According to a report by Canalys, worldwide shipments of wearable wristband devices reached 52.9 million units in Q3 2024, representing a year-on-year rise of 3%. Key drivers for such growth in the segment include a rebound in basic wristbands, robust performance within emerging markets, and further adoption across all product tiers of advanced activity tracking.

Key Highlights – Q3 2024

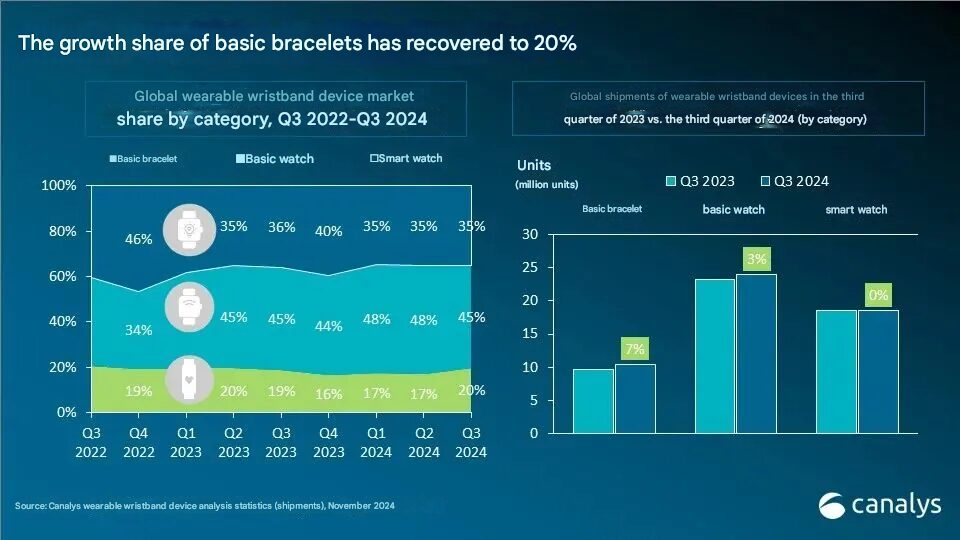

Category Growth

- Wristbands: Shipments increased by 7% year-on-year to 10.4 million units with launches such as the Xiaomi Mi Band 9 and Samsung Galaxy Fit3 driving the performance. That was the category’s first growth since Q3 2020.

- Basic Watches: Stabilized demand brought 3% growth, with 23.9 million units shipped. First-time buyers in emerging markets favored the adoption of AMOLED displays and advanced tracking features.

- Smartwatches: Growth at the margin of 0.1%, reaching 18.5 million units. Offsets in Apple’s shipment gains contribute to the stability of the category, with Huawei and Samsung gaining.

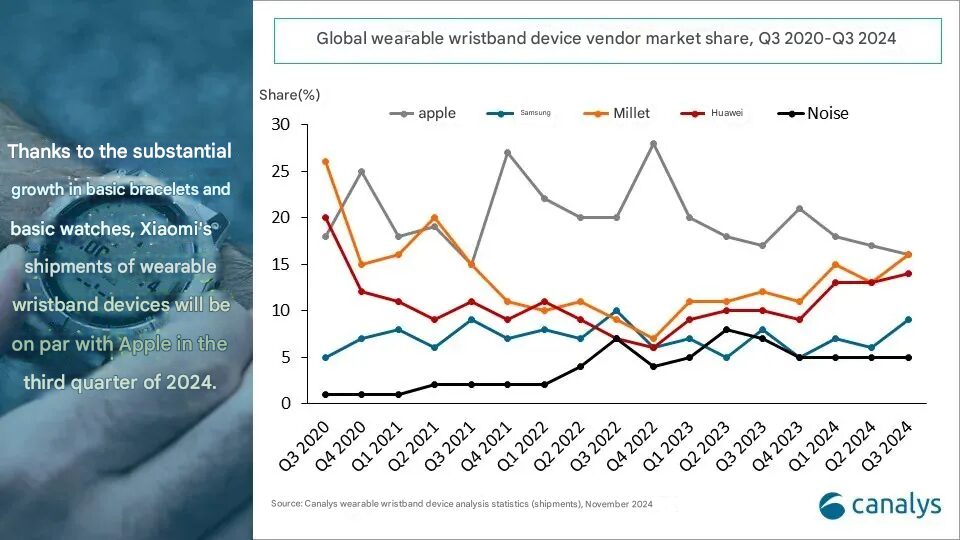

Xiaomi’s Record-Breaking Performance

Highest Shipments Since Q4 2020: Strong sales were contributed by the Mi Band 9 and Redmi Watch 5 series by Xiaomi.

