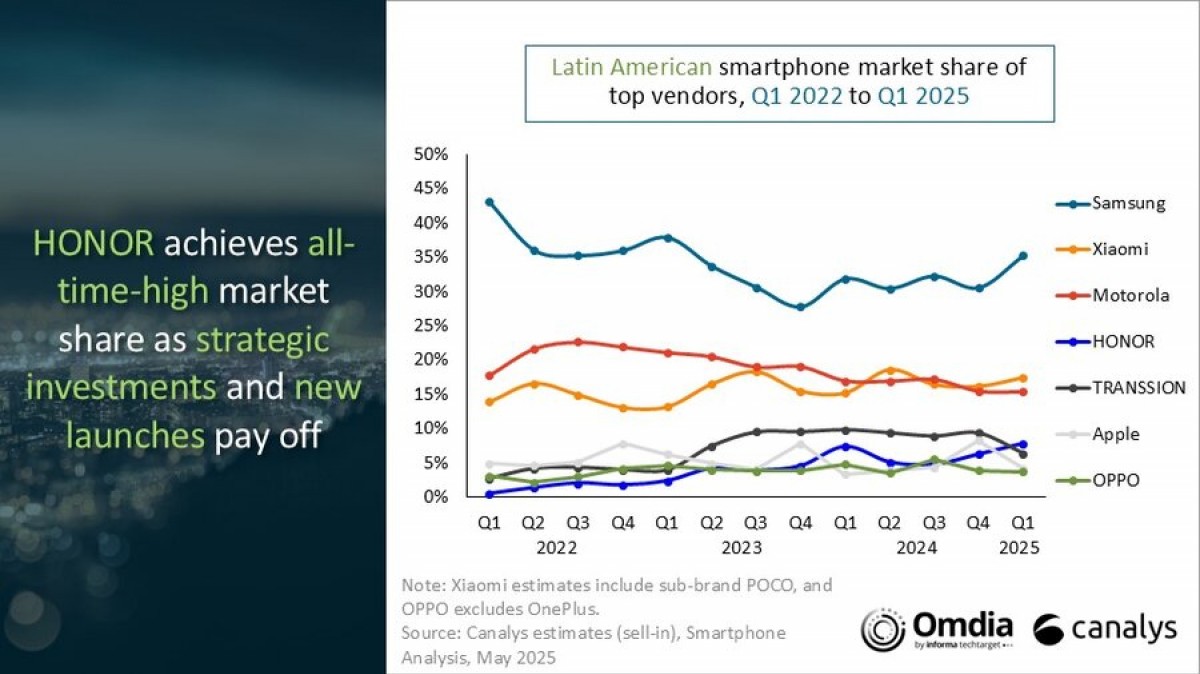

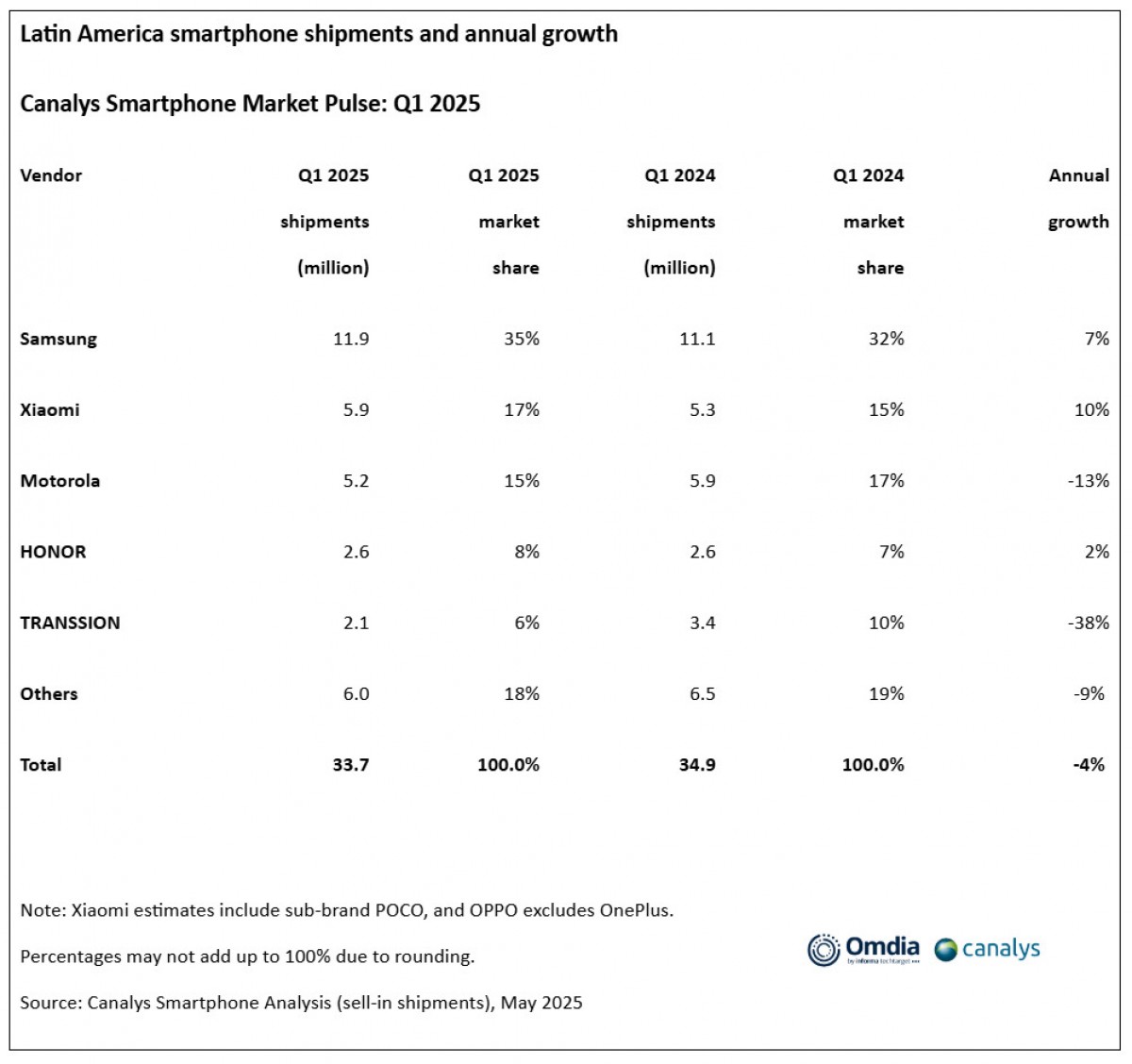

The Latin American smartphone market experienced its first decline in six consecutive quarters during Q1 2025, according to the latest Canalys report now incorporated into Omdia. Despite the overall market dropping 4% year-on-year to 33.7 million units, Xiaomi demonstrated remarkable resilience by achieving a 10% growth rate. This impressive performance solidifies Xiaomi’s position as the second-largest smartphone vendor in the region, capturing 17% market share with 5.9 million units shipped. The Chinese tech giant’s success comes at a time when other major players like Motorola faced significant challenges, highlighting Xiaomi’s strategic approach to the Latin American market and its ability to adapt to local consumer preferences.

Market Leaders Show Mixed Performance

Samsung maintained its dominant position in Latin America with 11.9 million units shipped, representing a 35% market share and 7% year-on-year growth. The South Korean giant’s continued success demonstrates its strong brand presence and diverse product portfolio across different price segments.

Xiaomi’s second-place finish with 5.9 million units and 17% market share represents a significant achievement, especially considering the challenging market conditions. The 10% growth rate showcases the brand’s increasing popularity among Latin American consumers who appreciate Xiaomi’s value proposition.

Regional Market Dynamics

Brazil emerged as the region’s standout performer, accounting for 28% of total shipments and being the only top-five market to achieve year-on-year growth. The Brazilian market expanded 3% to reach 9.5 million units, demonstrating consumer confidence despite economic uncertainties.

