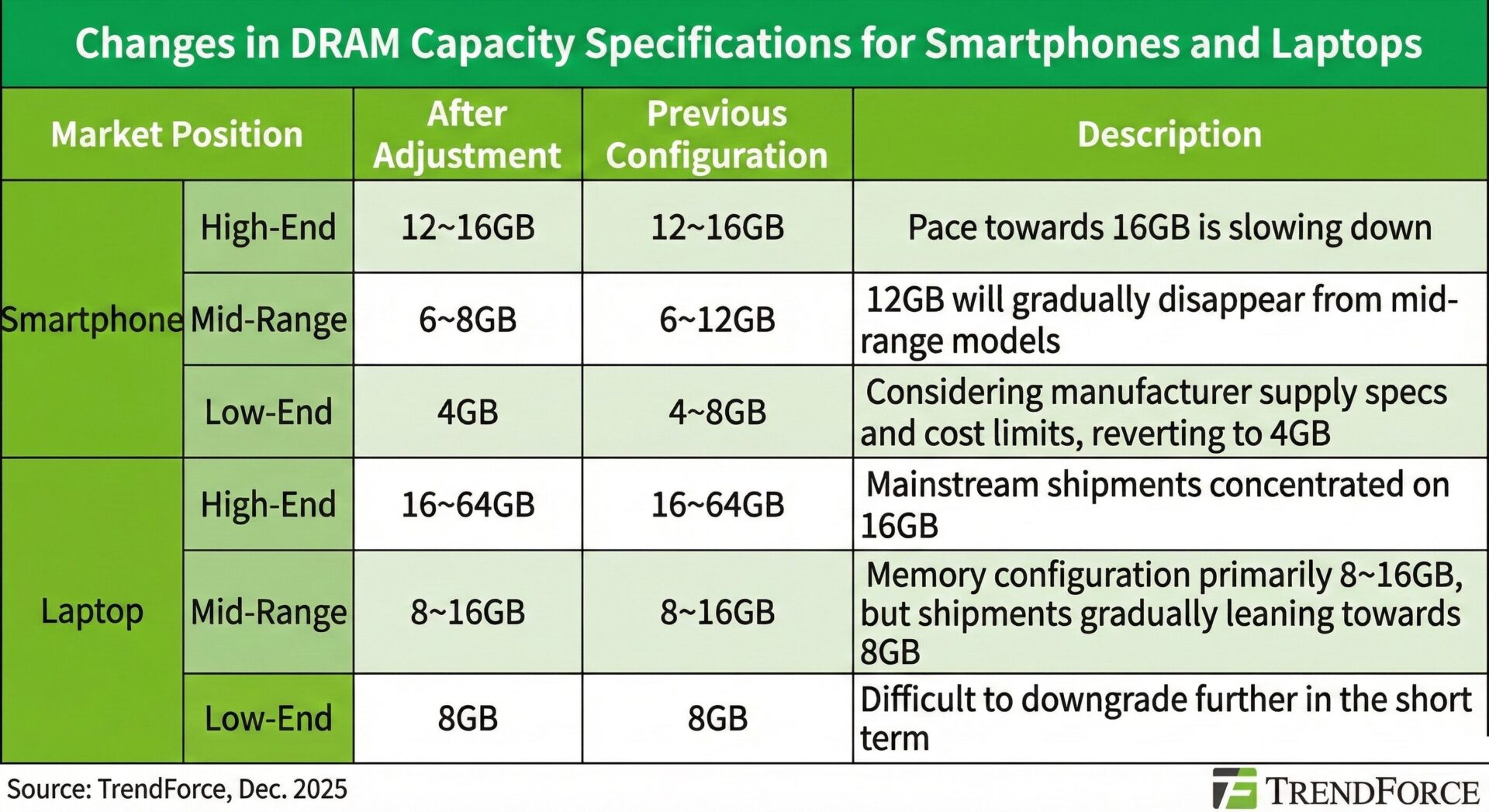

The most recent market survey from TrendForce paints a tough picture for the global smartphone and laptop markets due to a sharp increase in memory costs projected for early 2026. This change affects product pricing and specifications, particularly in the mid and low-end sectors. Brands are also seen to consider downgrading specifications due to memory playing a bigger role in BOM costs.

The Increasing Cost of Memory and Its Effect on the Industry

Trendforce believes that as time passes, the proportion of BOM costs that DRAM represents will continue to increase in 2026. Even in those product lines that are known for their high profit, like the iPhone, this trend will continue. Android manufacturers, who make use of memory as a major selling point, will now find themselves in a tight spot due to increasing memory costs. This particular point will affect Xiaomi especially, as 12GB RAM in their mid-range series is a common setup.

Mainland China and Android Firms: Impacts

The report further points out that memory-dependent product segments would face tough times in maintaining their competitive pricing. With increasing DRAM prices, companies are likely to make changes in supply cycles of last-gen models, along with increasing new model pricing. “User and mainstream product segments, with their usual 8GB and 12GB of RAM, may return to norm-touch baseline models with increasing manufacturing costs.”

Laptop Market will also Undergo Structural Changes

Computer manufacturers are also expected to rearrange their product offerings. High-end ultrabooks that feature soldered RAM cannot easily cut down RAM size. Such models are believed to be the ones that would immediately experience a huge jump in pricing.

Consumer Laptops Receive a Temporary Fix

The consumer laptop market has buffers of inventory and access to lower-priced memory stock, providing a mechanism for a stable market for a temporary period. But from the second quarter of 2026, cutbacks in specifications and/or pricing of DRAMs would become inevitable. The budget market would also face tough conditions in cutting memory further, owing to processing needs and OS.

TrendForce Forecasts Reduction in Specifications in 2026

The report underlines that “reducing specifications” or “delaying upgrades” are expected to be important levers for manufacturers of smartphones and PCs. This will be most notable for changes induced by DRAM, where companies are likely to standardize memory specifications on “the lowest acceptable level for a given market segment.”

- High-end and mid-end smartphones: RAM advancements will emerge with a stabilization of minimum industry requirements.

- Low-end smartphones: Expected to return to 4 GB RAM in 2026.

- Low-cost laptops: Not likely to see a cut in DRAM.

This trend will change industry expectations in terms of entry-level and mid-tier offerings.

Emir Bardakçı

Emir Bardakçı

I have a large ram but still can’t play emulator because of miui sentinel b.tch