- The expanded product line would include Pro, NFC, and Active variants for wider market reach.

- Shipments of Watch S series expanded by 70%YoY, reflecting progress in the premium segment.

- Challenges: Entry-level devices had been the focus, therefore there was a 9% YoY decline in ASPs, the lowest ever ASP since Q1 2021. Balancing affordability with high-end aspirations remains a key hurdle for Xiaomi.

Regional Market Dynamics

- Emerging Markets: Strong growth in Latin America and EMEA regions, with the main impetus coming from Xiaomi’s low-cost bands and Samsung’s Galaxy Fit3. First-time users are attracted by the increasingly affordable and feature-rich devices.

- North America: Declines in demand for the older models of Apple and Fitbit’s loss in market share resulted in weak performance. Mature markets lacked significant feature updates to spur upgrades.

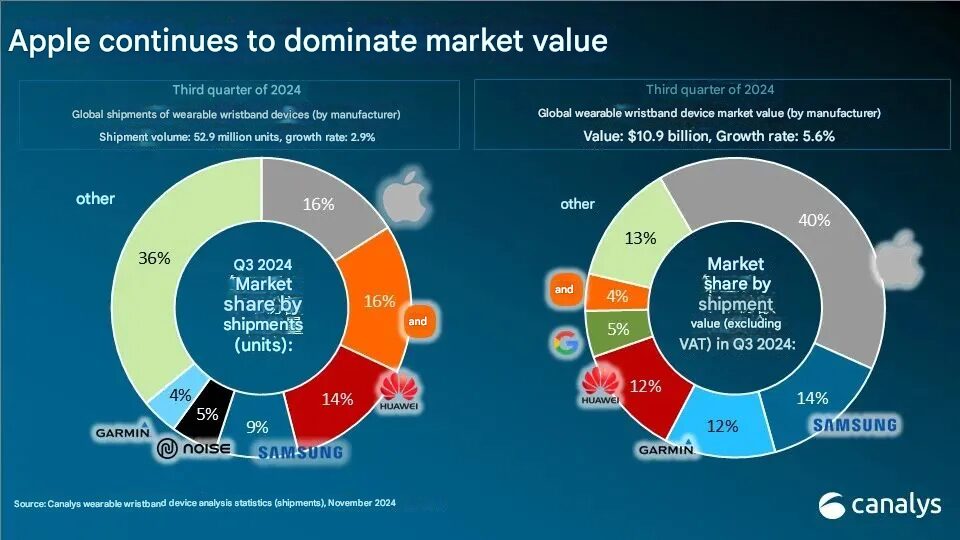

Market Share and Value

- Market Share Global-Shipments: Xiaomi and Apple were tied for first place at 16%. Huawei came with the portion of 14%, while Samsung represented 9%.

- Market Value: Apple leads with 40% market share and reflects its dominance in premium pricing.

Challenges and Trends in Wearables

Other features, such as AMOLED displays and more advanced health tracking, are becoming increasingly accessible, which raises consumer expectations.

- Decentralized Technology: Competition is rising from this shift and puts the manufacturers under pressure due to innovation required while sustaining profit margins.

- Market Potential of Smartwatches: Smartwatches accounted for 35% of shipments but had a very impressive 74% of market value. High-end smartwatches have remained fundamental to ecosystem stickiness and profitability.

- Future Innovations: Competitiveness requires that manufacturers invest in capabilities related to machine learning, dual processor architectures, and sophisticated sleep detection.

Analyst Commentary

According to Jack Leathem, Canalys Research Analyst, to maintain growth, the balance needs to be struck between innovation at the high end but also affordability. He also added that while the move into different price tiers has enabled Xiaomi to capture a more significant number of audiences, such a diversified strategy has its demerits, especially in the challenge of competing at both the entry and premium segments. According to Cynthia Chen, Research Manager, “Contrasting dynamics between emerging and mature markets indicate that vendors must revisit product strategies regionally in a bid to capture growth opportunities.”.

The return to growth for the wearable wristband market underlines the dynamism and innovation in the sector, with leaders like Xiaomi and Apple going full throttle, expanding their product lines and technological capabilities, while ideas balancing affordability against an upscale feature set will drive the next phase of development in the market.

Emir Bardakçı

Emir Bardakçı