According to Counterpoint Research’s latest market analysis, both Apple and Xiaomi recorded over 20% year-on-year growth in sales of their flagship smartphones during the first month of their respective product launches in China. That is for September 20–October 20, 2024, for the iPhone 16 series and September 19–October 19, 2025, for the iPhone 17 series. The report highlights how the iPhone 17 series and Xiaomi 17 series became strong revenue drivers for each brand. Take a look at previous trends for Xiaomi flagships on our overview of the Xiaomi 17 series, Xiaomi market performance guide, or HyperOS features page.

Strong Uptake of the iPhone 17 Series

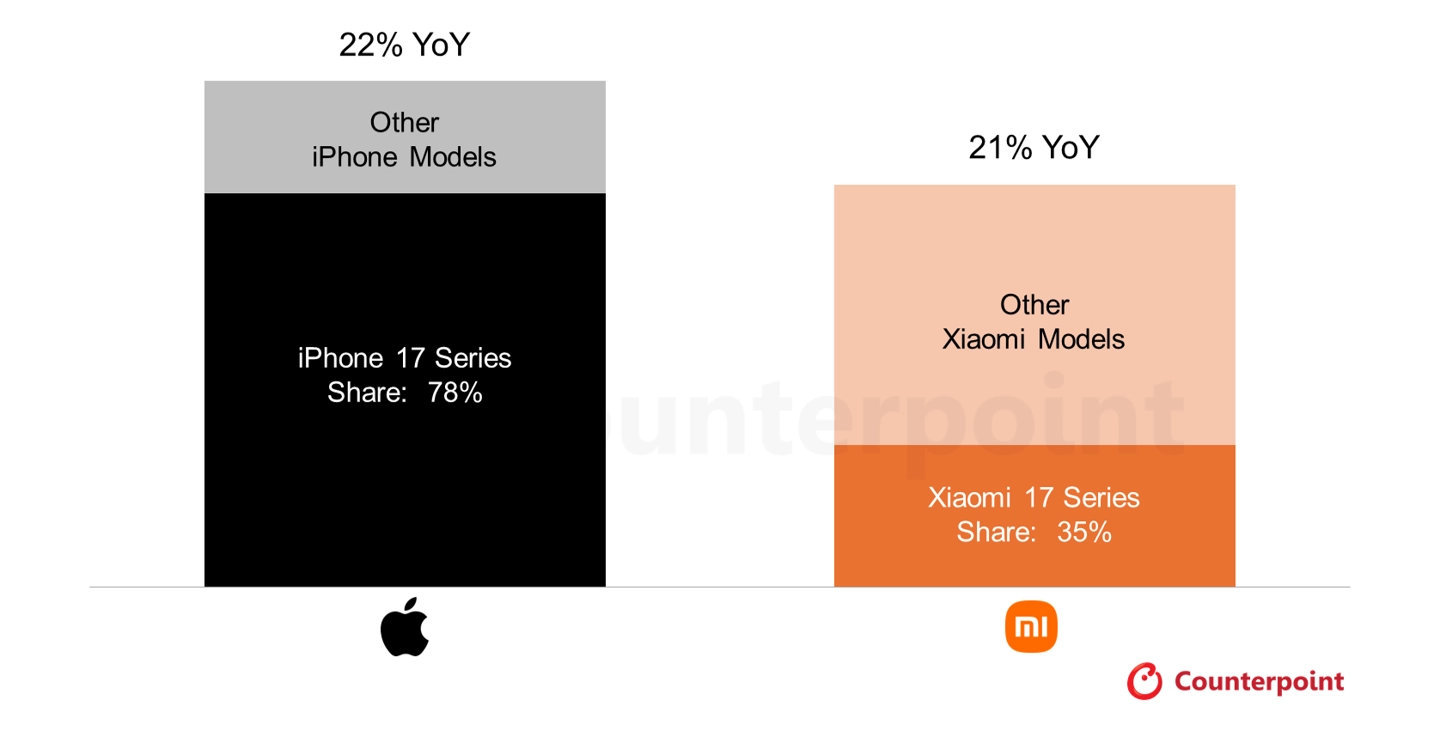

Apple saw a 22% year-over-year gain, mostly generated by the new iPhone 17 series. According to the statistics from Counterpoint, 78% of all Apple smartphone sales during the period under review came from the iPhone 17 series.

Analysts attribute this strong performance to an upgrade cycle among users who purchased devices during pandemic years. Both the base and Pro models have been positioned with a strong value-to-performance ratio, which helped Apple to maintain its sales momentum even after the Mid-Autumn Festival shopping season.

Consumer Upgrade Momentum

The trend of Apple’s demand is related to the timing of release and broader consumer expectations. As many users were ready to move from older hardware to more advanced devices, Apple struck at just the right time to catch this wave of upgrades. Its focus on balanced pricing and feature-rich models helped the company secure early demand.

Xiaomi 17 Series Sees Significant Gains in High-End Segment

Xiaomi also recorded 21% year-on-year growth, with the Xiaomi 17 series being front and center. Launching its flagships ahead of schedule allowed the company to capture robust pre-holiday demand. Moreover, the latest design of the rear display, highly praised by Chinese consumers, further enhanced the visibility and attractiveness of the series during this peak time for shopping.

Flagship Pro Models Lead Xiaomi’s Performance

Unlike in previous cycles, where the standard variant usually led the charge, this year’s purchases were dominated by the Xiaomi 17 Pro and 17 Pro Max. This is a reflection of Xiaomi’s continued strategy to move up the value chain and improve its average selling price.

This performance is in line with Xiaomi’s broader effort to reinforce premium design language and ecosystem value through platforms like HyperOS, which users can update via HyperOSUpdates.com or through our MemeOS Enhancer app on Google Play. It offers advanced feature access and system update tools.

Holiday Season Strategy Accelerates Market Demand

Both Apple and Xiaomi benefited from launching before the Mid-Autumn Festival, a period known for increased consumer electronics spending. According to analysts, this year’s buyers sought high-value devices with innovative design approaches. The iPhone 17 and Xiaomi 17 series captured those expectations effectively to help both brands outperform their previous year’s launch periods. The combination of refreshed design, powerful performance upgrades, and a wisely planned release strategy helped both companies stand out in a highly competitive flagship segment.

Source: Counterpoint Research (via IT Home)

Emir Bardakçı

Emir Bardakçı