The global smartphone landscape in 2025 is fiercely competitive, with both Xiaomi and Apple further consolidating their leads across different regions. Based on an in-depth analysis of the Q1–Q3 2025 data, Xiaomi’s market trajectory indicates stable performance, but current evidence suggests that it is unlikely for Xiaomi to surpass Apple in terms of global shipment volume in 2025. This conclusion is based on aggregated reports from leading market institutions and the strategic ecosystem focus of Xiaomi in general.

2025 Global Market Share Comparison

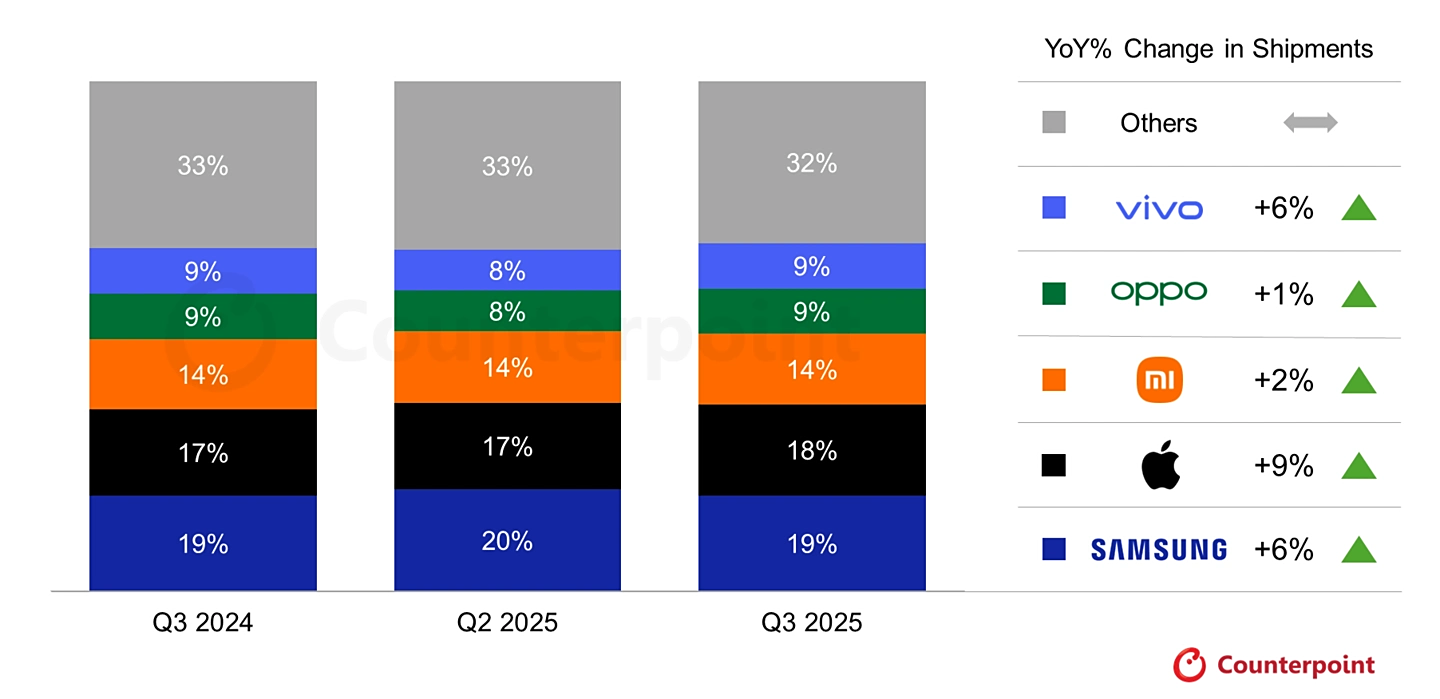

In 2025, the global smartphone market demonstrates shifting preferences, premiumization tendencies, and gaps in regional performance. For Q1–Q3, Samsung holds its position as the number one manufacturer, with controlled fluctuation rather than structural disruption in the competition between Apple and Xiaomi.

