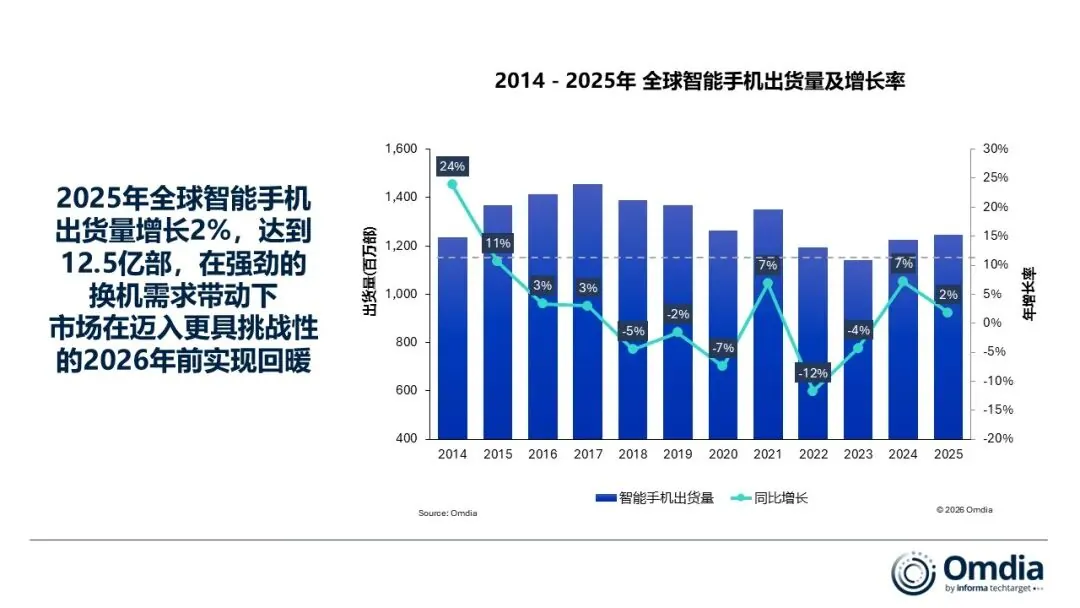

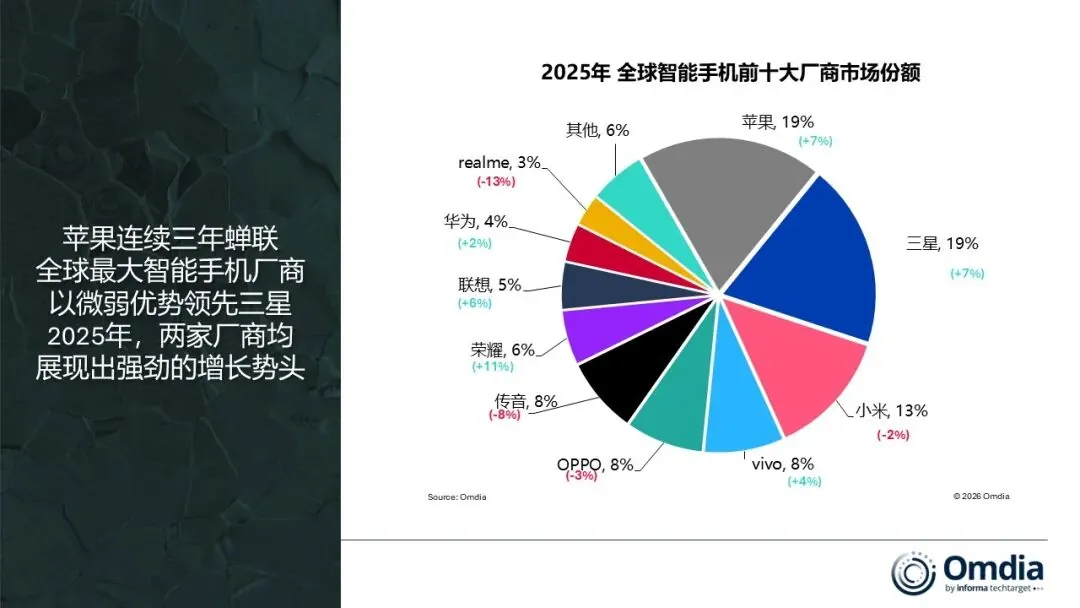

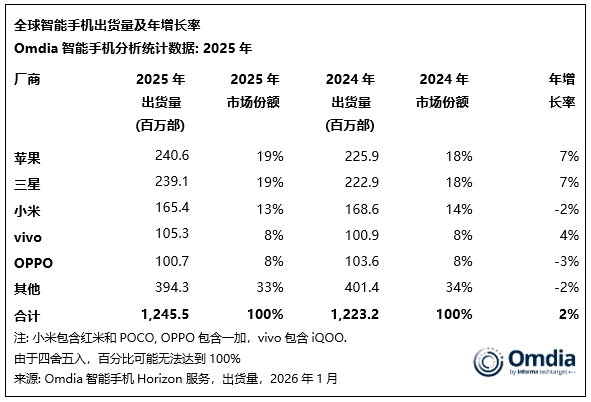

Global smartphone shipments reached 1.25 billion units in 2025 (+2% YoY), the highest volume since 2021. Apple secured the top position driven by iPhone 17 demand, while Xiaomi successfully defended its global top-three ranking. However, the 2026 technical landscape faces critical instability due to escalating DRAM and NAND supply shortages, requiring immediate optimization of inventory channels and component procurement strategies.

