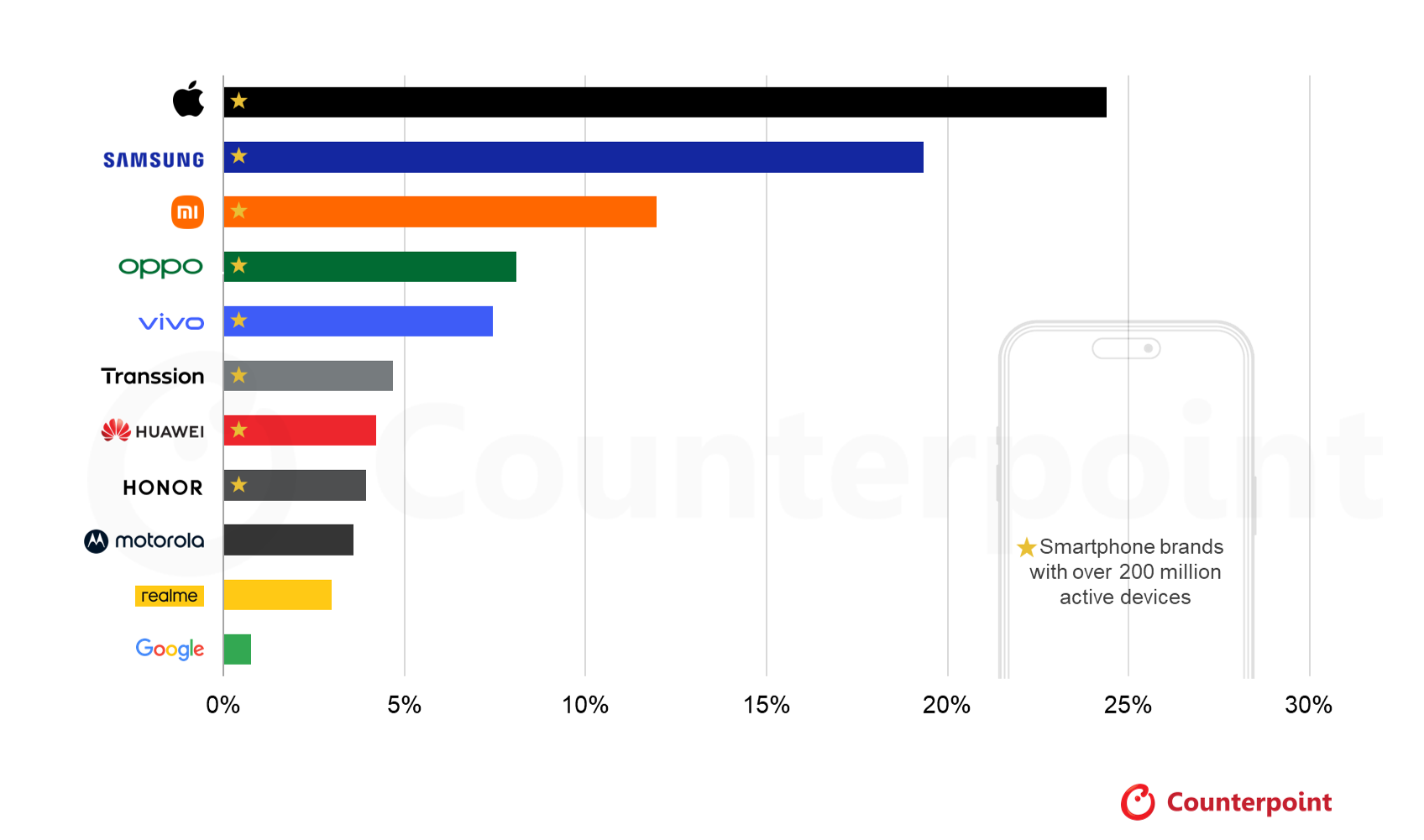

A new report from Counterpoint Research has revealed a significant consolidation in the global smartphone market. As of 2025, the number of active smartphone brands with a user base exceeding 200 million has reached eight, with the top two players maintaining a massive lead over the rest of the field.

According to the data, the global active installed base grew by 2% year-on-year in 2025. This slow growth is attributed to a lengthening replacement cycle, which has now extended to nearly four years.

The “Billion Club”: Apple and Samsung Dominance

While eight brands have crossed the 200 million mark, only two have broken the 1 billion barrier, together accounting for 44% of the entire global market.

-

Apple (~25% Share): The iPhone maker leads the pack, with one in every four active smartphones globally being an iPhone. remarkably, Apple’s net increase in active devices in 2025 was greater than the combined total of its seven closest competitors.

-

Samsung (~20% Share): Ranking second, Samsung continues to benefit from its vast portfolio that spans from entry-level A-series devices to premium foldables, giving it a strong global footprint.

The “200 Million Club” & New Entrants

Beyond the top two, the market is segmented into tiers of manufacturers who have successfully built massive ecosystems.

-

The Established Players: The “200 Million Club” includes Chinese heavyweights Xiaomi, OPPO, and vivo, which have solidified their positions in the mid-to-high-end segments.

-

The Rising Stars: Transsion continues to hold its ground by dominating price-sensitive markets like Africa.

-

The Newest Member: HONOR officially joined the club in 2025, becoming the latest brand to surpass 200 million active users.

-

On the Horizon: Brands like Motorola and realme are reportedly close to reaching this milestone.

A Shift in Strategy: From Hardware to “Lifetime Value”

The report highlights a critical shift in industry focus. With hardware upgrades becoming less frequent due to improved durability and higher costs, manufacturers are pivoting from chasing shipment numbers to maximizing “Customer Lifetime Value”.

-

The New Battleground: Brands are now prioritizing software experiences, on-device AI, and cross-device connectivity to keep users loyal.

-

Service Revenue: Currently, Apple is the only brand generating substantial double-digit growth in service revenue from its base. The challenge for other OEMs is to unlock similar value from their hardware users as hardware sales slow down.

Emir Bardakçı

Emir Bardakçı