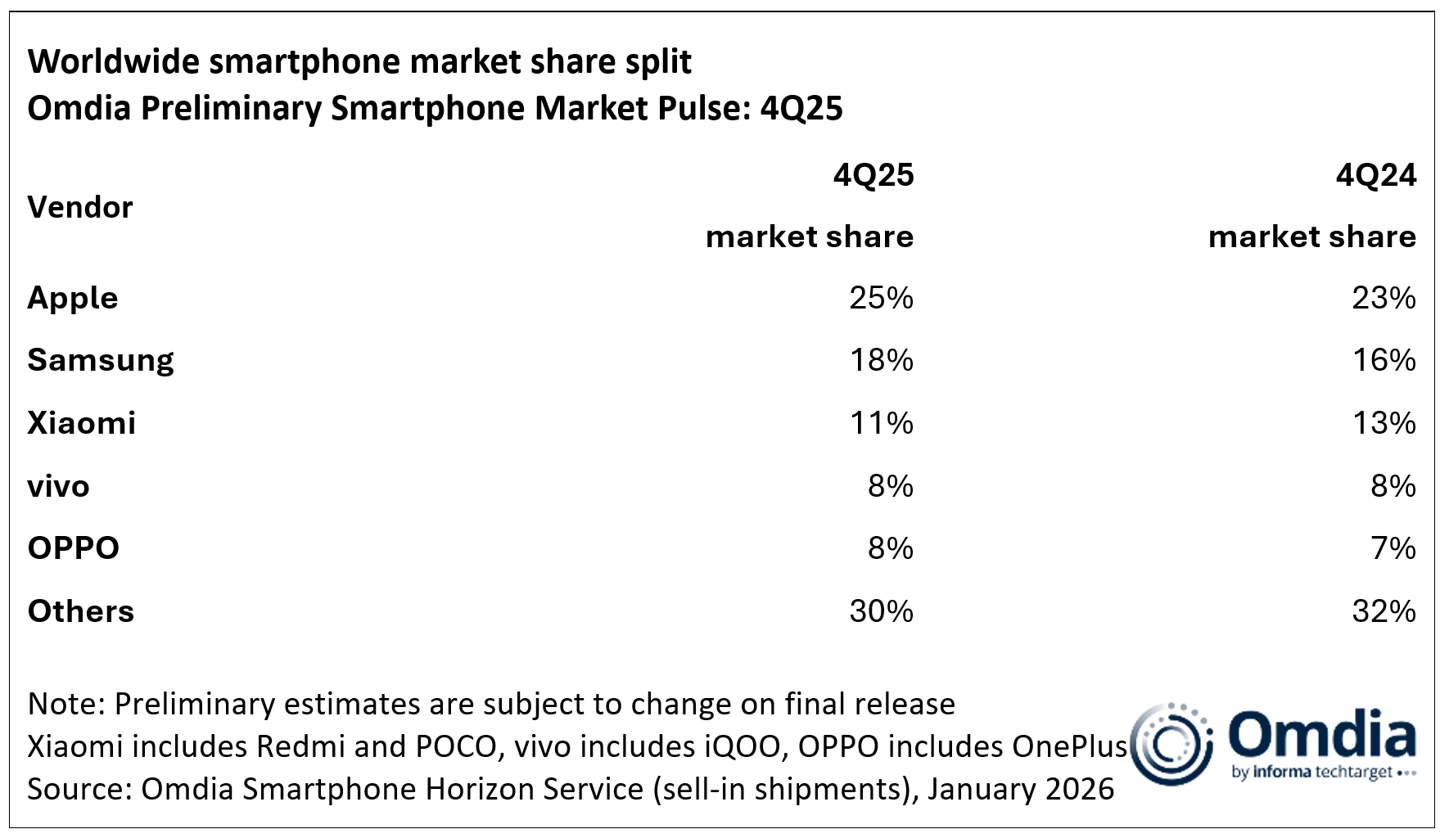

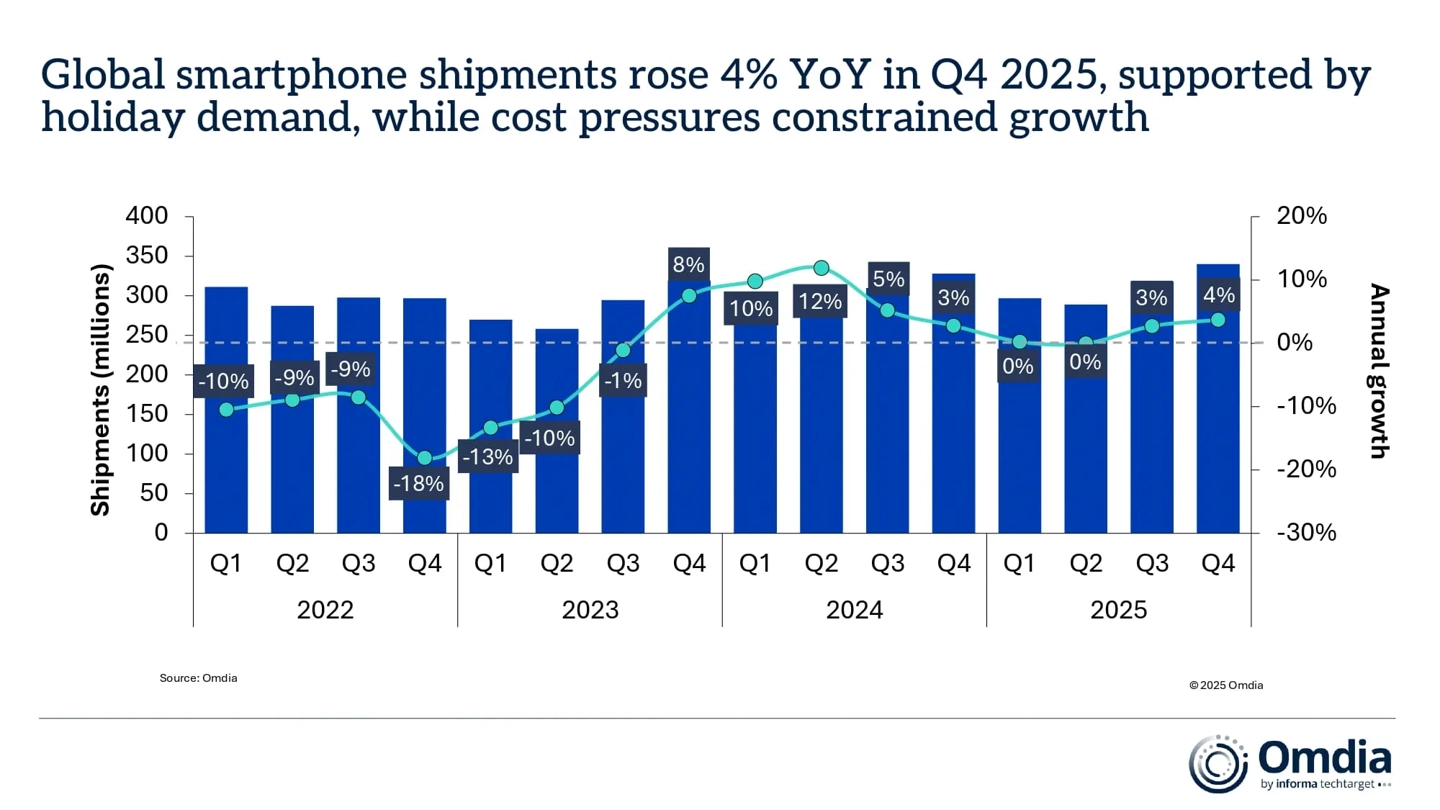

The latest worldwide smartphone market shipment stats are out for Q4 2025, and it offers an interesting insight into the Xiaomi world. In a highly competitive holiday market led by new offerings from Apple, Xiaomi was able to retain its third position in the world’s smartphone market, bagging 11% market share. Although there have been some sale-related challenges in certain regions for the brand, the trend appears to be relatively stable as we move towards 2026. With the successful launch of Xiaomi HyperOS on a larger number of products in the market, the brand has moved towards a pivotal point where it now focuses on an integrated system rather than just focusing on hardware.

TL;DR

- Xiaomi has the #3 global market share with 11% market share, following only Apple and Samsung.

- It is successfully transitioning to Xiaomi HyperOS. It is further enhancing Xiaomi HyperConnect.

- The global scarcity of LPDDR5 DRAM creates a difficulty for the pricing of 2026 by Xiaomi.

- High-end series such as REDMI K80 Ultra remain popular, at times being re-branded as Xiaomi T Series for other regions.

How did Xiaomi fare against the “Big Two” in Q4?

