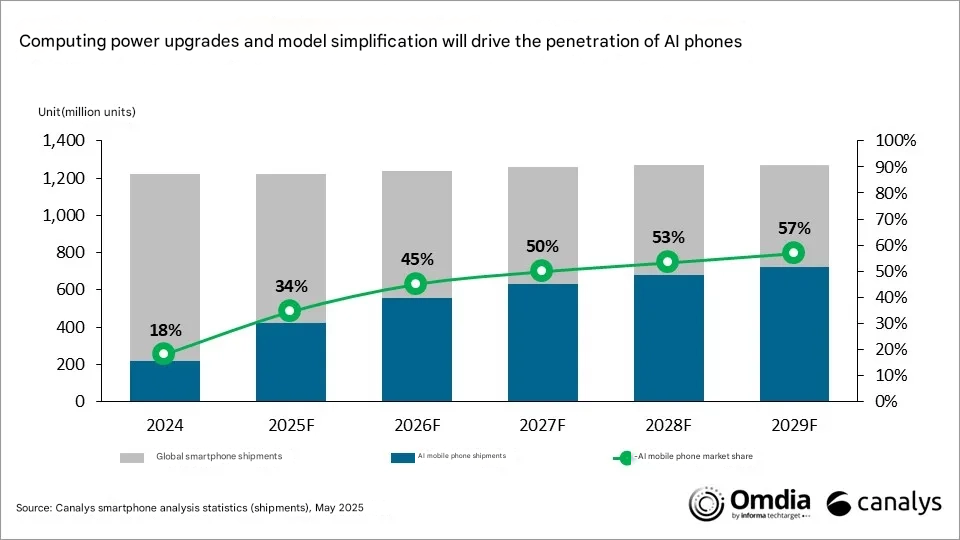

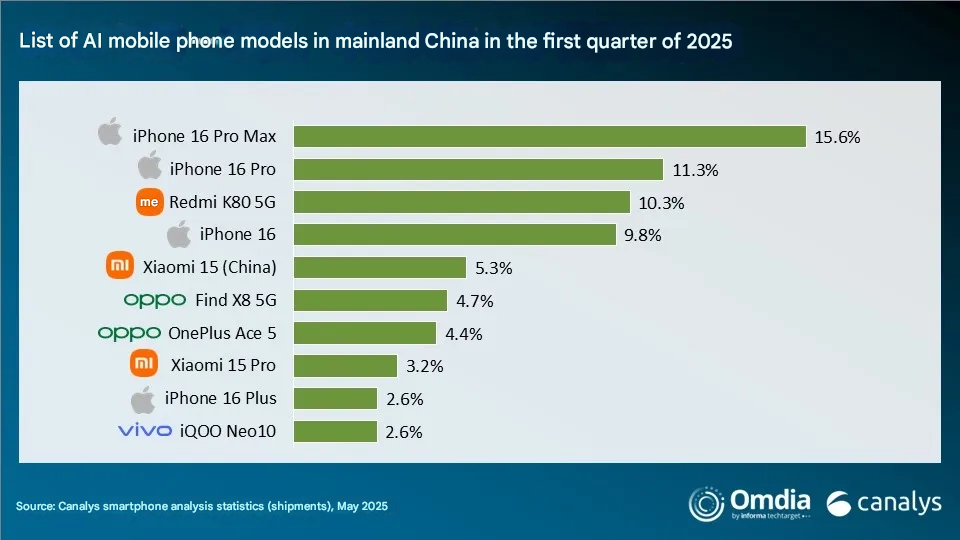

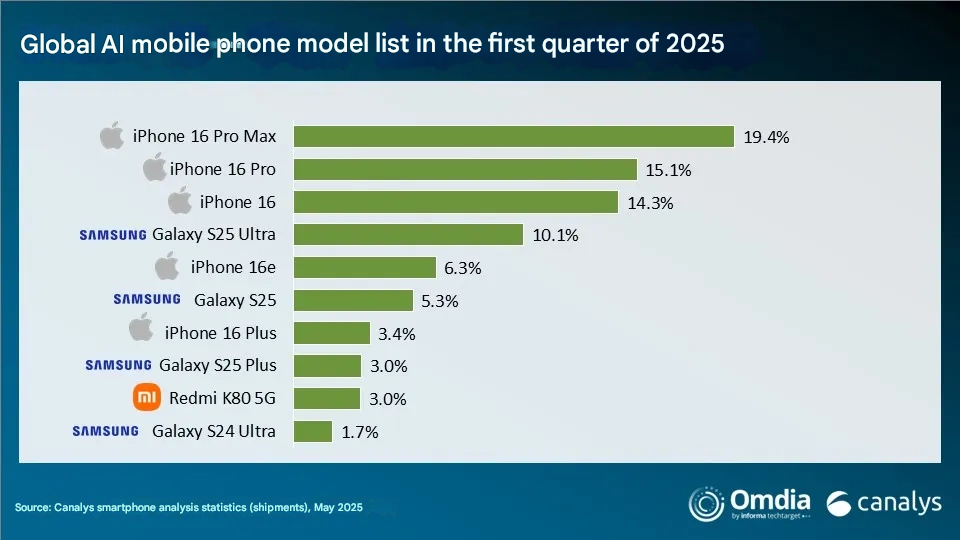

The rapid acceleration of artificial intelligence integration within the smartphone sector signals a transformative shift, according to recent projections from Canalys. By 2025, it is anticipated that AI-enabled smartphones will comprise 34% of the global market, driven by notable advancements in chipset performance and the streamlining of AI models. These improvements have democratized formerly high-end features, allowing broader access across device tiers. Innovations such as DeepSeek have reduced the computational demands of large language models, while leading semiconductor manufacturers continue to introduce sub-flagship processors capable of executing complex AI tasks natively. These technological strides are expected to sustain the momentum of AI smartphone adoption through 2025 and 2026, fundamentally altering user-device interaction paradigms.

Modest Recovery in the Global Smartphone Market

Despite significant macroeconomic and geopolitical fluctuations, the global smartphone market demonstrated resilience in the first quarter of 2025, achieving a modest year-over-year growth of 0.2%. Consumer purchasing patterns remain cautious amid prevailing uncertainties, compelling manufacturers to optimize inventory following the post-festival season surge of late 2024.

Canalys forecasts that global smartphone shipments will reach 1.22 billion units in 2025, reflecting a subdued 0.1% annual increase. The market continues to grapple with challenges such as declining replacement demand in entry-level segments and persistent geopolitical tensions influencing buying behavior.

