With the PC industry going towards AI-integrated hardware and cross-device ecosystems, the strategic question is whether Xiaomi will expand its laptop portfolio into global markets. Ongoing changes in supply chain stability, the operating system of choice, and evolving consumer expectations have reconfigured the competitive landscape among major Chinese brands. For readers already aware of Xiaomi’s ecosystem through products such as the Xiaomi Pad 6, Xiaomi Pad 7, or through in-depth reports on HyperOS Connect, this report provides a clear and structured view on whether Xiaomi is well-positioned to compete against Huawei in the global laptop category.

Xiaomi’s Strategic Position in the Global PC Market

These are a number of strong advantages that Xiaomi holds in the high-performance laptop space. The company continues to have access to the latest Intel and Qualcomm platforms, without the geopolitical restrictions imposed against Huawei. Consequently, this places Xiaomi in a position to provide modern technologies such as the latest Intel Core Ultra platform with advanced NPUs for AI workloads. This level of flexibility enhances Xiaomi’s competitiveness in regions where Windows-based systems continue to dominate consumer and enterprise purchasing behavior.

At the same time, Huawei remains hamstrung by international trade restrictions that limit its supply of x86 processors and the licensing of Windows. Its pivot to HarmonyOS-based laptops secures long-term independence, but global customers may face software incompatibility issues, especially outside of China, where Google Mobile Services remain vital.

