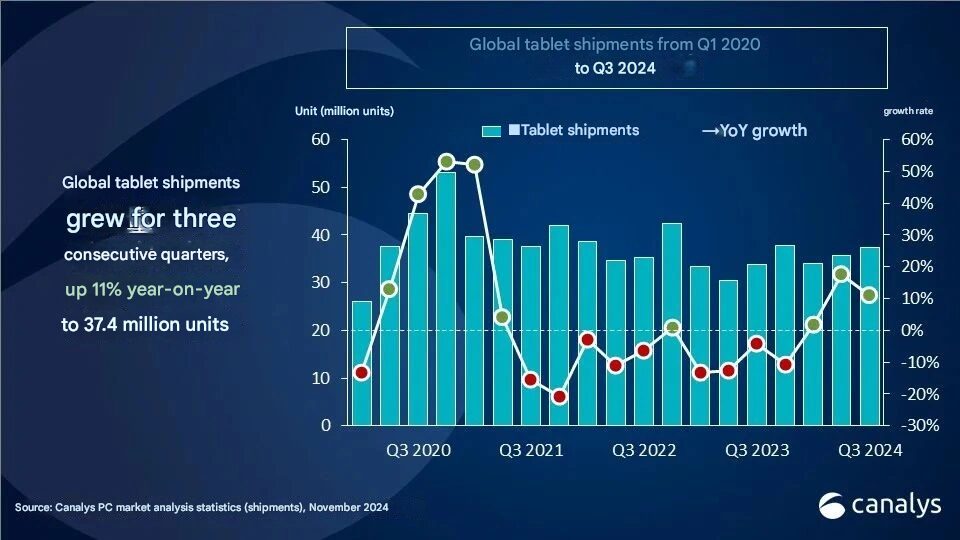

The global tablet market recorded a year-on-year growth of 11% in Q3 2024, reaching a total shipment of 37.4 million units, according to the latest report from Canalys. This is the third consecutive quarter of growth for the tablet industry, fueled mainly by an increase in demand from both consumer and commercial sectors. Among those, back-to-school season sales, holiday inventory preparation, and rising enterprise IT spending became significant contributors to growth.

Key Factors that Triggered Growth

According to Canalys research manager Himani Mukka, there is more than a single reason for the uptick in this tablet market despite it facing a more challenging consumer environment: “Bundled offers and aggressive promotions across markets were among factors driving tablet shipment amid the increasingly challenging consumer environment.”.

The third quarter saw retail channels stocking up in preparation for an early holiday discount season, with major shopping events including “Black Friday” and “Cyber Monday” in the US, and the “Double Eleven” shopping festival in some overseas markets. During these promotions, manufacturers launched enticing new products to encourage users to upgrade their old devices.

Economic factors, such as inflation, did affect consumer demand to an extent, but the commercial demand recovered and spurred device refresh and deployments across education, healthcare, and retail sectors. The tablets remained in high demand due to digital transformation, especially in segments like education, healthcare, and retail, where the demand for mobile computing solutions has increased further.

Manufacturer Rankings and Market Share

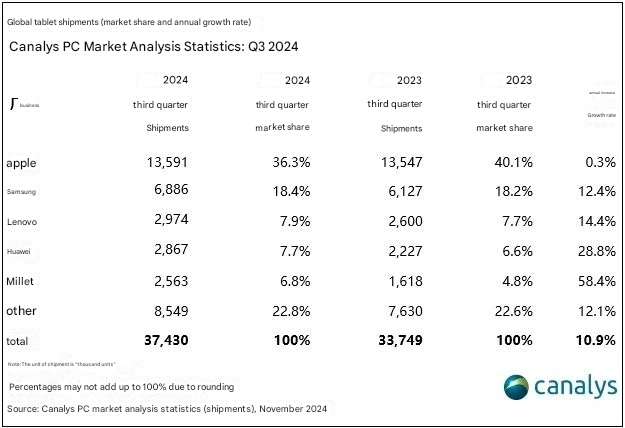

Apple continued to lead the Q3 2024 tablet market with a 36% share and shipped 13.6 million units. In second place was Samsung with 6.9 million units shipped, which was up 12% year on year. The rest of the top five consists of Lenovo, Huawei, and Xiaomi, which turned in strong performances during this quarter.

- Apple: Top with 36%, the vendor shipped 13.6 million units.

- Samsung: Managed to capture the second position with 6.9 million unit shipment, up 12% year-on-year.

- Lenovo: Can manage a 14% year-on-year growth.

- Huawei: Registered 2.9 million units in shipments, up 29%.

- Xiaomi: Ramp up from nowhere to be among the fastest-growing tablet manufacturers with an attractive growth rate of 58%.

The Outstanding Performance of Xiaomi

Xiaomi has again emerged as the fastest-growing maker in the Tablet Market, having achieved an impressive 58% YoY growth rate in Q3, 2024. Such rapid expansion by the company testifies that its strategic focus is on product innovation and competitive pricing, thereby enabling it to capture further market share in both consumer and commercial segments.

The growth of Xiaomi underlines its ability to meet the rising demand in emerging markets where capable, yet affordable, devices are in high demand. While the overall growth rate of the tablet market still reflects moderation, the recent performance indicates that the tablets remain well-placed to prosper in a number of end-user segments. Growing adoption of digital solutions in education, healthcare, and retail provides promising indications for potential advancements of tablets in consumer and commercial domains.

This is expected to be further energized by holiday promotions, paving the way for continued growth of the tablet industry into the upcoming quarters. As the market further develops, vendors such as Xiaomi, Apple, and Samsung will surely press harder with new features and promotions in cuts to attract consumer interest. The brands have plans ready to go at the start of the coming holiday season, with even more attractive offers and innovative products. This really assures that the tablet market will continue to be quite dynamic and competitive at the beginning of 2025.

Emir Bardakçı

Emir Bardakçı