Premium Segment Growth Attributed to AI Innovation

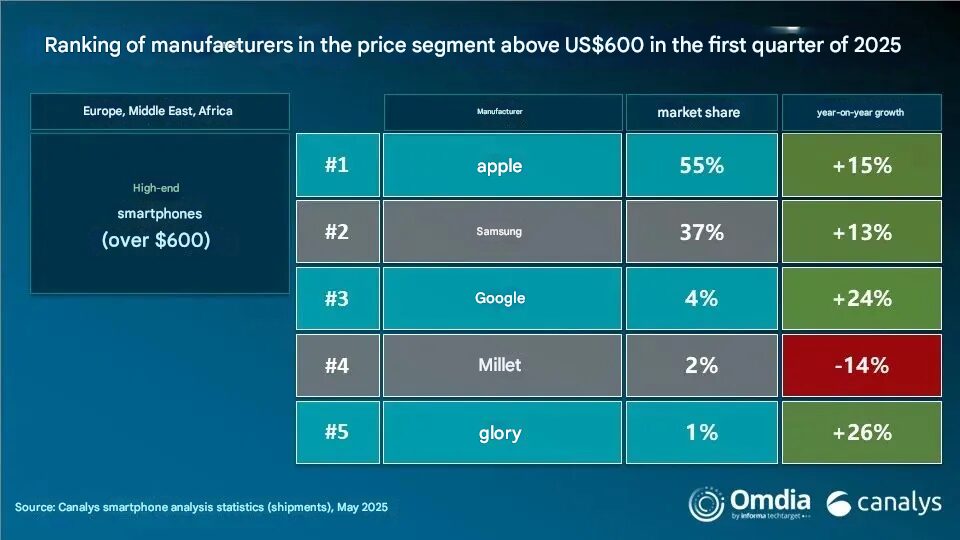

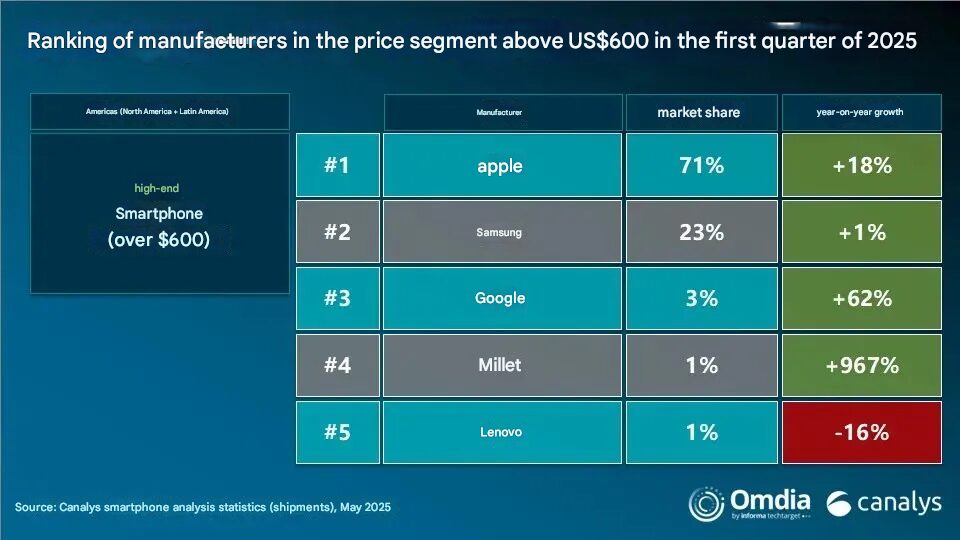

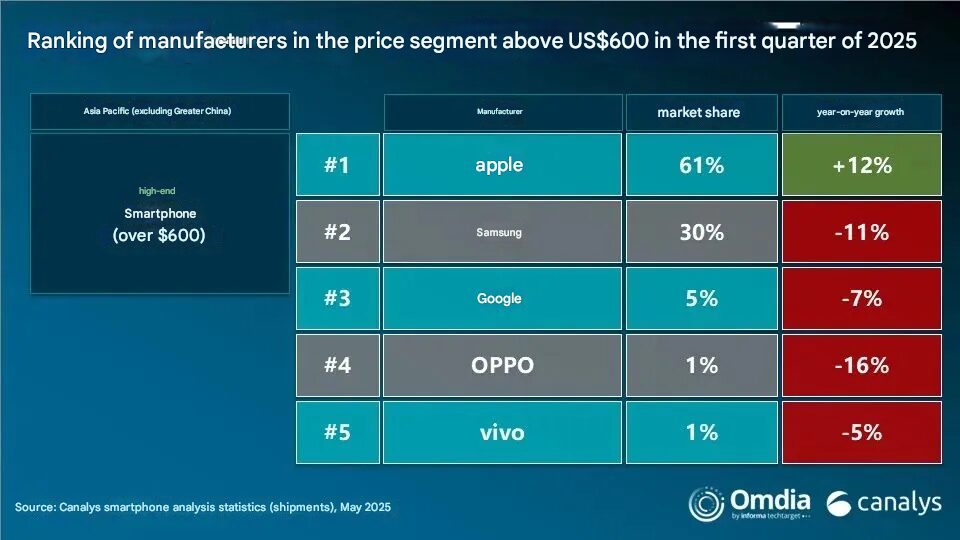

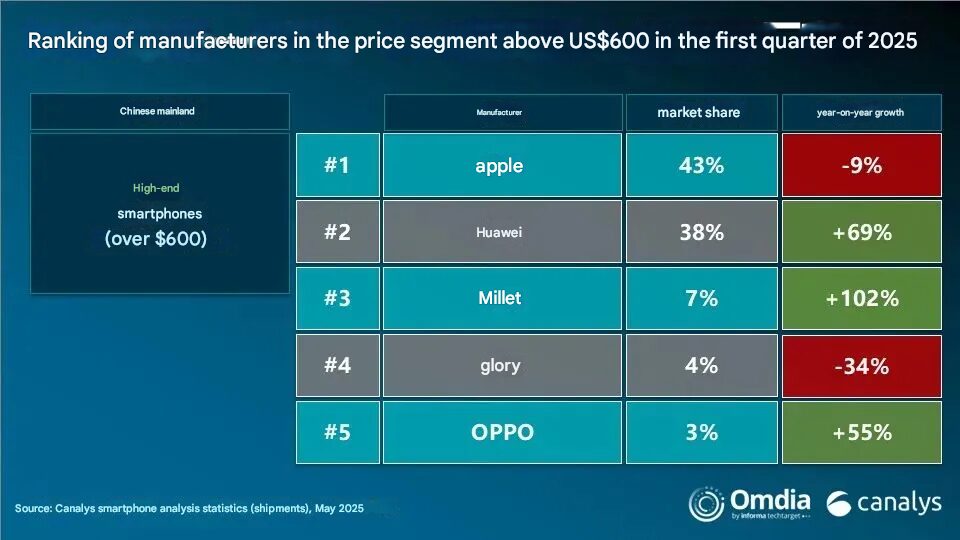

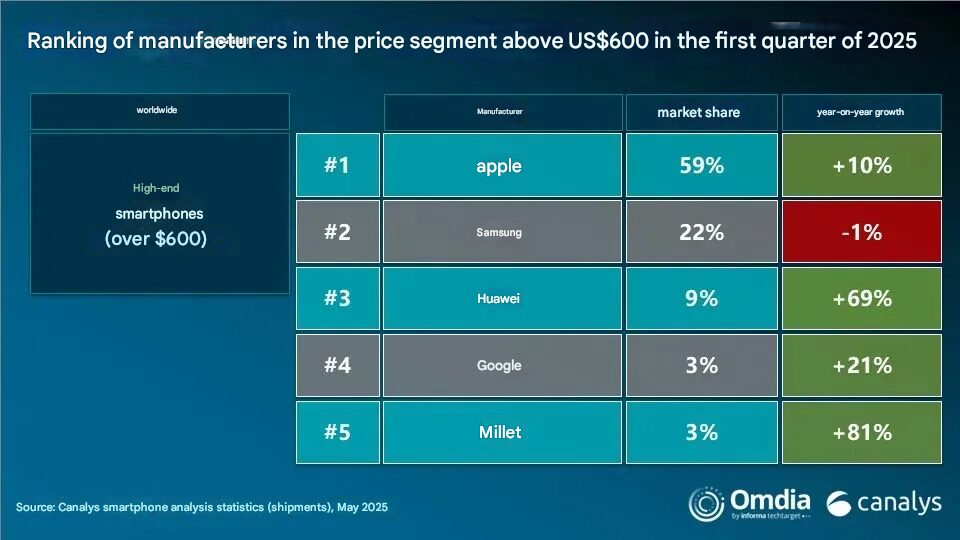

The high-end segment, encompassing devices priced above $600, has demonstrated robust performance, registering a 12% year-over-year increase in the first quarter of 2025. This expansion is primarily attributed to sustained investment in premium product lines and the accelerated deployment of AI functionalities.

