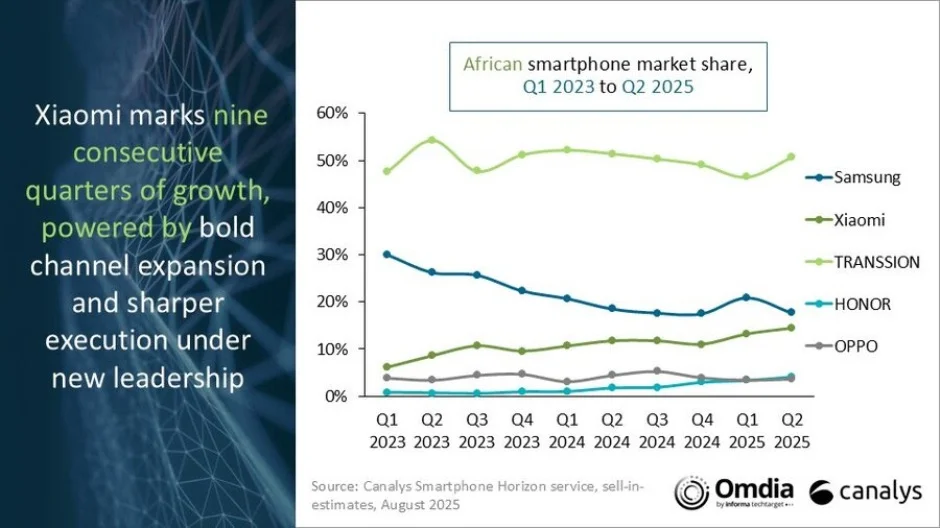

Xiaomi is making serious waves in Africa. The latest Canalys numbers show the company snagged third place with a 32% year-on-year growth—no small feat considering the competition. Their strategy? Focus heavily on key markets like Nigeria and Egypt, roll out a slew of affordable devices, and ramp up local investment. Result? Xiaomi now commands a 14% share across the continent.

The broader picture looks promising too. Africa’s smartphone market isn’t just holding steady—it’s expanding. Q2 2025 saw a 7% increase in shipments, reaching 19.2 million units. That puts Africa among the world’s fastest-growing regions for mobile tech. Xiaomi’s aggressive retail expansion, local partnerships, and sharp pricing strategies are clearly paying off.

Africa’s Market: Rebounding and Resilient

Africa’s economic headwinds are easing, especially in major markets like Egypt, Nigeria, and South Africa. Currency stabilization has empowered consumers, fueling sustained demand for new smartphones—even as global markets remain shaky. Forecasts predict a steady 2.1% compound annual growth rate through 2029, positioning Africa as a critical growth market for global mobile brands.

Regional Performance: Key Highlights

North Africa’s Momentum

- Egypt led the charge with 21% annual growth, buoyed by Eid promotions and ramped-up local production.

Sub-Saharan Strength

- Nigeria posted a strong 10% rebound.

- South Africa was up 2%, but 5G shipments skyrocketed by 63%.

- Kenya held steady, down just 2%, with financing plans and carrier deals driving adoption.

Xiaomi’s Strategic Edge

That 32% surge? It’s the payoff from Xiaomi’s calculated market entry and expansion. The company’s laser focus on ultra-affordable smartphones, expanding retail presence, and significant investment in local operations have proven highly effective, especially in Nigeria and Egypt.

Growth Drivers

- Leadership in budget-friendly segments

- Aggressive channel expansion

- Substantial local investments

- Competitive pricing models

The Competition: Who’s Leading?

- Transsion: Still in the lead with 6% growth.

- Samsung: Up 3%, largely through localized distribution.

- Xiaomi: Third place, but with standout growth.

- Honor: Gaining ground with entry-level models.

- OPPO: Restructuring, with notable investment in Egypt.

Budget Phones: The Real Battleground

Smartphones under $100 are dominating, with this segment jumping 38% in Q2 2025. As average selling prices drop, companies like Xiaomi are well-positioned to capture price-sensitive buyers.

Looking Ahead

Canalys projects a 3% growth in smartphone shipments for Africa in 2025, outpacing the global market despite rising component costs. The shift from consumer to production hub is creating new opportunities, and the “Made in Africa” trend is gaining traction.

Trends to Watch

- Companies are targeting rural markets for growth.

- Mobile payments and fintech adoption are accelerating.

- Local manufacturing is ramping up.

- African brands are emerging alongside international players.

Africa is quickly evolving from a growth market to a genuine innovation and production hub. With digital finance adoption soaring and competition heating up, brands like Xiaomi have every reason to double down on their investments across the continent.

Source: IT Home

Emir Bardakçı

Emir Bardakçı

beautiful market 😍

شركة شاومي ان اصلحت نظام هايبراس 3 مثل المنافسين الآخرين ستصبح الاولى او الثانية في العالم