Hardware Competitiveness

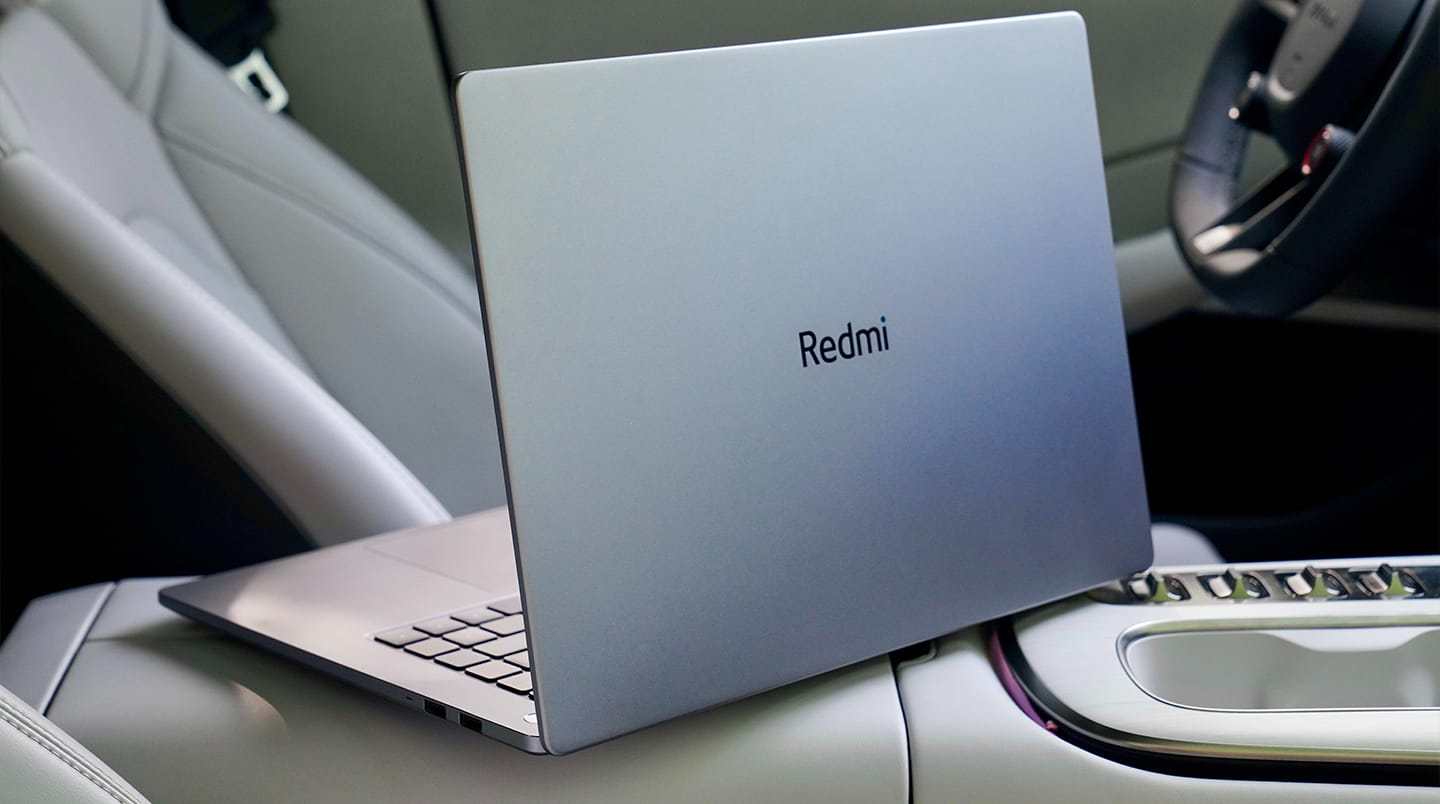

More recently, Xiaomi has featured aluminum unibody casings in its latest notebooks, and high-capacity batteries with high refresh rate displays make them ideal for those users who fall into hybrid categories that amalgamate productivity with high levels of entertainment or light gaming workloads. Huawei’s MateBook series still stands out in color accuracy, build quality, and 3:2 display ratios, but the over-reliance on previous-generation processors in international markets will very much create performance gaps in AI-focused tasks.

Ecosystem Integration: HyperOS Connect vs. Huawei Super Device

Ecosystem synchronization has become a defining metric for purchasing decisions in the premium laptop segments. Huawei’s Super Device architecture remains one of the most sophisticated multi-device solutions available on the market, offering seamless cross-screen control, distributed hardware sharing, and low latency communication. This structure is widely respected in the domestic Chinese market, where HarmonyOS is deeply integrated into daily workflow.

It’s also important to note that Xiaomi’s HyperOS Connect is very rapidly evolving and stands to gain from being closely tied to Google services: the system allows for clipboard transfer, screen casting, notification syncing, and camera sharing across Xiaomi phones, tablets, and upcoming laptop models. You may update Xiaomi’s ecosystem applications through HyperOSUpdates.com or our MemeOS Enhancer app on the Play Store, which would also unlock additional system-level capabilities.

Potential for Consumer Acceptance

With Google services on board, in addition to being familiar with Android, Xiaomi laptops could be more accessible than Huawei’s HarmonyOS-based systems for global users. It would mean lowering the transition barriers for international consumers who rely daily on Gmail, Google Photos, Maps, and other services from Google. Xiaomi, therefore, might benefit from broader retail availability in Europe, among emerging markets, where Huawei has operational constraints.

Can Xiaomi Realistically Compete with Huawei Globally?

With a clear technical lead in CPU generation, AI processing capability, and software compatibility, Xiaomi laptops are well-positioned to find global favor. Competitive pricing—commonly 30–40% below comparable Huawei models—further strengthens Xiaomi’s hand. Yet to be surmounted are the more fundamental issues of after-sales service, warranty infrastructure, and long-term reliability expectations from Western consumers.

Huawei has maintained strong brand loyalty within key markets due to its premium designs and long-term ecosystem maturity, along with a steady presence in enterprise deployments. Xiaomi’s mix of advanced hardware, approachable software, and aggressive pricing strategies could position it as a serious global competitor-if the company chooses to expand its laptop lineup internationally.

Xiaomi has the required technological foundation and ecosystem maturity to take on Huawei in the laptop business within global markets. While Huawei continues with strong innovation capabilities and a refined ecosystem, Xiaomi’s lack of geopolitical restrictions opens up its access to state-of-the-art processors, thus making it competitive. Its success in such an expansion will come down to whether Xiaomi can scale after-sales service operations to further strengthen a reliable global support network.

Emir Bardakçı

Emir Bardakçı