In the first quarter, Apple led with 19% of the global market share, ahead of Xiaomi at 14%. In the second quarter, Apple’s market share dropped to 17%, while Xiaomi held at 14%. Third-quarter results reset the gap as Apple reached 18.2%, and Xiaomi steadied at 13.5%. Such a positioning shows evidence of a structural disparity in the dynamics of performance, especially within North America, Europe, and the premium segments.

Why the Gap Bapus: Understanding the Core Dynamics

The reason for such divergence between the two brands is not because of a single variable but due to the combined effect of ecosystem strength, regional distribution, and portfolio segmentation. While Apple continues to enjoy the merits of a premium-driven business model, Xiaomi accelerates its diversification into EVs and AIoT solutions, a fact that, though financially beneficial, decreases the company’s dependence on phone shipments as the main driver of growth.

Apple’s 2025 Portfolio Dynamics and Market Impact

Apple’s 2025 pipeline has an interesting dichotomy where peripheral models see weaker demand, while the flagship lineup is very resilient. Despite the commercial underperformance of models such as the iPhone Air and iPhone 16e, the standard model of the iPhone 17 has significantly outperformed expectations.

A noticeable consumer trend in 2025 has been consolidation toward value-focused premium devices, a segment where the iPhone 17 positioned itself strategically. In turn, this secured Apple a stronger presence in critical markets such as China, with visibly improved early sales momentum compared to previous cycles. This structurally positions Apple to maintain its lead against Xiaomi in total global shipments throughout the year.

Premium Market Shift and the Role of GenAI

The premium segment, categorized as devices priced above USD 600, grew by more than 8% in the first half of 2025 and represents the most profitable segment of the global market, accounting for over 60% of total smartphone revenue. Much of this demand is driven by GenAI-enabled devices, a domain which both companies continue to innovate in, but where Apple uses deeper ecosystem integration.

Xiaomi 2025 Strategy: Human × Car × Home Ecosystem Transformation

The most influential factor affecting its core smartphone business is perhaps Xiaomi’s transition to a broader ecosystem company. In 2025, under the Human x Car x Home strategy, Xiaomi saw a remarkable growth of 234% in electric vehicle revenue and 44.7% growth in AIoT revenue. This showcases how Xiaomi is committed to expanding its business foundations beyond traditional mobile categories.

While this strategy does strengthen Xiaomi’s long-term competitive differentiation, it has a short-term consequence of falling ASP levels for smartphones and a slight drop in phone revenue globally. At the same time, Xiaomi maintains competitiveness in emerging markets with the assistance of the Redmi Note 14 series and cements its premium ambitions with the Xiaomi 15 lineup.

Regional Pressure Points: The India Case

India remains one of the world’s most crucial volume-driven smartphone markets. While Apple set a record with +25.6% YoY growth in Q3 2025, which propelled the brand into the country’s top four for the first time in history, Xiaomi fell –15.6%. This change continues to impact the global shipment differential between the two companies.

Conclusion: Can Xiaomi beat Apple in 2025?

A holistic review of the shipment data, pricing trends, regional performance indicators, and portfolio strategies of 2025 leads to a clear and data-grounded result: it is unlikely that Xiaomi will surpass Apple in terms of total smartphone shipments in 2025. The competition between the two brands is no longer defined by unit volumes alone but by ecosystem value, premium positioning, and GenAI advancements.

Xiaomi’s long-term strategy is extremely strong, especially with the expansion of its EV and AIoT ecosystem, while its premium ambitions through the Xiaomi 15 Ultra continue to position it as one of the most innovative brands globally. However, in terms of shipment volume, Apple’s premium-driven momentum and regional strength definitely give it the advantage for the remainder of the year.

Emir Bardakçı

Emir Bardakçı

What’s the use of increasing sales if you first buy a phone and then keep searching for a service center when there’s a problem? If there is only one service center in Agra (UP) and it is poor, charging money at their will and not providing bills. A few days ago, I got my phone serviced, and since then the battery problem and phone hanging started, even though it’s the company’s flagship phone, Redmi Note 12 Pro 5G.