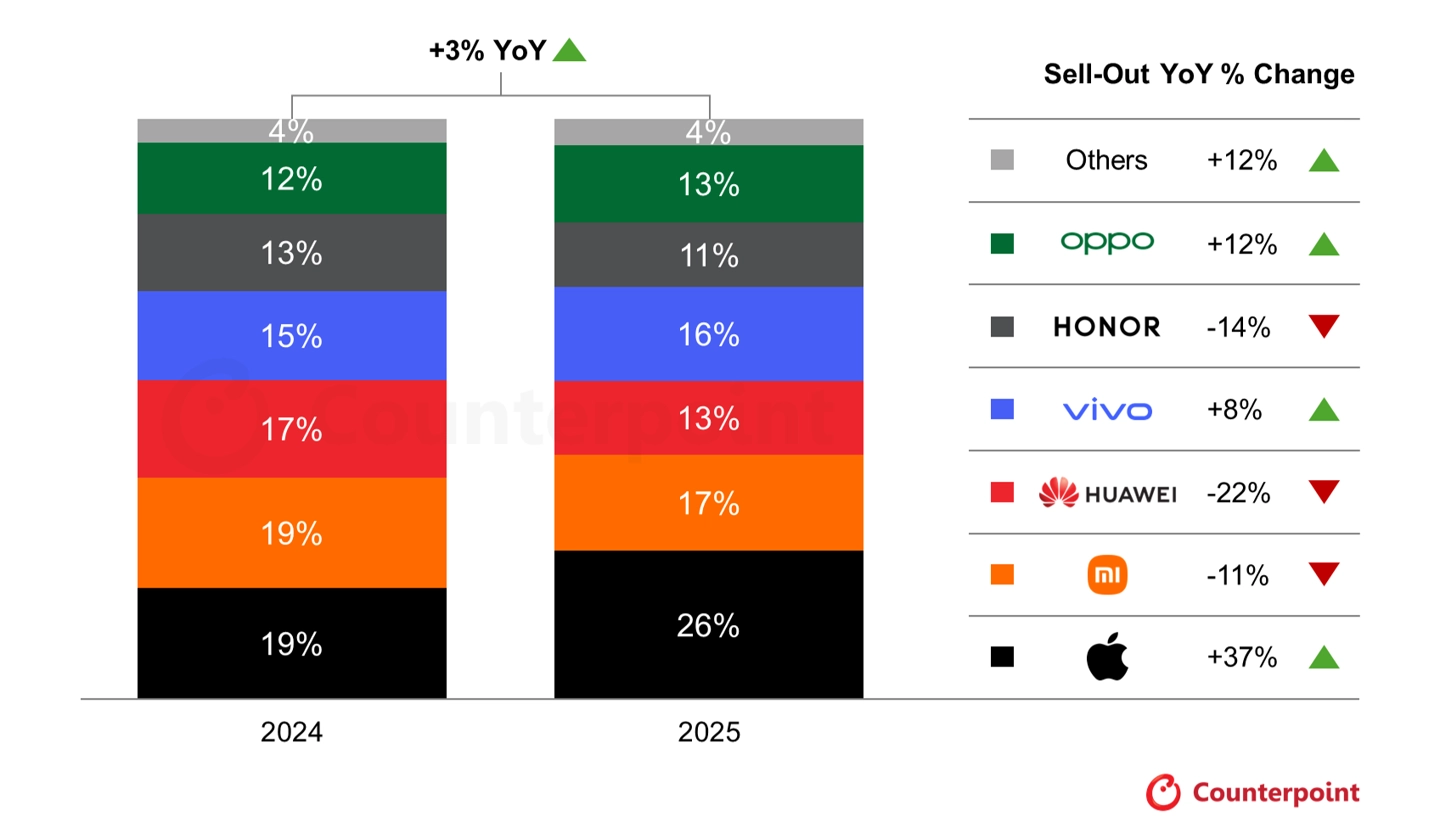

Counterpoint Research has published its yearly analysis of the performance of major brands in China’s Singles’ Day, thereby providing a clear view of the shifting market momentum. According to the firm, smartphone sales during the 2025 “Double 11” period grew 3% year-on-year, driven mainly by Apple’s strong iPhone 17 series. Without the contribution of Apple, though, the market would have declined by 5%, as consumer sentiment remains cautious amidst ongoing macroeconomic pressures.

Apple’s iPhone 17 Series fuels the market growth.

Apple had an exceptional year-on-year sell-out performance of 37% and became the central growth engine of the 2025 shopping festival. The standard iPhone 17 provided a strong boost with its upgraded storage, larger camera module, and advanced sensors for the same launch price as last year. As a result, sales doubled year-on-year compared to 2024.

Promotions also contributed to the growth. Both iPhone 17 Pro and Pro Max were discounted by RMB 300, or around USD 42, driving double-digit growth in the mid-to-high-end segment. Counterpoint analysts pointed out that product positioning and pricing precision were both key factors in Apple’s success during the event.

Xiaomi Records 11% Decline Amid Changed Launch Timing

Meanwhile, Xiaomi posted an 11% year-on-year decline in 11.11 sales. The main contributor to this decline was a shift of product timing: the 15 series gave Xiaomi strong momentum during the Double 11 period in 2024 but, in 2025, the Xiaomi 17 series had already launched earlier, which shifted the peak selling cycle to one month before the promotion.

As the attention across manufacturers shifted to newly launched flagship devices, the old Xiaomi models did not hold up well. While this could raise the brand’s ASP, it also compressed the overall shipment volume during the promotion period. Despite this short-term setback, the early flagship cycle of the brand signals a long-term strategy aimed at capturing steady demand ahead of heightened competition.

Domestic Brands Under Pressure as Release Schedules Change

While Apple grew, a number of domestic brands felt headwinds in the 2025 event. Huawei was down 22%, due mostly to its Mate 80 series launching two weeks after the promotional window and thus missing critical traffic. Honor was down 14%, likely because of mid-cycle product timing. Meanwhile, OPPO was up 12% and Vivo up 8%, reflecting better-aligned releases and stronger mid-range offerings.

It also differentiates between sell-out, or consumer purchases, and sell-in, or shipments to retailers. The report adds that the 11.11 figures are indicative of real consumer demand. This makes the performance shifts all the more meaningful for evaluating upcoming strategies ahead of 2026.

Emir Bardakçı

Emir Bardakçı