on-year as reported by the most recent report by CounterPoint Research. This decline comes in the face of extreme inventory challenges to top players such as Xiaomi, who sits at number four in this pivotal market. Even in challenging overall market environments, the high end segment remains phenomenally robust, with those handsets priced above 45,000 rupees ($540) increasing by 15% and achieving 14% market share – the highest growing segment in any price segment within India’s competitive phone market.

With its reputation for great value-for-money propositions in India, Xiaomi has sought to find its way around these tough conditions by streamlining its range of products and emphasizing premium experiences demanded by Indian users in increasing numbers. Its strategic move is well timed as peers in the industry focus on selling off existing stock rather than launching aggressive new product offerings.

Market Leaders and Performance

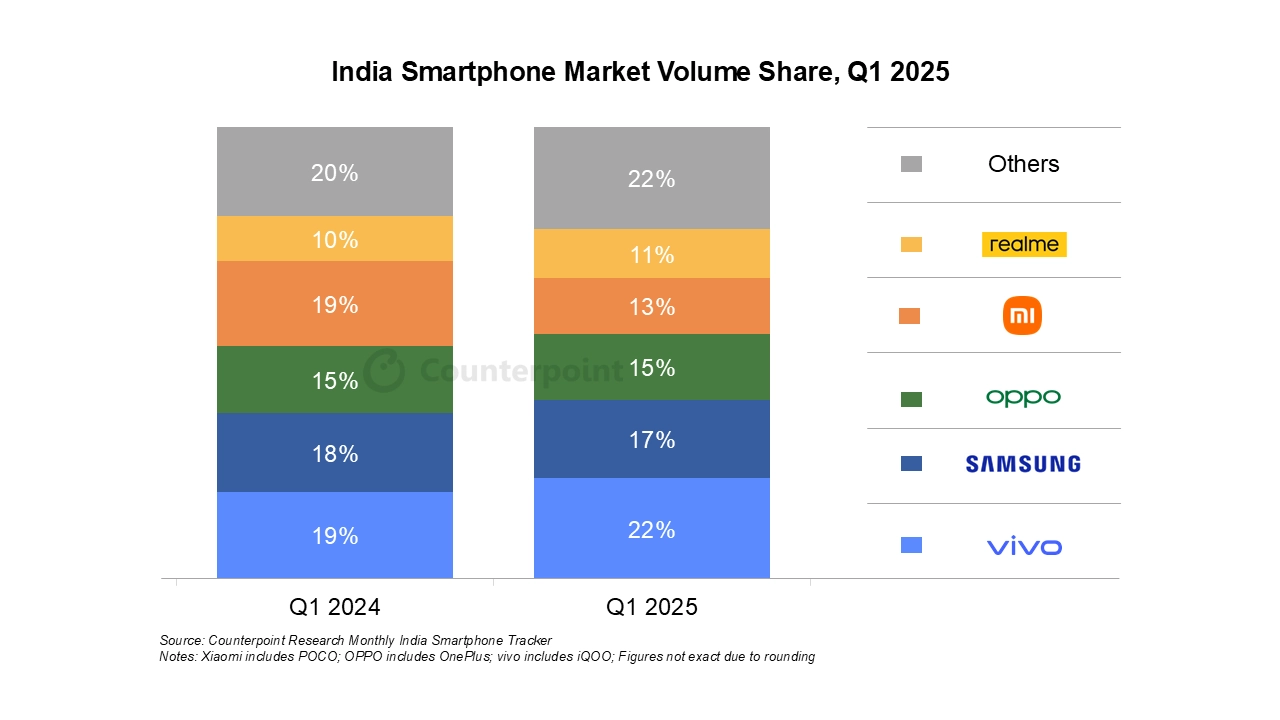

The CounterPoint report identifies a competitive market where vivo occupied the top spot for the third consecutive quarter with an impressive 22% of market share and 9% growth compared to last year. Their sub-15,000 rupee ($180) offerings fared extremely well.

Samsung moved to the second spot with 17% market share, thanks to several launches of new models across price points. Their S25 Ultra series particularly contributed to S-series reaching historical highs in the premium segment.

OPPO ranked third at 15% followed by Xiaomi at 13% and then realme at 11%. Although Xiaomi suffered somewhat following inventory constraints, it is still an influential giant in the market.