Leading High-End Smartphone Manufacturers:

- Apple – Retains dominant market leadership with a 59% share, realizing 10% growth through strategic inventory management.

- Samsung – Maintains second position, despite a 1% contraction attributed to the S25 series not matching the success of the S24 AI lineup.

- Huawei – Achieves third place with a 9% share and an impressive 69% year-over-year surge, driven by innovative foldable models such as the Pura X.

- Google – Occupies fourth position with 21% growth, underpinned by continual AI enhancements in the Pixel series.

- Xiaomi – Registers a remarkable 81% growth, ranking fifth, propelled by a synergistic ecosystem strategy and successful expansion in international high-end markets.

Xiaomi’s Ecosystem Strategy Yields Competitive Advantages

Xiaomi’s notable ascent within the premium segment is attributed to its integrated “people, cars, homes” product ecosystem. This comprehensive approach has enabled the company to deliver seamless interconnectivity across diverse device categories while simultaneously solidifying its premium market positioning globally.

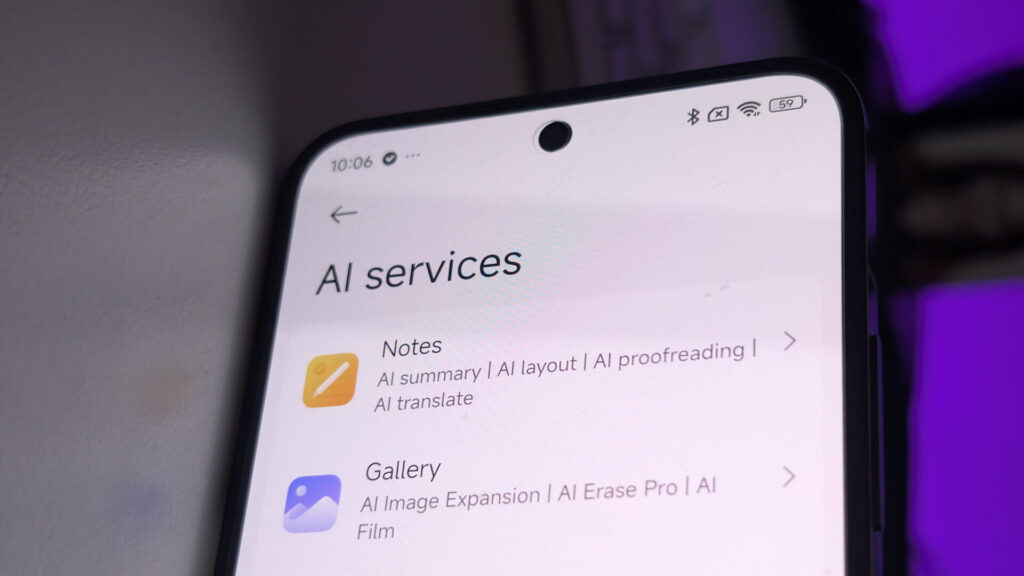

The company’s AI smartphone initiatives are bolstered by the integration of HyperOS, which augments user connectivity and facilitates advanced intelligent features. Users seeking to maximize their Xiaomi devices’ capabilities may consult HyperOSUpdates.com or utilize the MemeOS Enhancer application, available on the Play Store, for system optimization and access to additional functionalities.

Market Outlook

Projections indicate that the global smartphone industry will maintain modest growth, with a compound annual rate of approximately 1% from 2025 through 2029. AI is anticipated to play an increasingly pivotal role in product differentiation as continued chipset advancements make sophisticated features accessible across a wider price spectrum.

The ongoing evolution of edge AI and model optimization is expected to further democratize artificial intelligence in mobile devices, establishing AI functionalities as a standard rather than a premium distinction.

Source: Canalys, IT Home

Emir Bardakçı

Emir Bardakçı