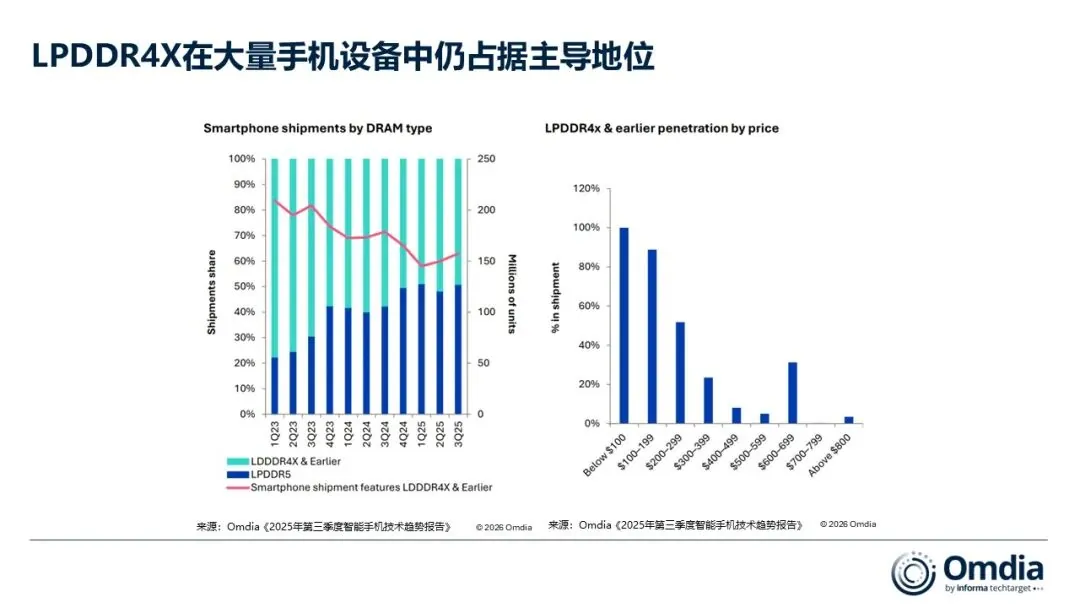

The 2025 market recovery masks a critical supply-side bottleneck emerging in 2026. Omdia’s “DRAM Eats Smartphones” analysis identifies severe supply constraints on DRAM and NAND flash memory as the primary technical limiter for the upcoming fiscal year. These semiconductor shortages will disproportionately impact manufacturers dependent on LPDDR4/4X standards and low-margin hardware.

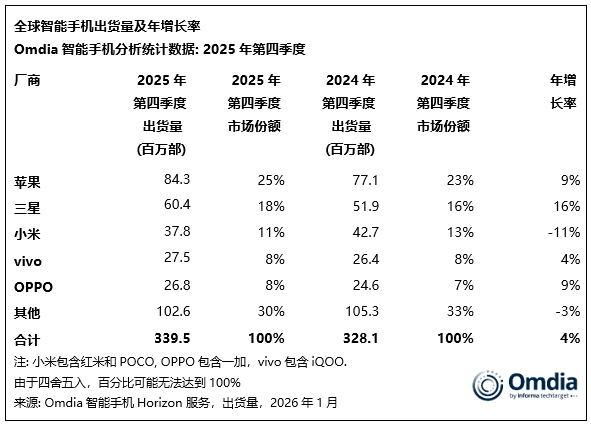

| Manufacturer | Shipments (M) | YoY Growth | Primary Driver / Constraint |

| Apple | 240.6 | +7% | iPhone 17 demand; Mainland China growth (+26%). |

| Samsung | N/A | +7% | Galaxy S/Z flagship resilience; Entry-level (A0x/A1x) recovery. |

| Xiaomi | Top 3 | -2% (Q4) | Portfolio expansion (POCO to AIoT); Weak entry-level segment. |

| vivo | 105.3 | +4% | Strong performance in India; Domestic stability. |

| OPPO | 100.7 | -3% | A6x series release; realme merger scheduled for 2026. |

Xiaomi’s Q4 2025 shipment contraction (-2%) correlates with the referenced weakness in entry-level models, which are most vulnerable to component price fluctuations. To counteract margin compression, the strategy must pivot from pure volume to value growth through the high-end REDMI and Xiaomi portfolios.

Operational stability in 2026 requires leveraging Xiaomi HyperOS and Xiaomi HyperConnect to drive AIoT ecosystem value, reducing reliance on standalone handset hardware margins. Manufacturers lacking long-term supplier agreements for memory modules will face forced price adjustments, dampening consumer demand. Success depends on mitigating these supply chain pressure points while executing the scheduled integration of realme into the OPPO ecosystem and countering Huawei’s resurgence in Mainland China.

Source: ITHome

Emir Bardakçı

Emir Bardakçı