The premium segment demonstrates strong growth

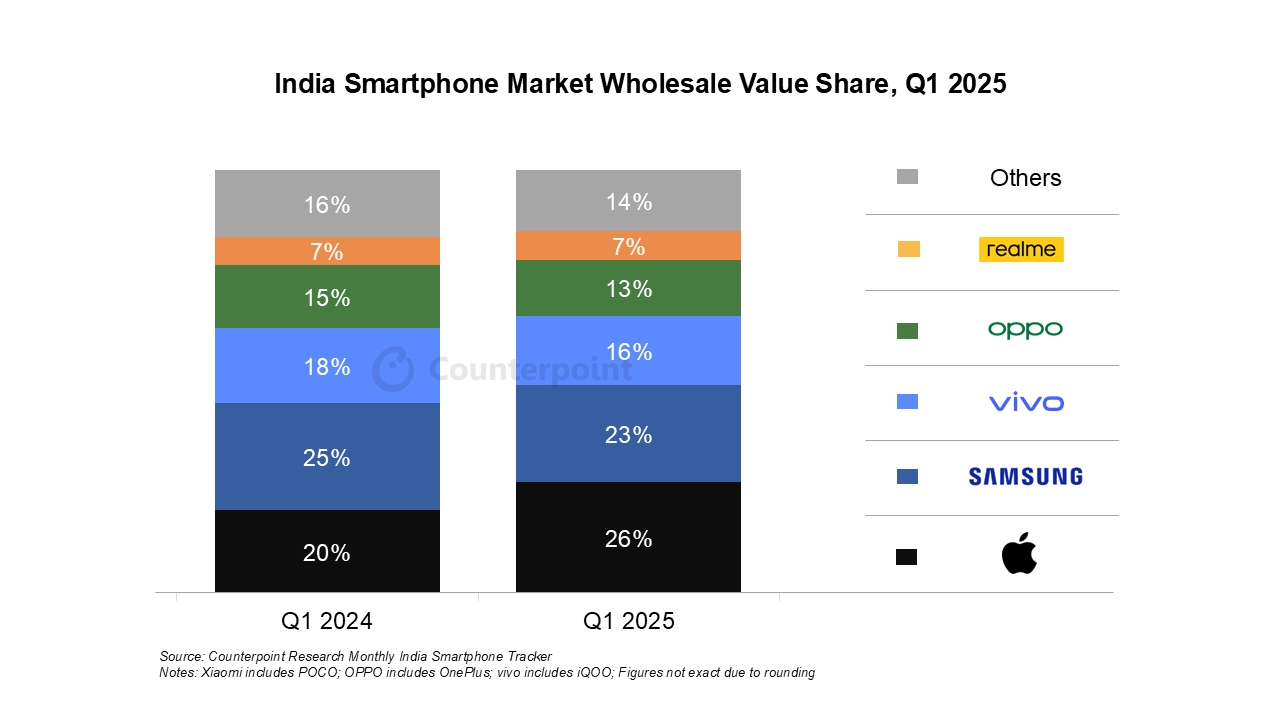

Even as overall market size shrinks, India’s ultra-premium segment remains resilient. The segment reported historic first-quarter shipments with growth of 29%, commanding both premium space and overall market value with 26% of total market value share.

This premiumization comes with challenges and opportunities in equal measure to Xiaomi, as it continues to grow its footprint in higher price ranges with models such as the Xiaomi 15 Series with flagship features at competitive prices.

Industry-Wide Inventory Problems

The report identifies inventory management as the biggest challenge facing India’s smartphone brands. New product releases declined by 26% annually as producers concentrated on selling existing stock to enable stable operations.

Xiaomi users who want to maximize their gadgets at this time can access the HyperOS Updates app at HyperOSUpdates.com or obtain the MemeOS Enhacer app at the Play Store, which offers access to hidden Xiaomi capabilities, system app updates, and screen update controls.

What to Expect Next

As the market rebalances to existing stock levels, industry observers look to possible recovery in the latter half of 2025 as brands can be expected to launch newer and improved products as and when inventory stress eases.

For Xiaomi enthusiasts, it may translate to thrilling new releases in store in the months to come as the firm continues to bolster its foothold in this strategic market.

Source: IThome

Emir Bardakçı

Emir Bardakçı