Mexico, representing 22% of regional shipments, faced significant challenges with an 18% decline, marking the second consecutive quarter of contraction. This downturn reflects broader economic pressures affecting consumer spending patterns.

Central America, which consolidated its position as the third-largest market in 2024, experienced its first decline in seven quarters with a 7% year-on-year drop. Colombia and Peru rounded out the top five markets in the region.

Competitive Landscape Shifts

The market saw notable changes among other competitors. Motorola, traditionally strong in Latin America, experienced a 13% decline to 5.2 million units, resulting in a 15% market share. This represents a significant shift in the competitive landscape.

Honor demonstrated steady growth with 2.6 million units shipped, achieving 8% market share and 2% year-on-year increase. Meanwhile, Transsion faced substantial challenges with a 38% decline to 2.1 million units and 6% market share.

For users interested in maximizing their Xiaomi experience, downloading the MemeOS Enhancer app from the Play Store provides access to hidden Xiaomi features, system app updates, and on-screen update access capabilities.

Source: Canalys

Emir Bardakçı

Emir Bardakçı

![Update life of Xiaomi, POCO, REDMI devices: Full list [February 2026] 6 HyperOS 2](https://xiaomitime.com/wp-content/uploads/2025/03/HyperOS-2-300x163.jpg)

Hello respected ones, will the Xiaomi 13T Pro get version 2.2 or not? When will it be released? My phone is running OS version 2.0.102.0 VMLEUXM. This way the kernel…