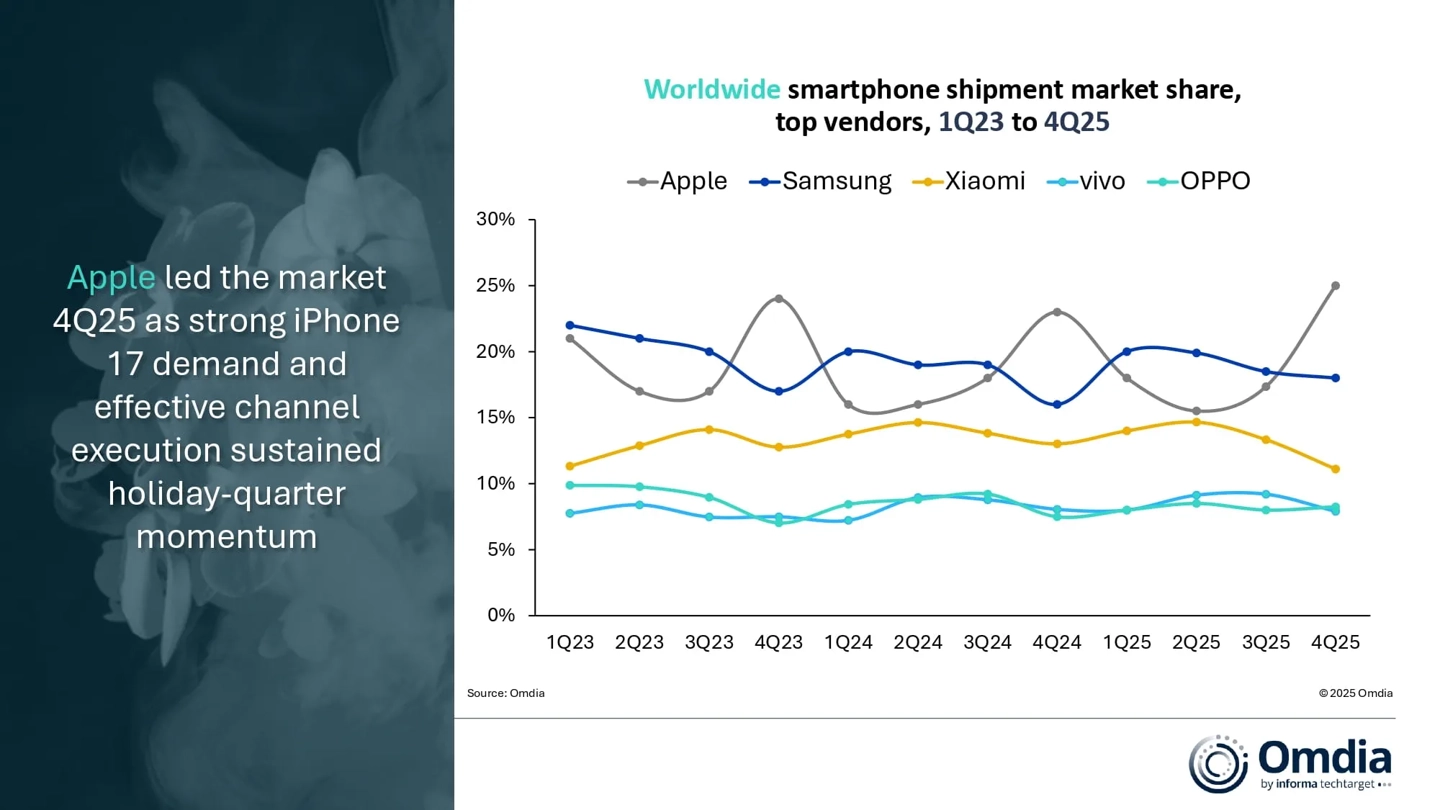

Within a quarter that saw a record high of 25% market share for Apple, Xiaomi was able to maintain its position at 11%. Although this represents a slight decline from its former highs, we feel that it is a result of its decision to focus on profit over volume at the lower end of the market. The REDMI K Series‘ success in China has been one of the key contributors to these sales figures.

What is happening with Huawei in 2026?

According to the senior analysts at Omdia, the future is not without its challenges either. Today, the market is witnessing a considerable shortage of LPDDR4 and LPDDR5 DRAM, which are the key pillars of Xiaomi’s mid and flagship models, as stated below: I’ve observed that this is already making manufacturers change their 2026 lineups. For Xiaomi, this means that there will be a greater emphasis on the Snapdragon 8 Elite for high-performance models and fewer budget models to uphold “pricing discipline.”

The Role of Xiaomi HyperOS and Ecosystem Development

But it’s not only in the smartphone business that Xiaomi has placed its “Human x Car x Home” vision. The use of Xiaomi HyperConnect has made it imperative for users to own the Xiaomi Pad and Xiaomi Band series. What we are witnessing here is a clear pattern where consumers who already have a Xiaomi Pad 7 or the new XRING O1 are much likely to remain loyal to the brand for their future smartphone purchases. Ecosystem lock-in is the hidden key for Xiaomi to compete with Samsung in the under-$300 smartphone market.

What’s next for Xiaomi fans?

Moving forward to the second half of the event, we are looking at Xiaomi’s focus on efficiency in operations. The brand is expected to support higher price points with improved trade-in options and tighter integration with Xiaomi HyperOS functionality. I’ll definitely keep an eye on the Global releases to see how they cope with the rising price of memory. It’s a delicate balancing act, but it’s not a problem that any brand but Xiaomi could handle with “bang for the buck” in a supply crisis.

Emir Bardakçı

Emir Bardakçı