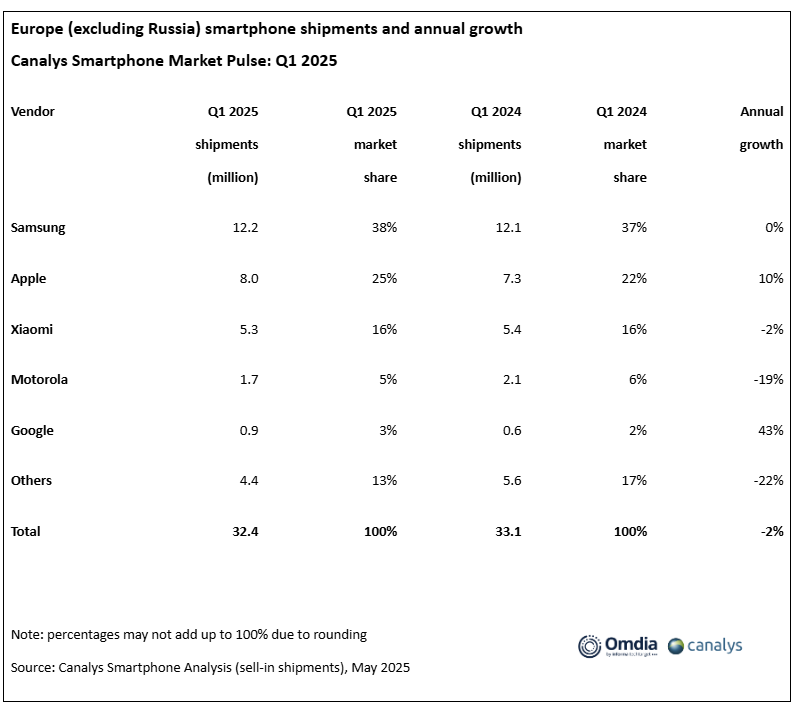

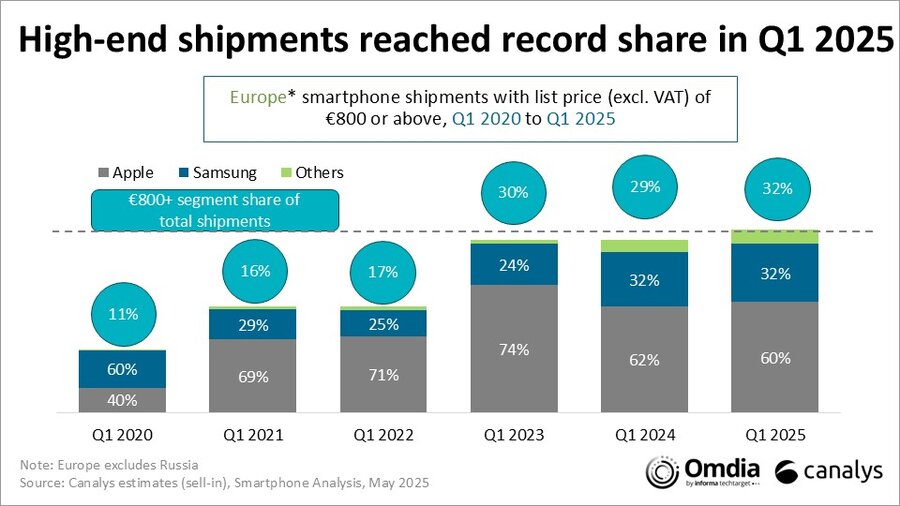

The European smartphone industry had tough conditions during Q1 2025 with total shipments coming in at 32.4 million units, a 2% decline from the same period a year ago as per Canalys analysis. While the overall market shrank, Xiaomi proved to be resilient as it fared well with 5.3 million shipments and 16% market share. The smartphone market witnessed major upheaval as producers coped with the inventory backlog from the overestimation during Q4 2024, with premium over €800 phones hitting an all-time 32% market share as a reflection of the desire for high-end smartphones.

