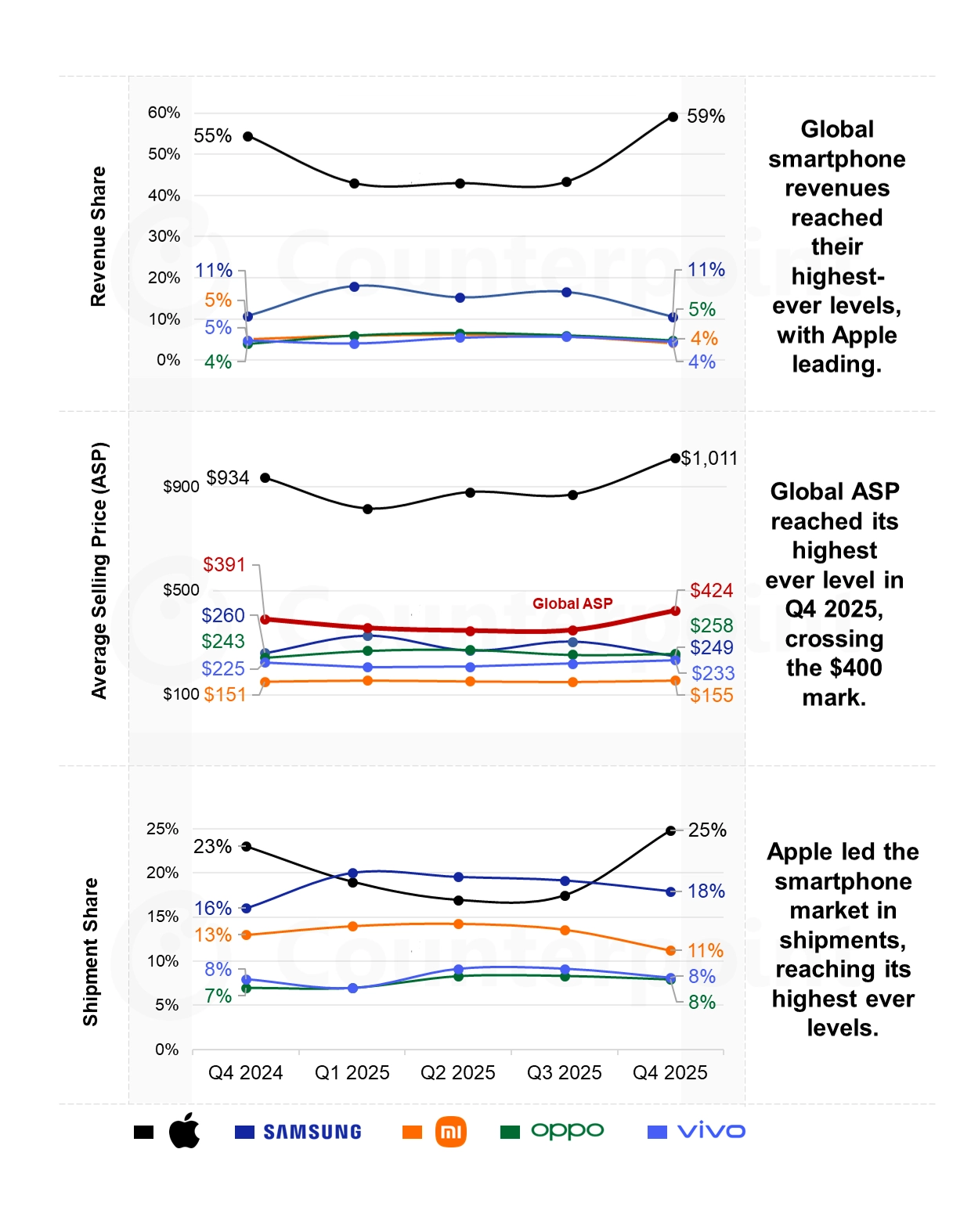

The global smartphone market reached a historic inflection point in Q4 2025. Total revenue surged 13% year-on-year (YoY) to a record $143 billion, while shipment volume grew by a modest 5%. This disparity confirms that market expansion is now driven by “selling at higher prices” rather than volume. The global Average Selling Price (ASP) increased by 8%, surpassing the $400 barrier for the first time due to rising material costs and consumer shifts toward premium hardware.

Apple (Market Leader)

Apple extended its dominance, achieving record quarterly levels for both revenue (+23% YoY) and shipments (+14% YoY). Growth was catalyzed by an iPhone 17 “supercycle,” with a heavy mix of Pro models driving ASPs higher across the US, China, and Western Europe.

Samsung

Samsung retained the second-largest revenue share (11%) and recorded the highest shipment growth among top brands (+17% YoY). However, this volume was primarily driven by the mid-range Galaxy A series and holiday promotions, causing the brand’s ASP to actually decline by 4% despite the launch of the Galaxy S25 and Z Fold7.

Xiaomi

Xiaomi faced significant headwinds from supply chain constraints and component cost inflation. Consequently, the brand recorded a 9% decline in revenue and an 11% drop in shipments, specifically losing ground in core markets like China and India. While high-end releases boosted Xiaomi’s ASP by 3%, this was insufficient to offset the volume loss in entry-level and mid-range segments.

OPPO & Vivo

OPPO demonstrated strong performance with a 23% YoY revenue increase, driven by the premiumization of its portfolio (Reno 14 and Find series). Vivo secured a 6% revenue increase, anchored by stability in the Chinese and Indian markets.

2026 Outlook: Cost Structures & AI

Market analysis suggests that average device prices will continue to rise throughout 2026. This trend is supported by:

- Increasing consumer demand for AI capabilities.

- Rising costs in the semiconductor sector, specifically DRAM and NAND storage.

High component costs are projected to compress shipment growth potential in 2026, forcing manufacturers to prioritize value creation and product restructuring over sheer volume efficiency.

Source: Counterpoint

Emir Bardakçı

Emir Bardakçı