The latest Omdia analysis shows a mixed landscape in India’s Q3 2025 computing market, where the PC segment achieved double-digit annual growth while the tablet market contracted notably. According to Omdia’s report, India’s PC shipments reached 4.9 million units during the quarter, representing a 13% year-on-year rise. Notebook and desktop demand remained strong thanks to holiday-season inventory buildup and a decent business procurement cycle. Meanwhile, tablet shipments declined 19%, with Xiaomi posting an 8.9% year-on-year decline, despite continuing to enjoy healthy traction in the consumer segment. Additional Xiaomi shipment data can be seen in our sections on Xiaomi market data and Xiaomi Pad series performance.

India’s PC Market Registers Record Growth in Q3 2025

India’s wider PC market presented strong momentum across the quarter. Omdia noted that notebook shipments grew 12% to 4 million units, while desktop shipments jumped 18% to 920,000 units. These increases were principally driven by early holiday inventory builds and brands’ continued execution with delivery performance for enterprise customers. This combination allowed the PC market to reach its highest Q3 volume to date.

The consumer PC market grew strongly, up 20% year-on-year. Online retail activity was more intense, with early promotions, while offline channels continued to grow, thanks to selective discounts and well-structured cashback programs. At the high end, shipments of premium laptops expanded by 27%, reflecting an increased consumer preference for better performance.

Overview of PC Brand Performance

The following table outlines the total PC shipment in India for Q3 2025:

| Brand | Shipments (Units) | Market Share | YoY Change |

|---|---|---|---|

| HP | 1,317,000 | 27% | +1.3% |

| Lenovo | 891,000 | 18.3% | +14.4% |

| Acer | 742,000 | 15.2% | +12.5% |

| ASUS | 522,000 | 10.7% | +20.6% |

| Dell | 505,000 | 27% | +5.1% |

These results point to stable enterprise demand and strong consumer enthusiasm, contributing to one of the best quarters for PCs in India.

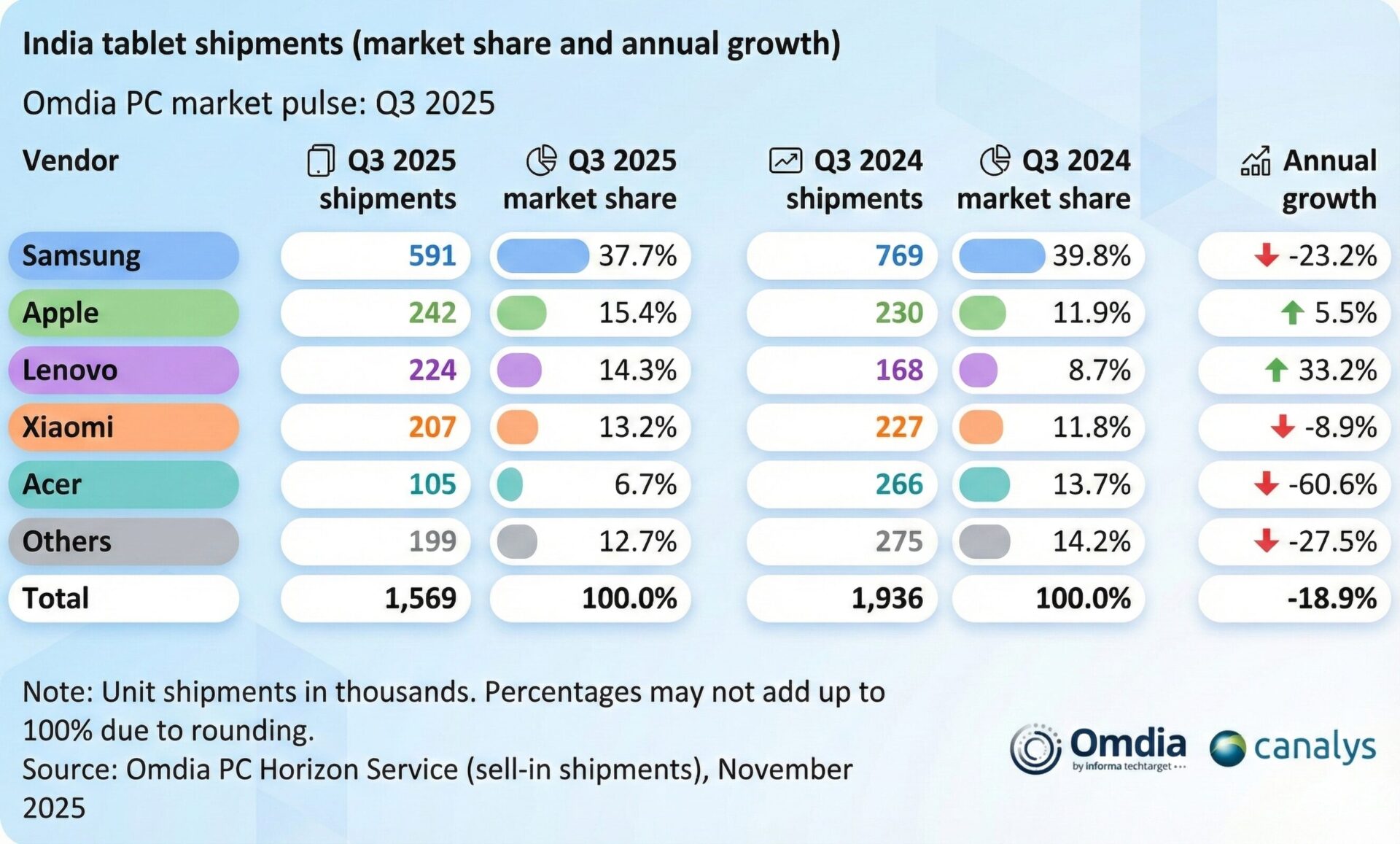

India’s Tablet Market Shrinks Despite Consumer Increase

In contrast to the PC growth trajectory, India’s tablet market declined 19% year-on-year, with total shipments falling to 1.6 million units. The contraction was primarily driven by delays in government-backed education procurement programs, which traditionally account for large shipment volumes. However, consumer tablet demand increased 14% on the back of entertainment-oriented usage and seasonal retail promotions.

Overview of the Performance of Brands Selling Tablets

| Brand | Shipments (Units) | Market Share | YoY Change |

|---|---|---|---|

| Samsung | 591,000 | 37.7% | –23.2% |

| Apple | 242,000 | 15.4% | +5.5% |

| Lenovo | 224,000 | 14.3% | +33.2% |

| Xiaomi | 207,000 | 13.2% | –8.9% |

| Acer | 105,000 | 6.7% | –60.6% |

The shipment volume of 207,000 units by Xiaomi signals stability in this marketplace, regardless of the overall downturn. Xiaomi has retained its position as one of the core tablet vendors in India with a 13.2% share. Consumer-driven demand, especially for models positioned in the affordable entertainment and productivity categories, continues to support Xiaomi’s long-term presence in the region.

Xiaomi’s Position in India and Market Dynamics

Although Xiaomi saw an 8.9% YoY decline in tablet shipments, the context of its overall performance has been quite resilient. Consumer demand for tablets surged, but total market shipments have been impacted by temporary delays in public-sector projects. Once procurement cycles get back to normal, brands such as Xiaomi are expected to pick up shipment momentum again, more so with price-optimized models and reliable regional channel support.

This leads to the company’s long-standing presence in India’s consumer technology ecosystem, from smartphones, Xiaomi Pad, smart home products, and experiences on HyperOS, which in-turn maintains competitiveness for quarters to come.

Emir Bardakçı

Emir Bardakçı