Market Overview and Major Challenges

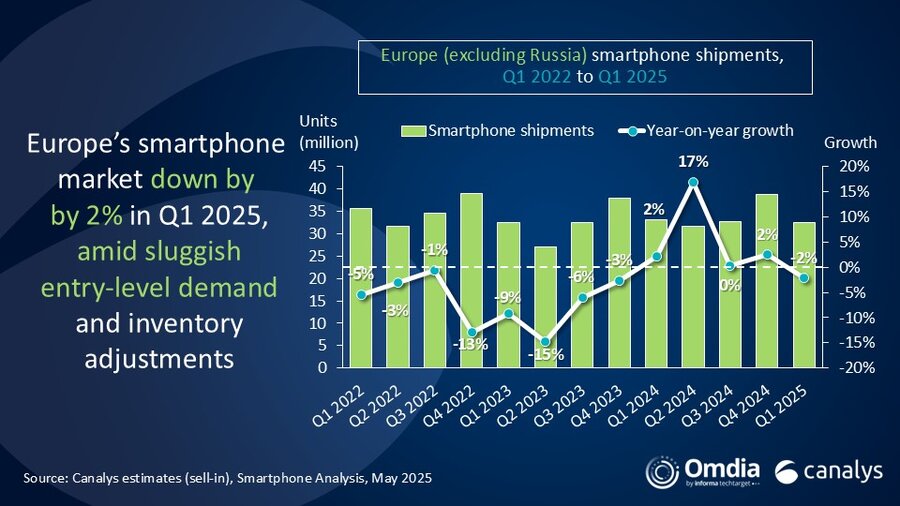

The European smartphone market outside of Russia suffered a 2% decline during Q1 2025, owing mostly to a lackluster entry-level smartphone demand. Canalys’s Senior Analyst, Runar Bjørhovde, cited a number of factors contributing to the decline.

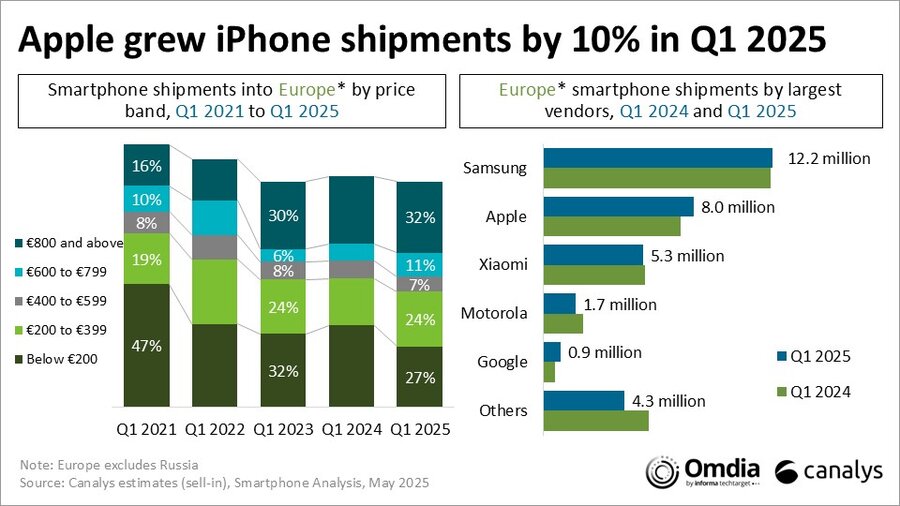

Manufacturers had overestimated terminal demand in Q4 2024 by a great deal, leading to massive channel inventory overhang in early 2025. The overestimation specifically hit entry-level sales of devices, with the under €200 smartphones seeing a decade-low shipment level.

Brand Performance Analysis

Samsung consolidated its lead with 12.2 million shipments, retaining 38% market share. The Galaxy S25 series led the way with strong performance, with premium sales hitting all-time highs through channel promotion and device bundling programs.

Apple achieved impressive 10% growth despite discontinuing iPhone 13 and 14 models due to USB-C directive requirements. Strong consumer and corporate demand pushed Apple’s shipments to 8 million units, capturing 25% market share.

Xiaomi’s Resilient Performance

Xiaomi exhibited outstanding stability in the face of market fluctuations, delivering 5.3 million units with a negligible 2% decrease. The performance was well ahead of the likes of Motorola, with a 19% decrease, which shows the robust European market presence of Xiaomi.

The firm’s capacity to hold 16% market share under tough market conditions is an attestation to effective product portfolio management and appropriate pricing strategies across the different segments.

Premium Segment Growth

Premium products with a price tag over €800 accounted for 32% of the European market, a new regional sales record. It shows the consumer desire to spend on premium technology despite the general market struggles.

Market Recovery Outlook

Although entry segments faced problems during Q1 2025, the robust premium market performance suggests there are prospects for manufacturers who are concentrating on innovative technologies and value-added attributes.

Users can also keep themselves updated with the latest developments from Xiaomi via HyperOSUpdates.com or by downloading the MemeOS Enhancer app from Play Store for special features and system upgrades.

Source: Canalys

Emir Bardakçı

Emir Bardakçı